Australian company Global Tech Exchange says that its Initial Coin Offering (ICO) has ceased in accordance with Australia Securities Investments Commission (ASIC) requirements.

The Brisbane-based venture had been looking to raise between $10 and $50 million for the creation of a cryptocurrency trading platform, with the token sale running until 10th December.

“Global Tech has issued full refunds to all investors. If you have invested with us and have not yet received a refund please contact support@gttrade.io,” it announced on its website.

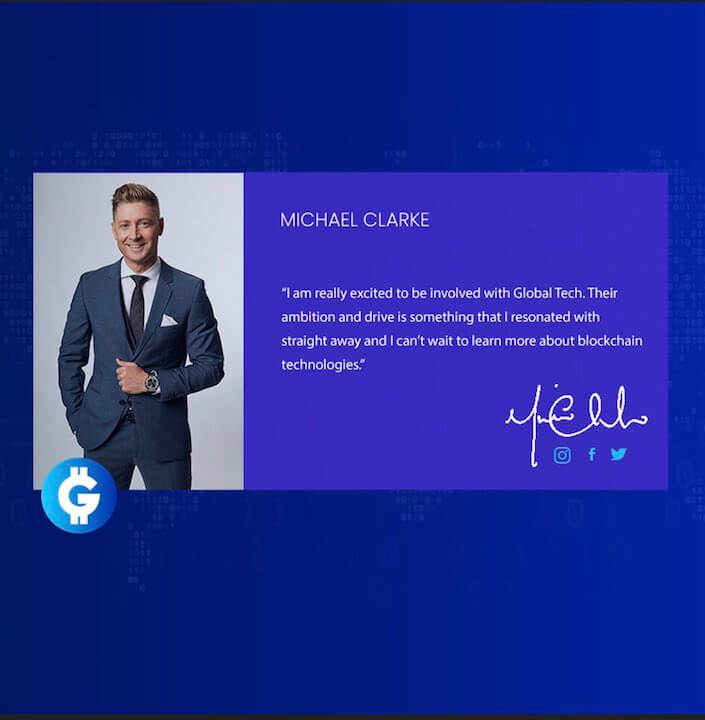

The project was given a boost when cricket player Michael Clarke announced his involvement on Twitter.

But he is no longer onboard, the statement noted. “Global Tech would like to inform you that it wishes to comply with all of ASIC’s requirements and requests, to the best of its ability,” it concluded.

Last month, ASIC issued a warning on “misleading” ICOs and crypto-asset funds targeted at retail investors.

In a document published on its website, the financial watchdog said that it had taken action to stop several proposed ICOs. It also recently clamped down on the issue of a Product Disclosure Statement for a crypto-asset managed investment scheme.

Consistent problems identified by ASIC were: the use of misleading or deceptive statements in sales and marketing materials; operating an illegal unregistered managed investment scheme (MIS); not holding an Australian financial services licence.

ASIC Commissioner John Price said: “If you raise money from the public, you have important legal obligations. It is the legal substance of your offer – not what it is called – that matters. You should not simply assume that using an ICO structure allows you to ignore key protections there for the investing public and you should always ensure disclosure about your offer is complete and accurate.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire