While an outright ban is kept at bay by both governments and central banks, there is also no commitment on their part to let this space flourish to reap the benefits of progress.

Amid rumours of taxing all Bitcoin transactions and “fake news” about the Belgian Justice minister’s negative views on cryptocurrencies, it’s hard to distinguish the wheat from the chaff. Let’s examine recent news items to discern a clear position.

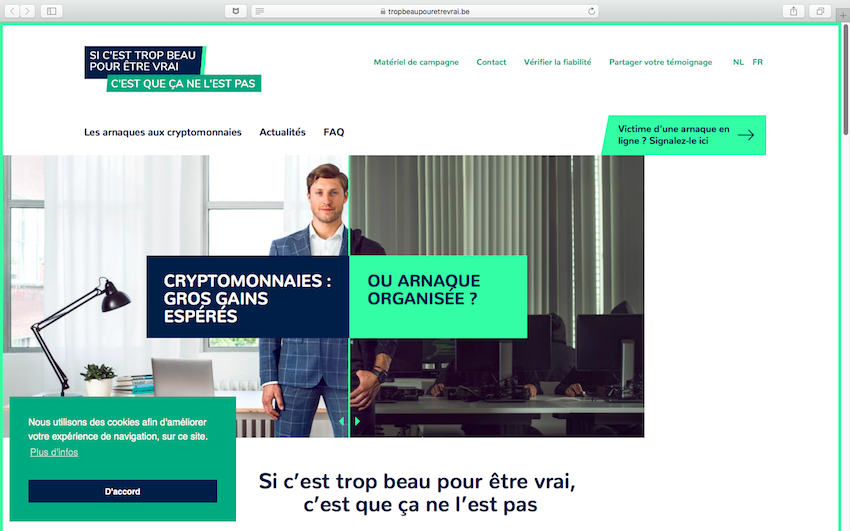

With growing public interest in mind, the government has recently launched a website, warning its citizens about common crypto-related frauds. Given how $1.7 billion has been lost in cryptocurrency frauds, hacks and thefts since 2011, informing citizens on how they can protect their money in a volatile market seems like a smart decision.

Earlier this year, the country’s stance on the taxation of cryptocurrenciesalso emerged. The Special Tax Inspectorate (STI) expects Belgian crypto-investors to declare their gains as miscellaneous income on their tax returns, paying a 33% rate in the process.

Upon an examination of their general capital gains tax, we find there is no discrimination between these assets and other investments. The 33% tax rate applies to all gains. The poorly-named STI is currently cooperating with foreign exchanges to collect the information it needs to investigate any potential misdeeds by its citizens.

Given that any regulatory framework would be the consequence of the policy recommendations of the European Central Bank, which have yet to emerge, European countries are free to regulate cryptocurrencies as they see fit.

While recent developments can be interpreted as a general distrust of innovative solutions, they must also be considered in light of taxation and the protection of the public interest. Ignorant of their intentions, we can’t judge these events as indicative of an anti-crypto stance by the Belgian government.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire