As of today, the cryptocurrency bear market has reached 391 days. By this time next month, the bear market would have stretched beyond the 420 days seen between 2014 and 2015. Officially, it could be the longest bear market in crypto’s short history. To refresh your memory, a bear market is defined as a drop of 20% or more from a recent high, although some prominent traders like Alessio Rastani argue that model is incorrect and the threshold should be lower.

Since 2011, Bitcoin has experienced around six epic meltdowns, with losses ranging from around 36% to 86%. Each time, the market has come back stronger than ever, culminating in the 2017 bull run that drove Bitcoin towards the $20,000 price range.

At the height of the bull market in early 2018, cryptocurrencies were valued close to $1 trillion. Less than 12 months later, the market bottomed at just over $100 billion. The bearish trend is expected to continue until at least mid-2019, according to a combination of technical analysis, market sentiment, and history of monthly momentum. There are, of course, other reasons to expect the bears to maintain control. These include regulatory uncertainty, hesitation on the part of institutional investors to participate, and the fallout from the long-winded ICO boom.

Interestingly enough, Bitcoin has managed to set higher lows in six of the last seven years. In other words, Bitcoin’s price bottom is incrementally higher almost every year stretching back to 2012.

If that doesn’t make you happy, I really don’t know what will.

Buying pressure for cryptocurrencies on the horizon?

As reported on Coin Rivet last week, Russia could be looking into Bitcoin as a hedge against the US dollar and the imposed US sanctions.

As eToro’s senior market analyst Mati Greenspan points out in his daily newsletter: “[…] the major setback here is that there is currently no legal framework for [Russia] doing this. However, from what I understand, the idea of setting up a national CryptoRuble is being discussed among government officials and could very well happen within the next couple of years.”

Elina Sidorenko, the chairperson for the government committee for overseeing cryptocurrencies, has now clarified that while Russia might want to do this, it could be another 30 years before this becomes a reality.

Although dear Russia might take its time to go all-in on Bitcoin and other cryptocurrencies, the majority of underdeveloped countries could maybe make a move sooner due to unexpected fiat currency issues, monetary problems, or commercial barriers. As I’ve mentioned countless times before, Bitcoin is a means to achieve an end, greater than speculation for that matter. We just need patience and the ability to see things from a long-term perspective.

Although at the moment things do seem quite gloomy, what I imagine in the long-term is cryptocurrency taking over the world.

Need proof?

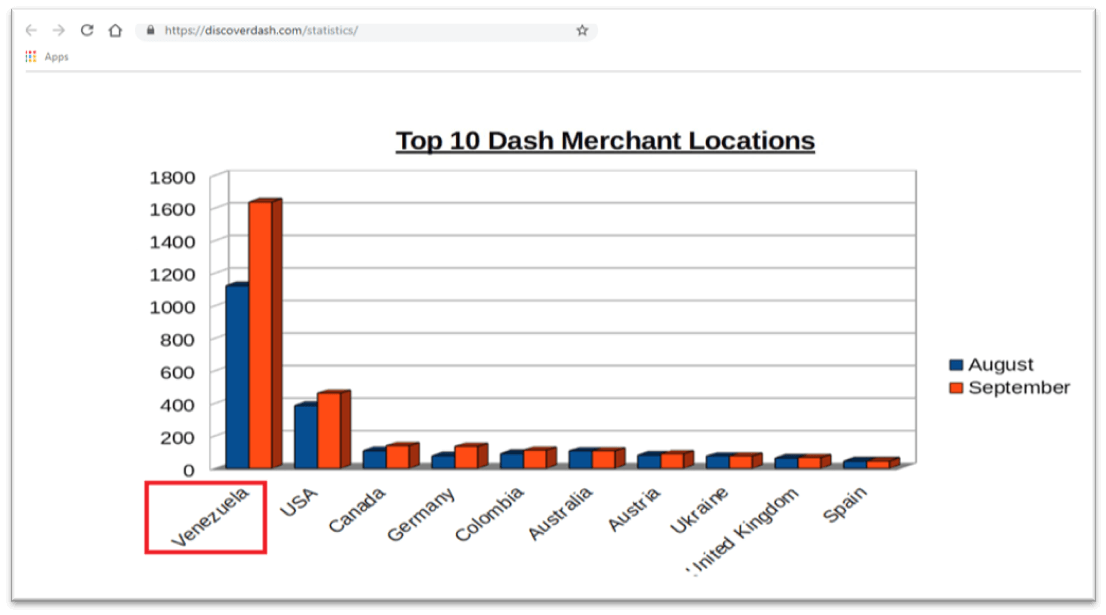

Look at how well Dash is performing in Venezuela and other Latin American countries.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.