Bitcoin’s price action over the past few days has come at a slight cost. As we saw during the height of the 2017-2018 bull run, whenever Bitcoin becomes popular, its transaction fees skyrocket. Not only that, but the mempool – or the memory pool where unconfirmed transactions are stored – is also getting bigger.

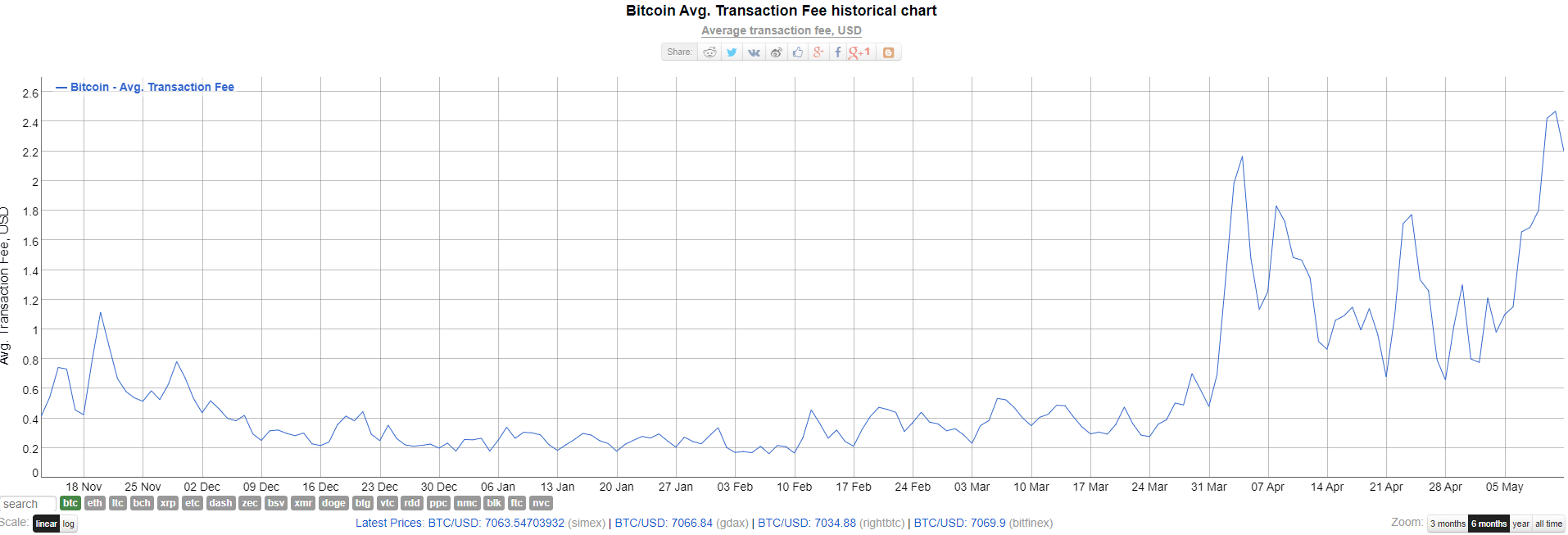

BTC transaction fees have soared to a new 11-month high. At the time of writing, the average Bitcoin transaction fee is about $2.50. That’s up from $0.75 earlier in May – which itself is still some way above the yearly low of $0.17.

The chart above shows Bitcoin’s transaction fees for the past six months.

Now compare that to the Bitcoin price trajectory over the same time period (which you can find here) and we see a clear correlation. The peak transaction fee of $2.50 was recorded on May 12. The median transaction fee also peaked on the same day.

Those fees apply to an average transaction value of just $409, according to Bitinfocharts. That may only equate to fees of 0.36% of the amount presented, but anyone looking to send a substantially lower sum would still have to pay roughly the same transaction fee.

Bitcoin transaction fees are not dependent on the amount sent, but on the total number of transactions happening in that moment. In other words, fees rise when the blocks on the blockchain get too full. Only so many transactions can fit into Bitcoin’s 1MB blocks. Full blocks result in higher transaction fees, as holders must now compete to get their transactions through in time. Not only that, but the number of transactions not being approved begins to increase.

According to data from Bitinfocharts, the BTC block size has been pushed close to its limits for the past three months. We can see in the chart above that the number of unconfirmed transactions keeps rising, as it clearly mimics surges in Bitcoin’s price action. This means any time there’s a BTC price surge, we should expect transaction fees and the number of unconfirmed transactions to rise.

At the moment, blocks seem quite close to being full, which is another trigger for an increase in unconfirmed transactions and fees.

Meanwhile, the number of Bitcoiners using SegWit to move money is perched above 40%, and there are little signs of more addresses joining in the meantime – which is a total shame if you ask me.

SegWit refers to nodes on the Bitcoin blockchain that strip out certain data from transactions in order to reduce their size. This in turn allows for more transactions to fit in a single block. SegWit blocks can expand to 4MB, and according to optimists, they will be able to handle millions of transactions per second when paired with the Lightning Network.

However, SegWit has drawn plenty of controversy. Many question its security due to the fact that it doesn’t operate fully on the blockchain. Rather, SegWit nodes – or ‘channels’ – are opened up, allowing nodes to validate certain data without sending it to the blockchain. In essence, you can use a hash to validate bits of information without committing said data to be fully verified on the blockchain. What’s interesting is that, looking above, we seem to be stalling in terms of adoption.

Could it be due to the ongoing block size debate?

Right now, the Bitcoin community is divided between ‘big-blockers’ who want to scale Bitcoin on-chain and ‘small-blockers’ who want to move everything over to SegWit and the Lightning Network (off-chain solutions). Two of the most influential proponents of the first solution are Roger Ver and Craig Wright, while key supporters of the second solution lie within the Bitcoin core community and core programmers like Greg Maxwell and Jimmy Song.

The legacy of this debate, which started around 2015, can still be felt to this day. The entire Bitcoin Cash hard fork saga was based around the same contentions. And as some of you remember, Bitcoin’s adoption of SegWit was the reason that Bitcoin Cash (BCH) split off and became its own coin in the first place.

Bringing this back to very recent events, there’s even a feasible idea circulating that SegWit was inadvertently responsible for the latest Binance hack.

Interestingly, over 99% of the stolen BTC was sent to a SegWit address on Binance. Since Binance has not yet adopted SegWit, there’s a strong possibility that its security safeguards weren’t able to register the transaction.

You can see more below as discussed by Ivan on Tech.

Don’t forget the most important advice out there:

“Not your keys, not your coins.”

Safe trades!

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire