Bitcoin is again making higher highs as the price breaks out across the board, taking the decentralised and global asset class back above a $100 billion valuation.

However, as Bitcoin has made fresh highs it seems that the altcoin-market is seeing some pain with 5% losses across the board against the BTC pair today. Since BTC traded at a dominance above the alt-coin market of 50% in late March, the figure has now broken out above 55% as the crypto economies validate its choice as the king of this new distributed economy.

With Bitcoin now trading at more than $6000 on Bitfinex, the premium to the traded price at other major non-tether based exchange remains close to $300 or $6%.

In an interesting twist, we have also seen the price of USDT remain and even trade above $1 as opposed to the last time large premiums appeared in the market and the stablecoin lost its peg.

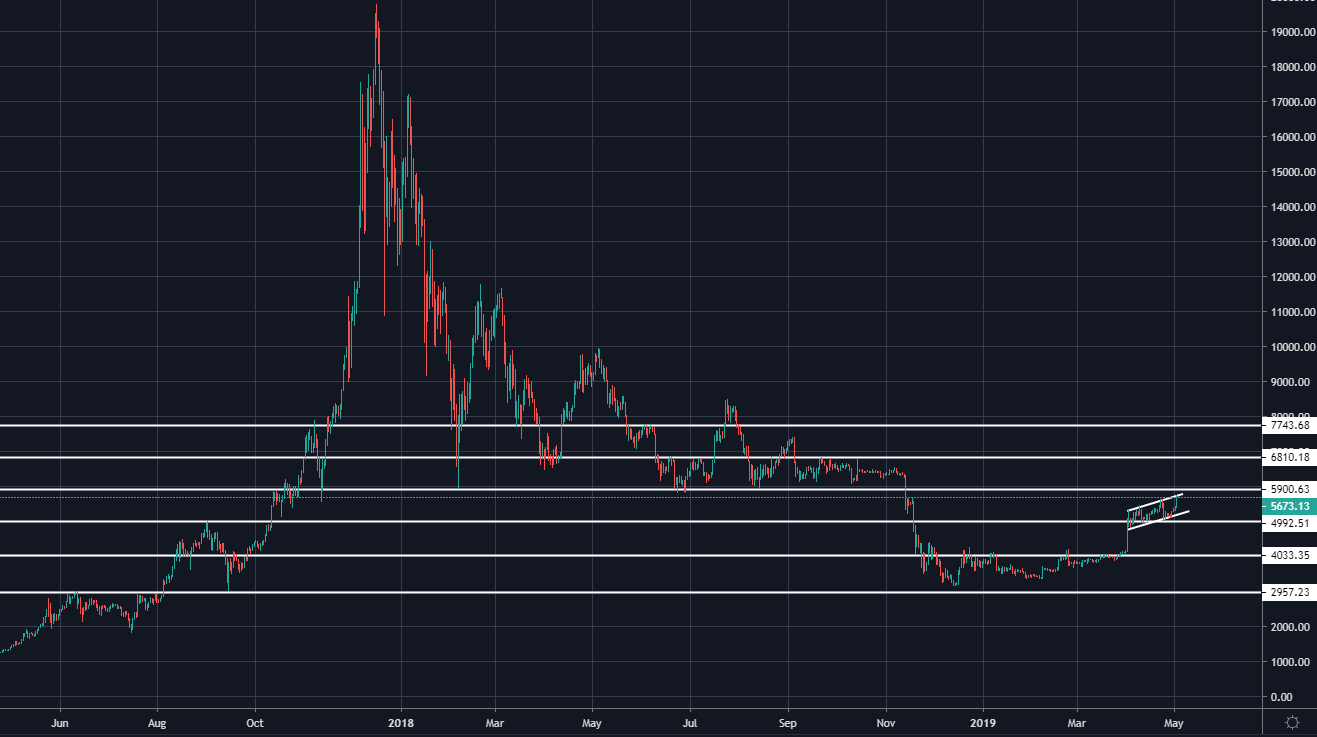

Because of the disparities in price forming over the last week, it’s not always clear where the lower resistance line may officially be plotted. After a series of higher lows and higher highs on some exchanges, it seems like Bitcoin is primed to now give the major hurdle of resistance between $5,800 and $6,200 a test, with a potentially upcoming short squeeze for margin traders who are hedging BTC stored on cold wallets in their possession.

Since the epic April Fool’s rally that took Bitcoin above its $4,200 resistance, we have seen a good month’s solid trading above the psychological $5,000 price point. Over the last six hours, we have also seen the bulls in control, with a number of short positions liquidated over the last couple of hours.

The last big move by the bulls took the bears for more than $500 million in liquidation (just on BitMEX). As the liquidations ramp up, you can clearly see who is in control of the price and direction in this fundamentally undervalued asset class and burgeoning crypto economy.

If a short squeeze happens here, it may provide the rocket fuel needed to catapult the industry back into the realm of not just a hundred, but a multi-hundred dollar market cap.

Given the central stage that coverage over this industry now takes (in comparison to just a few short years ago), it’s getting more and more difficult to make a case that there’s little potential for this asset to disrupt digital payments on a global scale.

It’s actually more likely than ever before.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire