Ethereum’s mining difficulty has been increasing over time following the activation of the difficulty bomb, leading to less blocks being produced. On average, Ethereum miners previously forged a new block every 10 seconds, but interestingly, due to the difficulty algorithm increasing, blocks are now being produced every 18 seconds.

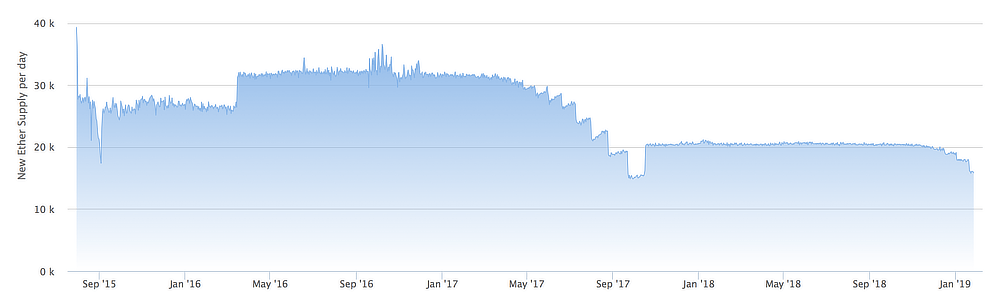

The Constantinople update, which was going to reduce block rewards from three to two ETH, has been put off so many times now that Ethereum’s ice age protocol has automatically initiated to reduce new Ethereum supply from about 20,000 a day to 15,000.

This means that the total supply of ETH has been steadily decreasing, on average by 2,000 ETH per week, as less blocks are found and produced by Ethereum miners.

Since late December 2018, there’s close to 25% fewer blocks being produced.

Ethereum’s price action

Although this can ultimately be a good thing in terms of price, it can also lead to some security problems. The fact less blocks are being mined means the incentive for miners also decreases, as they win less ETH because they find less blocks on average. This means the total hash rate also decreases over time.

Looking at the short term, we could see ETH price resistance levels rising due to less ETH being available on the market. Liquidity could take a small hit as well.

However, in my opinion, I see the effects of a shorter supply of ETH as generally positive.

For the time being, I see Ethereum’s price enjoying gains from reduced inflation.

I personally think variance may now cause some blocks to take as much as two minutes to forge, with the network’s capacity potentially being affected, although fees still remain at half a cent.

Let’s see what the short-term future holds.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.