This regular column is part of our cryptocurrency analysis and features the Bitcoin price plus daily, weekly and monthly price movement. We analyse the Bitcoin price against US dollars (BTC to USD). One of the founding principles of Coin Rivet is to promote understanding of cryptocurrencies and blockchain technology. Part of that understanding is looking at pricing trends for cryptocurrencies. This column is a regular analysis of the Bitcoin price (BTC to USD). We compare against the US dollar for ease of comparison (all our cryptocurrency analysis will put values in the US dollar equivalent).

In discussing the prices of various cryptocurrencies, we are not recommending a coin neither are we recommending that you should invest in one. In fact, the more you learn and study the more you will realise that the price fluctuations of cryptocurrencies are volatile. As we all know the value of investments can go up as well as down. In the case of cryptocurrencies that can be a lot – in both directions.

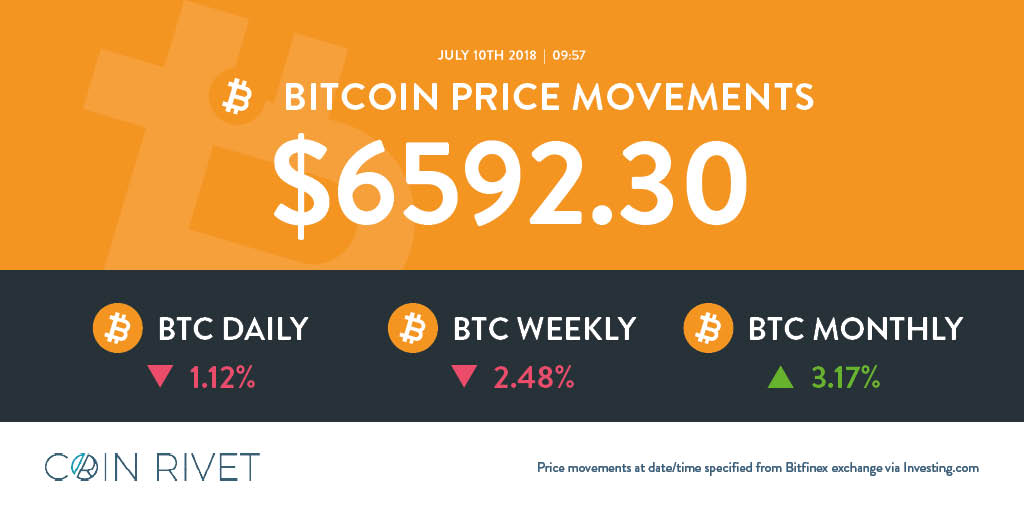

Bitcoin daily price 10 July 2018, 9am (GMT)

Price: US$ 6,592.30

Daily: -1.12%

Weekly: -2.48%

Monthly: 3.17%

If you would like to find out more about Bitcoin and other Cryptocurrencies, then some of the information and links to other articles, recent news stories and guides on our site will be useful.

About Bitcoin

In August 2008, the domain name bitcoin.org was registered. On 31st October 2008, a paper was published called “Bitcoin: A Peer-to-Peer Electronic Cash System”. This was authored by Satoshi Nakamoto, the inventor of Bitcoin. To date, no one knows who this person, or people, are.

The paper outlined a method of using a peer-to-peer network for electronic transactions without “relying on trust”. On 3rd January 2009, the Bitcoin network came into existence. Nakamoto mined block number “0” (or the “genesis block”) which had a reward of 50 Bitcoins.

Our regular article lists The Top 10 Cryptocurrencies.

What can I buy with Bitcoin?

Without doubt, Bitcoin is a hugely disruptive force within the financial services sector. However, although many potential users may have an awareness of the innovations behind digital currencies, the real-world feasibility of Bitcoin in everyday scenarios is little known by the average consumer.

From gaining an in-store presence on the High Street to emerging as an online payment alternative, the cryptocurrency is accepted in more places than you might expect. The catch? The details beyond widespread compatibility are what may make all the difference.

From the unique constraints as you make your online purchases and transfer times that the average consumer may not expect, Bitcoin may not yet be a complete replacement to fiat currency for everyday use cases, but its temporary issues could be a worthwhile compromise for advantages just around the corner.

Find out more by reading the full article.

Regulation looms large as resistance to cryptocurrency mania grows

Cryptocurrencies are likely to become heavily regulated amid fears they are in a bubble and facilitating illegal activities, it has been suggested.

The comments by Andrew Cornell, Managing Editor of ANZ publication bluenotes, follow a report by the Bank for International Settlements (BIS) which referred to cryptocurrencies as a “combination of a bubble, a Ponzi scheme and an environmental disaster”.

Cornell writes in a blog that there has been a growing resistance to cryptocurrencies, which has contributed to speculators cashing out. The BIS, for example, warned they have a limited ability to satisfy the signature property of money, are unable to scale with transaction demand and fluctuate greatly in value.

The bank regulatory body said the emergence of cryptocurrencies calls for a globally coordinated approach to prevent abuses and strictly limit interconnections with regulated financial institutions. “In brief, like it or not, cryptocurrencies will be regulated, heavily,” Cornell writes.

Find out more by reading the full article.

Bitcoin.Live boss slams short sighted BIS crypto report

Bob Loukas, the founder of Bitcoin.Live, has hit out at a recent report from the Bank for International Settlements (BIS) that called into question the stability and longevity of cryptocurrencies.

“With claims that Bitcoin is a poor substitute for the traditional institutional backing of money and that the technology comes with poor efficiency and vast energy use, you could say that the powerful banking group is looking backward and not forward. The report appears to be not only short sighted but also unware of the revolutionary changes that are happening right now,” he says.

Whilst the BIS report casts a large shadow within the UK, other countries are showing a more welcoming approach, Loukas argues. He flags up Dutch banking giant ING, which recently published new research showing the growth and acceptance of cryptocurrencies. Elsewhere, Facebook has reversed a high-profile ad ban and the Bahamas is set to offer a government-backed cryptocurrency pilot.

Find out more by reading the full article.

Environmental impact of bitcoin mining

We all know Bitcoin mining involves using electricity to power miners (processors) but what is the environmental impact?

The industry of Bitcoin mining has grown massively since the currency launched, from the hobbyist right up to industrial scale professional operations. But just how much power is consumed in the mining of Bitcoin?

In 2017, several media organisations were granted access to one of the world’s largest Bitcoin mines, located in Inner Mongolia (China), operated by Bitmain Technologies. An excellent analysis of the mines operation by PWC analyst Alex DeVries estimated that the 25,000 mining machines at the factory emits 8,000 to 13,000 kg of CO2 per Bitcoin mined. That works out at 24,000 – 40,000 kg of CO2 per hour.

That’s a lot. The US Environmental Protection Agency estimates that the average passenger vehicle emits about 0.404 KG of C02 per mile driven. So, for every hour the mine in Mongolia operates it emits at least the same amount of CO2 as 59,405 miles travelled by a car. So if we drove a car from our office in the UK to Mongolia and back seven times we would emit the same CO2 as the mine does in an hour.

Find out more by reading the full article.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire