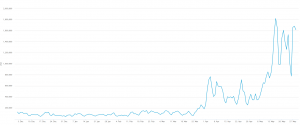

The Bitcoin mining hash rate is currently at 58,000,000 TH/s and is fast approaching its mid-2018 highs of nearly 60,000,000 TH/s.

The hash rate has made a surprise comeback after falling to almost half its current total during the December 2018 capitulation in BTC price.

The total daily block and transaction reward paid to miners has also seen an almost four-fold increase in the last six months, rising from under $5 million to currently above $20 million a day.

Key to the recent rise in miner revenues has been the huge increase in transaction fees, which have gone from a daily total of $63,000 in late March to now more than $1 million a day over the last few weeks.

$1.8 billion in online hardware

Based on estimates from Litecoin founder Charlie Lee’s September San Francisco conference talk, the current SHA-256 hash rate translates into around $1.8 billion in online hardware value for the Bitcoin mining network.

Other hourly costs for the network (based on a $0.1 kwH electricity cost) come to around $540,000 in just electricity for those miners to hunt for 75 BTC that would currently trade at around $660,000.

With the next Bitcoin halving just under a year away, between now and then we may see a new bull market break out for Bitcoin mining before the hourly reward drops down to 37.5 BTC.

Mining difficulty is also up around 30% from the December low, while the price of Bitcoin has increased close to 280% in the same period.

As ROI for mining operations continues to outpace the returns for BTC, the sideline investor may again look to make a move into the crypto ecosystem to get their hands on one of the 3.2 million BTC that are yet to be issued into circulation.

For more news, technical analysis, and cryptocurrency guides, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.