Today I want to outline a very simple trend-following strategy for you.

Trend-following as an investment strategy divides opinion. I’ve found it to be extremely effective over the years, but I recognise that it only works in markets that are trending. Markets often go through extensive periods where they don’t actually go anywhere – they range-trade – and trend-following can actually lose you money in these environments. You get false buy and sell signals and you get whipsawed out the markets.

However, when a market is trending in one direction – whether it is up or down – trend-following can be a good strategy. The whole HODL meme was basically trend-following. In a bull market, there is no better strategy than buy and hold. The colossal bull market of 2016 and 2017 defied all expectation, and those that played it best were those that HODLed.

However, to buy and hold in a bear market is fatal. You want to sell and hold. Those that sold early in 2017 will be glad they did now. Those that HODLed will be less convinced about the meme.

One famous example of trend-following, by the way, is turtle trading. This was a strategy employed by two legendary commodities traders of the 1970s and 1980s, Richard Dennis and William Eckhardt. Dennis had turned an initial stake of less than $5,000 into more than $100 million. He believed anyone could be taught to trade the futures markets, while his partner, Eckhardt, thought Dennis had a special gift. They set up an experiment to settle the debate.

Dennis would find a group of people to teach his rules to, and then have them trade with his own money. He was so convinced he was right, he was prepared to risk his own money. The training lasted just two weeks. He called his students “turtles” after turtle farms he had visited on holiday: just as the farms produced turtles, so he thought he could produce traders. Their story would eventually become the basis for the film Trading Places.

Another great trend-follower was the legendary investor Jesse Livermore. “It never was my thinking that made the big money for me,” he said.

“It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine – that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

Trend-following helps you stay on board and catch the large part of any move, whether it is up or down. Crypto is a bipolar market – the world either loves it or hates it – so you tend to get fairly good trends in both directions.

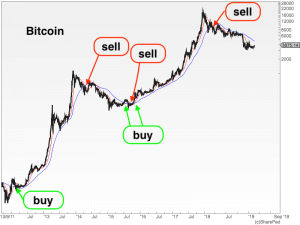

So here is one simple trend-following strategy. I use the 21-week or the 6-week simple moving average (SMA). You can play about with charts to find time combinations that suit you. For example, if you are a frequent trader, you might use daily or even hourly combinations instead of weekly. Some people prefer exponential to simple moving averages. They can all work. But here I am using simple moving averages.

When the 6-week SMA crosses up through the 21-week SMA, and the price is above, you have your buy signal. Both SMAs should be flat or sloping up. When the reverse happens – the 6-week SMA crosses down through the 21-week SMA and the price is below – you have your sell signal.

Here is Bitcoin since 2011. The 6-week SMA is the red line. The 21-week SMA is the blue line. I have marked both the buy and sell signals.

We got a buy signal in January 2012 with Bitcoin at $6. It actually pulled back to $4 – that’s a correction of over 30% – but the sell signal never came so we held. The sell signal came in April 2014 with Bitcoin around $500. So even though you missed the high (at $1,200 in late 2013), you still got a move of $6 to $500, which is a profit I think most people would settle for.

2015 was an annoying year. There was a buy signal in June. Bitcoin was at $300. We got a sell signal in early October with Bitcoin at $250. So we lost $50. We then got another buy signal that same month with Bitcoin at $380. This would have been a hard pill to swallow. But if you followed the system, you got on board one of the most epic bull markets in history.

You wouldn’t have sold your Bitcoins at $20,000, but you would have sold them in March 2017 with Bitcoin around $9,000. Again, $380 to $9,000 is a profit most people would take.

Today we remain on a sell signal.

If you start fiddling around with exponential moving averages, they actually work better with Bitcoin than simple moving averages, but for the purposes of clarity, I have stuck with simple moving averages. (Exponential moving averages give greater weighting to more recent weeks – unlike simple moving averages which weight each week equally.)

This is an extremely long-term strategy I have identified here. If you want something a bit more racy, then use daily moving averages.

If you use daily moving average crosses (again, the 6- and 21-day simple or exponential moving averages), Bitcoin – and most cryptos besides – are on a buy signal. But I have to say, I find the weekly moving averages work better with crypto.

Dominic Frisby is author of the first (and best, obviously) book on Bitcoin from a recognised publisher, Bitcoin: the Future of Money?, available from all good bookshops, and a couple of rubbish ones too. Dominic is director of Cypherpunk Holdings (CSE:HODL), a company set up to invest in privacy-related technologies. Follow Dominic – @dominicfrisby

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.