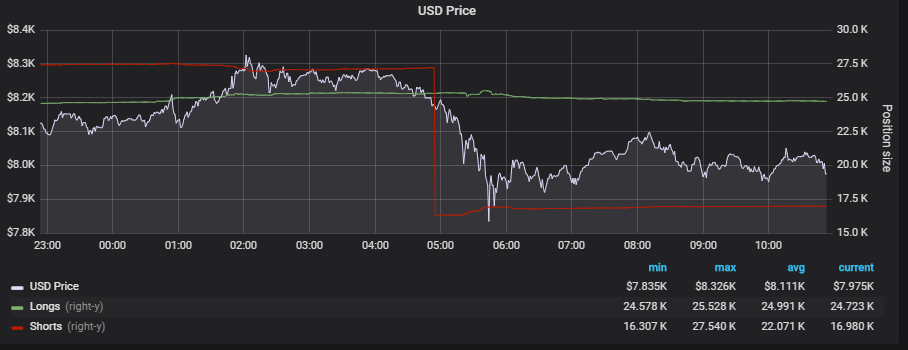

Hong Kong-based crypto exchange Bitfinex saw a short position worth around $84 million (10,500 BTC) closed on Thursday as the long/short dynamics on the major exchange dropped from 52% short to under 40% in a matter of minutes.

The 12% change in the long/short ratio can be seen as a bullish switch in sentiment as the total number of margin shorts has fallen from an early May high of 32,000 BTC to its current level of just under 17,000. The $130 million in total margin short interest is trading in the BTC/USDT market, which has a verified volume of close to $200 million of trading action every day.

The large short position closed when price was trading just above $8,200, but the effect was swiftly mopped up by the order book as spot buyers fully absorbed the closure of the $84 million short position.

Despite the recent controversies surrounding the iFinex-backed exchange involving the New York Attorney General’s office, margin longs on the exchange have held steady and have in fact climbed up from 18,000 to a recent high of 26,000. Compared to the dwindling short interest of under 17,000 BTC, the margin long ratio is currently at a 60% high that has not been seen since early April – just after Bitcoin’s breakout from $4,200.

As longer-term investors continue to buy the ‘dips and dumps’ in the crypto market, the signal of such an order being closed into the order book (without too much volatility) suggests that large players are being patient and waiting for the price action to come to them, as Bitcoin and other major altcoins have experienced a period of 30-40% gains in a week.

For more news, technical analysis, and cryptocurrency guides, click here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire