Miami, FL, United States, 14th April, 2022, Chainwire

Developers of Accumulate are announcing the highly anticipated release of the Accumulate Whitepaper.

The document provides a detailed look at Accumulate’s identity-based, delegated proof-of-stake blockchain solution and how it plans to achieve its mission to create a universal communication and audit layer for individuals, entities, and blockchains to transact with each other using Accumulate Digital Identifiers or ADIs.

Through cutting-edge innovations in blockchain interoperability, scalability, and modular design, Accumulate is forging a new path for the decentralization of the traditional economy and the onboarding of millions of individuals and entities to the Web3 space.

Point 1 – Identity & Key Management

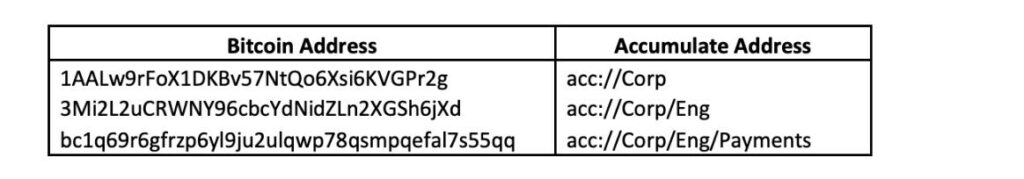

Accumulate Digital Identifiers or ADIs are human-readable addresses similar to website URLs that are chosen by individuals or assigned by organizations to represent their presence on the blockchain. Digital identifiers refer to a system for assigning unique digital identities to assets, individuals, or entities on the blockchain.

ADIs enable more flexibility and deployment of complex operations by issuing a hierarchy of keys with different permissions or levels of security.

This allows entities operating on the blockchain to more easily build standardized yet scalable protocols for other entities to interact with and exchange sensitive information with them based on their access permissions for specific data sets.

Using ADIs, Accumulate can serve as the de-facto communication and audit layer between blockchains, enabling the seamless transfer of tokens or other kinds of digital assets between ADIs across different chains regardless of their consensus mechanism.

Point 2 – Solving the scalability trilemma through a unique modular blockchain architecture

A modular blockchain architecture separates the transaction execution, network consensus, and data availability functions of a blockchain into various specialized components through the use of sidechains, shards, and layer 2 scaling solutions.

Accumulate was born out of the understanding that designing a modular architecture is the only way to truly solve the blockchain scalability trilemma.

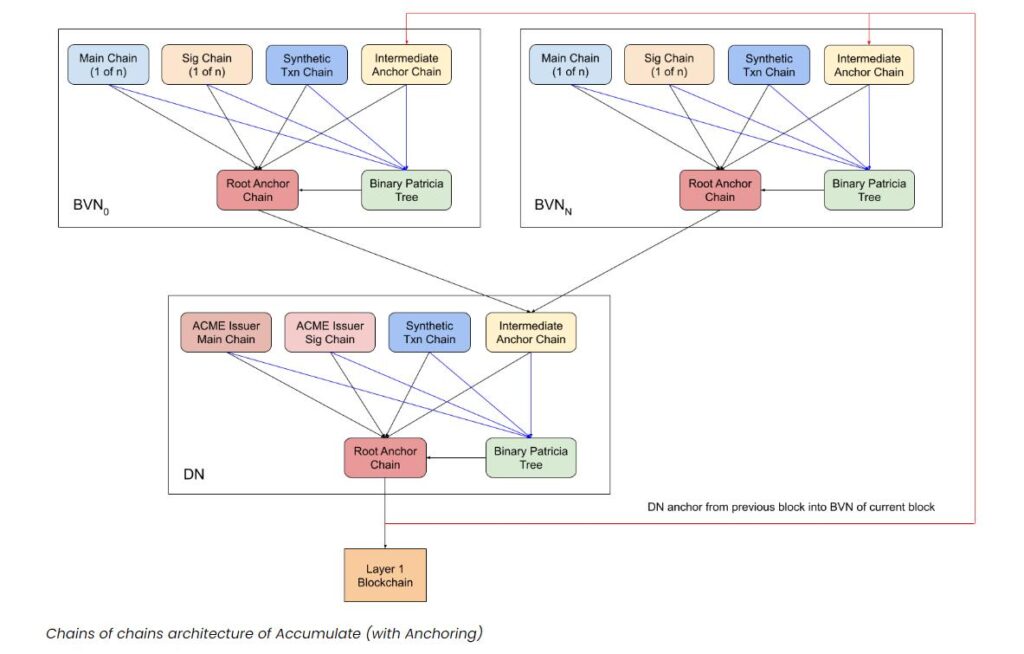

According to the whitepaper, “Accumulate by-passes the trilemma of security, scalability, and decentralization by implementing a chain-of-chains architecture in which digital identities with the ability to manage keys, tokens, data, and other identities are treated as their own independent blockchains.”

