exc-5b2377362b6a2838e7825de7

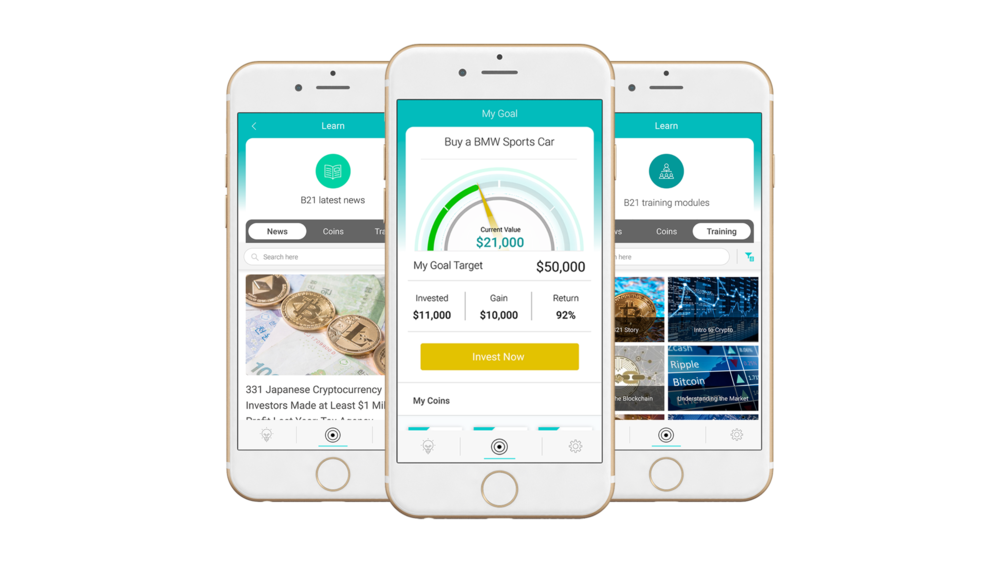

The mobile-focused platform enables people to create their own portfolio of cryptocurrencies, including Bitcoin, Ethereum and EOS. Users can set goals, contribute funds and track progress and received tailored artificial intelligence-powered investment advice based on research into individual tokens. This aims to help users to build a portfolio catered to their risk preferences and investment goals.

B21 will offer additional personalised portfolio services for high-net-worth clients. Miles Paschini, Co-founder of B21, says: “Market research shows that consumers want to invest straight from their devices in alternative asset classes, while maintaining the trust that their investments are held safely.”

At launch, the app will be available for iOS and Android, and investors will be able to fund their accounts in their own local currency. B21, whose team previously developed the industry’s first crypto-linked debit cards, has applied for a custodial licence to comply with regulations covering protection of customer assets; segregation of customer and company funds; maintaining robust and accurate transaction records; and cold storage of customer funds. By acting as a custodian, B21 eliminates the need for people to hold their own private keys.

The FinTech’s eponymous token will be used as the only form of settlement between the platform and users. The token will be used by investors to settle fees, and to incentivise and reward referrals to the platform.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire