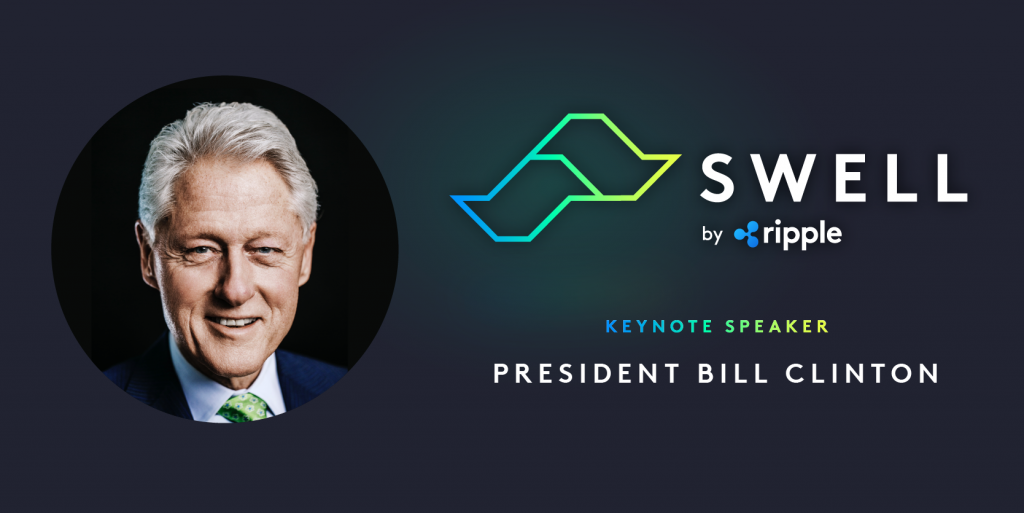

Ripple has announced Bill Clinton as the keynote speaker for its policy, payments and technology event Swell, which will take place in the blockchain venture’s home town of San Francisco, California from 1st to 2nd October.

“At a time when groundbreaking technology and regulation were often on a collision course, President Clinton helped usher in a period of extreme growth and adoption of the internet, shaping what it is today. He also established programmes that bridged the “digital divide” and brought new technology to underserved communities around the world,” says Ripple.

It adds: “These learnings are perhaps more relevant now than ever before. Like the internet boom of the 90’s, we are at an impasse: digital assets and blockchain technology offer a way for value to be exchanged as quickly as information – creating more financial inclusion and economic opportunity. However, with this new technology comes potential for concern, requiring thoughtful policy to protect consumers from risk without hampering innovation.”

Gene Sperling, National Economic Council Director and Advisor under Presidents Clinton and Obama, will moderate a Q&A with President Clinton during the keynote address.

This year’s Swell programme will also feature:

Regulation is a hugely divisive topic in the crypto space, with some arguing that it is an essential part of achieving mainstream status and others stating it will hamper innovation. Ripple is firmly in the former camp.

During a recent interview with Fox Business, Cory Johnson, Ripple’s Chief Market Strategist, said that the company was “thrilled” to see regulators making their presence felt. “One person’s regulation is another person’s protection,” he argued. “I believe it is really important for investors to be protected. We’ve seen what happens when there aren’t investor protections, investors have lost a lot of money. And we’ve seen some really bad actors in the world of crypto.”

Other countries are, however, leapfrogging the US in the race to grab a piece of the crypto action. “A lot of other countries are moving faster than the US to try to provide really clear lanes of where business can act, what’s right and wrong,” he said.

Singapore, Switzerland and Thailand are working really hard to make sure businesses develop in those countries around blockchain. “The US is starting to do some things, the SEC is trying to figure some stuff out, but other countries aren’t waiting around and entrepreneurs aren’t waiting to start businesses.”

Headline grabbing China, he added, is a peculiar case. “Most of the Bitcoin and Ether money is taking place where power is cheap, which is China and where they have access to the best computer chips, which is China. Most Bitcoin and Ether is being mined in China. XRP isn’t being mined, it was pre-mined if you will. So as a result, it uses virtually no power compared to other things, running a node on the network is so much cheaper and there aren’t any mining costs associated with that.”

And Johnson stepped up his backing of XRP, arguing that it is a much better tech than Bitcoin. “We look at it as blockchain 2.0. Bitcoin is a fascinating idea, but it is breaking down in the sense of how to use it, closing transactions is really slow.”

“We’re looking at a business problem, which is moving money across borders. It is crazy in this era of technology that in a matter of seconds I can send a text message to a friend in Rome, with emojis and a gif of Neymar falling down, but if I want to move money from New York to Mexico City it takes five days and costs over 500 basis points. We’ve created a bunch of software products to move money in a matter of minutes, using XRP as a basis technology. XRP will have great value over time,” he concluded.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire