Bitcoin is nearing a dramatic death cross that would almost certainly cause a period of sustained downside price action over the coming weeks.

A death cross is where the 50 exponential moving average (EMA) crosses the 200 EMA to the downside, which is looking increasingly likely on the four-hour Bitcoin chart.

On Thursday last week, when Bitcoin fell to $9,150, it seemed to be the death cross was inevitable. However, the bulls saved the day with an explosive $1,000 rally to propel Bitcoin back above $10,000.

For a few hours over the weekend, it looked as though Bitcoin would continue its upward trajectory by breaking through $11,200, but it simply wasn’t to be.

Instead, Bitcoin experienced a gruelling and almighty rejection at this level on Saturday evening, with prices subsequently falling back to around $10,300.

The 50 EMA and 200 EMA on the four-hour chart have been running parallel this weekend. If Bitcoin falls back to $10,300 or even below $10,000, the 50 EMA would begin to tick down below the 200 EMA, resulting in the first death cross since September 7.

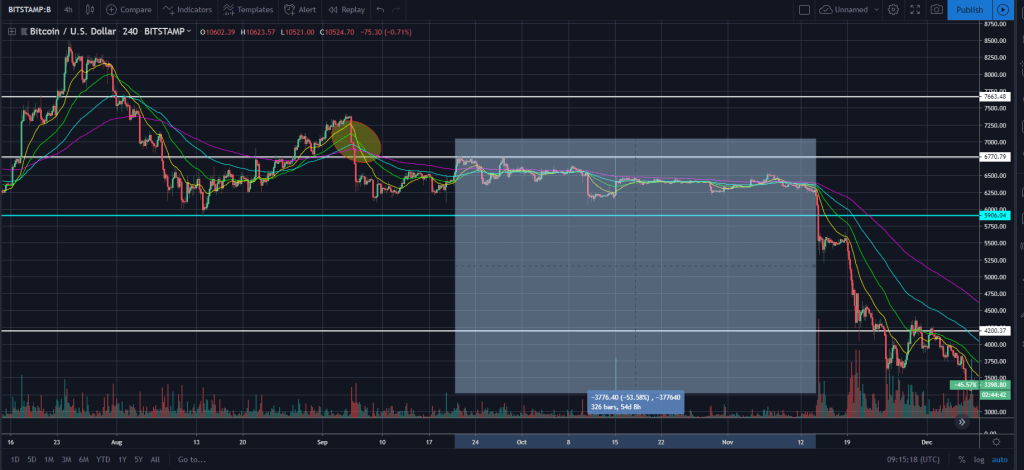

After the four-hour death cross took place last year, Bitcoin levelled off for around one month before falling by more than 50% all the way down to $3,150.

It’s worth noting that in the current bull cycle, a death cross may not have as much of a negative effect, with buyers more inclined to ‘buy the dip’ amid the recent uptick in the markets.

Downside targets if the death cross comes to fruition would be $10,100, $9,700, and $9,150, but it would also be possible to see $8,550 and $7,650 come into play.

The 200 EMA on the daily chart is moving back up to around $7,650, so this could be a potential level for a bounce if prices do drop significantly.

While downside price action seems likely, the four-hour death cross can still be averted. If the bulls really want to defend this area, a rally upwards of $11,200 would be enough to invalidate this theory, with price likely to move back up towards $12,000 and potentially $13,000.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.