Bitcoin is once more creeping up to challenge the $8,400 level of resistance before a potential bull market continuation towards a five-figure price tag.

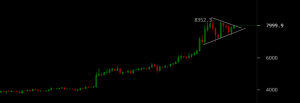

The digital asset is currently coiling up in a snake-like formation, with price following a consistent ascending channel before the parabolic breakout above $6,000.

Over the past two weeks, Bitcoin has seen a sequence of five higher lows and two very distinct lower highs as price looks poised to spring out of its current wedge with an explosive move either up or down.

Bitcoin has a rich history of trading in the $6,000-$8,000 range after spending many months of the 2018 bear market inside this zone.

Given that sentiment seems to be turning optimistic as a result of retail and institutional FOMO, the charts seem to suggest that if the $8,400 level breaks, the psychological five-digit mark will be the next short-term target for the king of all decentralised assets.

Buying the dip

At the moment, Bitcoin buyers continue to ‘buy the dip’ following a multitude of attempts to drive prices lower in the midst of fiat chaos. In the last few weeks we have seen an escalation of the trade war between the US and China coupled with the continuation of the Brexit debacle, which took another turn today following the resignation of the UK Prime Minister Theresa May.

Commenting on the trade war, American broadcaster Max Keiser reported “that China could dump its $1.1 trillion of treasuries to retaliate against US tariffs”.

In recent weeks, we have seen the Chinese yuan trade 2.5% lower against the US dollar as the impact of the tariffs take effect on the currency (which let’s not forget is now included in the IMF‘s SDR basket).

As the cost of keeping its peg gets more and more expensive, the People’s Bank of China may be faced with no choice but to start dumping its large cache of US treasuries as it requires dollars to defend confidence in its own currency.

Lack of correlation

Stock markets are also globally poised on a knife-edge with markets like the S&P500 now sitting precariously on a support level that has rejected price on five or six occasions in the last 14 months.

On the back of wobbles for major economies, Bitcoin has been steadily trading upwards and towards the key $8,400 level of significant resistance. In recent weeks, we have seen long-term speculators and retail investors rush in to buy the digital asset as it fell to lows of $7,000.

As asset managers are forced into looking at exposure as a key factor in allocation decisions, the lack of correlation between the stock market and crypto assets in recent months can be seen as a positive for cryptocurrency’s ability to act as a hedging instrument against a traditional allocation in stocks or government-backed treasuries.

For more news, technical analysis, and cryptocurrency guides, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.