Each ADI is made up of a collection of independent sub-chains that are managed by 4 account types:

- Token Accounts:

- For issuing tokens and tracking deposits and withdrawals from a token account.

- Data Accounts:

- For tracking and organizing data approved by an ADI

- Staking Accounts:

- For staking Accumulate’s ACME tokens to participate in consensus and secure the network

- Scratch Accounts:

- For accruing data that is needed to build consensus across the Accumulate network and enabling the coordination of multisig validation.

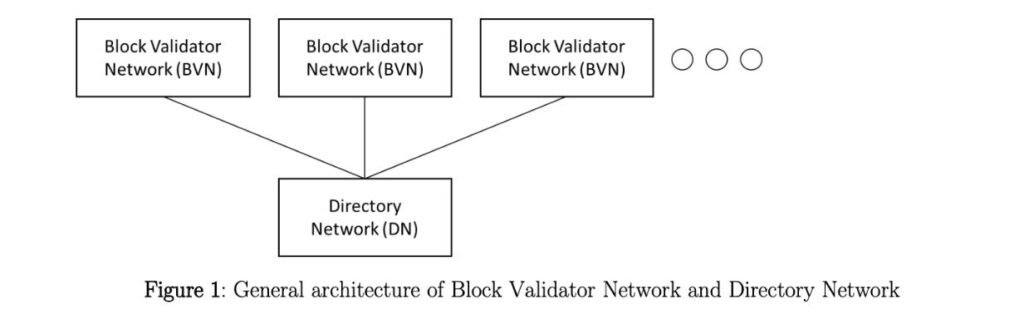

Accumulate also features Block Validator Networks or BVNs, which are responsible for producing hashes of data that are tied together and summarized by a Directory Network (DN).

The DN is a central network that consolidates the records of all transactions that occur between the 4 ADI accounts and their various sub-chains, thereby allowing Accumulate to maintain a single unified state, even while existing as many fragmented networks running in parallel.

Point 3 – Data Anchoring

Data security is a critical component of the scalability trilemma that is often overlooked.

Through a process called ‘Anchoring’, Accumulate is able to backup transaction data that is recorded on Accumulate to more decentralized layer 1 blockchains like Bitcoin and Ethereum.

With Anchoring, a cryptographic proof or hash containing batches of Accumulate transactions from across the entire network is inserted into the Bitcoin or Ethereum blockchain and validated by miners on those networks. This is the equivalent of backing up your data on multiple hard drives that each have their own unique security system.

According to the whitepaper, “Anchoring essentially buys the security of a larger network at a cost that is independent of the number of transactions. For example, a root hash derived from 10,000 transactions can be anchored into Bitcoin at the cost of a single Bitcoin transaction.”

Point 4 – Tokenomics

Accumulate native token (ACME) has a maximum supply of 500 million and is distributed as a block reward to stakers and validators of the Accumulate network.

ACME also carries deflationary properties, as portions of the tokens supply are burned whenever a new ADI is generated using ‘Credits’ which are separate utility tokens used to pay for services on the Accumulate network that can only be minted by burning ACME.

Credits are non-transferable tokens with a fixed USD value. This means that enterprise customers can leverage them for use within the Accumulate network without worrying about regulatory compliance issues. Credits also allow companies to track predictable costs long-term by using Credits as the denominator asset for all settled transactions.

Accumulate’s ‘Burn and Mint’ Equilibrium model is designed to enable ACME tokens to recycle through the Accumulate ecosystem and create value in a variety of ways for multiple stakeholders.

ACME tokens are burned to produce Credits which are used to purchase ADIs as well as other goods and services. Burned ACME tokens are then sent to an unissued pool, where they are released back into the network through minting as block rewards.

A portion of the reissued ACME tokens are rewarded to stakers and validators, while the rest goes towards supporting community development funds and issuing grants to fund new projects on the network.

Like the Bitcoin network, ACME block rewards will steadily decrease over time as the burn rate increases due to more Credits being minted to pay for ADIs. This tokenomic model should encourage ACME holders to participate in staking by locking up their tokens, driving even more long-term value for ACME.

Point 5 – Use Cases

The use cases that can be applied on the Accumulate network span a multitude of products, customer types, and industries, from healthcare and supply chains to Defi, NFTs, and the metaverse. A key area of focus is to enable enterprises to adopt ADIs in order to leverage decentralized protocols in order to bridge real-world assets onto the blockchain and participate in Defi while still being regulatory compliant.

Examples of this include:

Bringing transparency to the Supply Chain process

As an example, Accumulate can resolve problems with a lack of transparency in tracking drug production and transportation by enabling seamless communication across disparate centralized databases and blockchains using ADIs for everything from individual drug products and digital documents to transport authorities, retail stores and even IoT devices that monitor perishable goods.

This enables existing blockchain consortiums consisting of one group of drug development stakeholders to share information with other retailers, regulators, or consumers without incurring any significant costs.

Enabling better control of Patient Medical Records

The Accumulate key management system allows patients to replace the entities assigned to prior keys with new entities, or to issue new keys and revoke access to old ones, all without needing to create a new ADI.

In addition, the owner of an ADI can create multiple accounts and sub-identities based on a hierarchy of keys that give sub-identity owners custom access to certain data. For example, patients could map out a hierarchy of relevant stakeholders who need access to different types of medical data; from their primary care physician to their insurance provider, or for one-off cases where a user has to provide specific healthcare data to an immigration agency in order to visit a new country.

Onboarding the Corporate World to DeFi

Using Accumulate, corporations can more easily translate traditional asset valuation techniques into the digital realm by assigning unique ADIs to corporate assets (land, machinery, invoices, patents, etc) according to their appropriate classification (convertibility, physical existence, usage) and classification sub-type.

Each classification could come with its own set of lending rates, compliance conditions, or access permissions (e.g only corporations with a certain level of creditworthiness or within certain geography can borrow these assets).

These rules could be embedded into smart contract code to allow more efficient and scalable deployment of these assets within the network.

Improve Liquidity Sourcing in the Metaverse

The aggregation of various DeFi and NFT marketplaces under a single ADI-enabled communication layer creates an opportunity for liquidity to be more easily injected into the system in order to provide buyers and sellers with the best prices to enter and exit their positions within the metaverse. Large financial institutions such as banks or hedge funds can leverage the Accumulate network to put significant amounts of capital to work that can be used to provide liquidity and facilitate market-making amongst consolidated NFT, cryptocurrency, and gaming assets from various blockchains.

Ultimately, the Accumulate network is combining the best aspects of blockchain scalability, interoperability, modular design, and decentralized identity to create a truly novel solution that will onboard the traditional economy unto Web3 while enabling a multichain ecosystem to thrive under the ADI system.

About Accumulate

Accumulate emerged as a successor to the Factom protocol, forking its code to create a brand new network in November 2021. Factom was launched in 2014 as one of the earliest layer-2 blockchain protocols, serving as an alternative to the direct use of the Bitcoin blockchain for the management and organization of data.

Accumulate adapts some of the features developed by Factom, including the modular ‘chain of chains’ architecture and data anchoring while innovating in other areas such as its emphasis on decentralized digital identifiers as the basis for all operations that occur on the Accumulate network.

The Accumulate network is designed by Paul Snow, who is also the Chief Blockchain Scientist at Inveniam and Defi Devs, the former CEO and chief architect of the Factom protocol and co-author of the Accumulate whitepaper alongside Kyle Michelson, Anjali Sridharan, Umut Can Çabuk, Ethan Reesor, Ben Stolman, Drew Mailen, Dennis Bunfield, and Jay Smith.

Detailed in the whitepaper are several key developments that the Accumulate team has been working on to enable blockchain to onboard the next billion users.

Learn more by reading the Accumulate Whitepaper.

Contacts

President

- Michael Creadon

- Inveniam DeFi Devs

- support@defidevs.io

Press release disclaimer: This is a paid press release. Coin Rivet recommends readers to undertake their own research on the company. Coin Rivet does not endorse and is not liable for any content or products on this page.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.