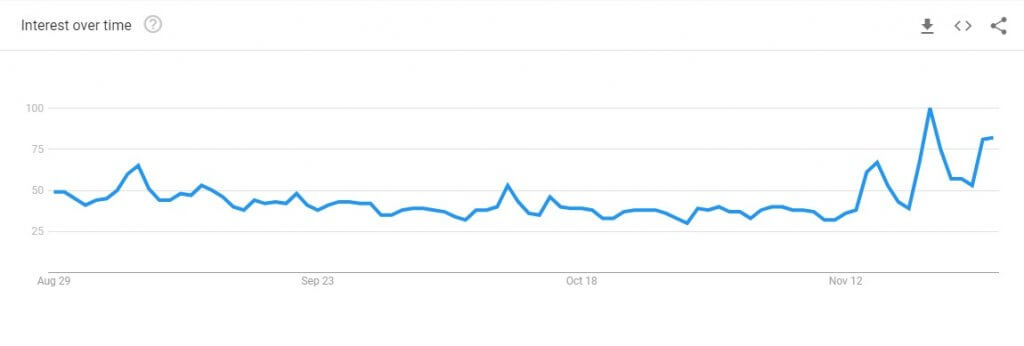

Google searches for Bitcoin have hit the highest level since April, emphasising a reversal in terms of interest in cryptocurrencies and the digital asset class as a whole.

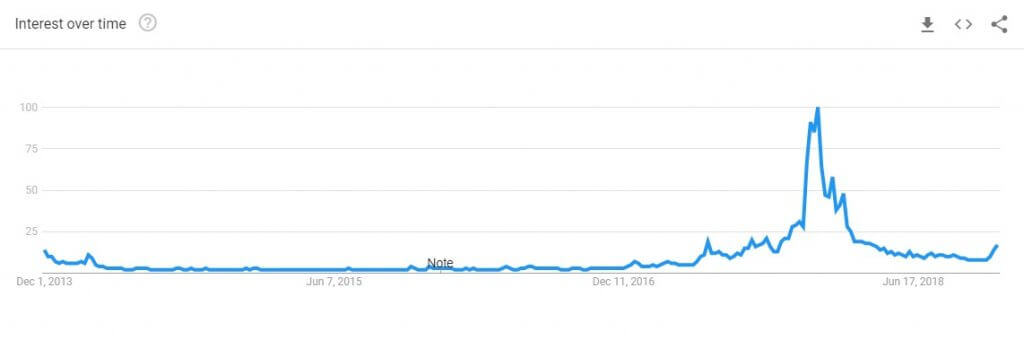

The stagnant price action before November’s breach of yearly lows saw overall interest in cryptocurrencies subside, hitting the lowest point since April 2017, before the hype cycle around last year’s bull market.

The trend in Google searches for Bitcoin peaked on 17th December 2017. Interestingly this was the same day Bitcoin hit its all-time high of $20,000.

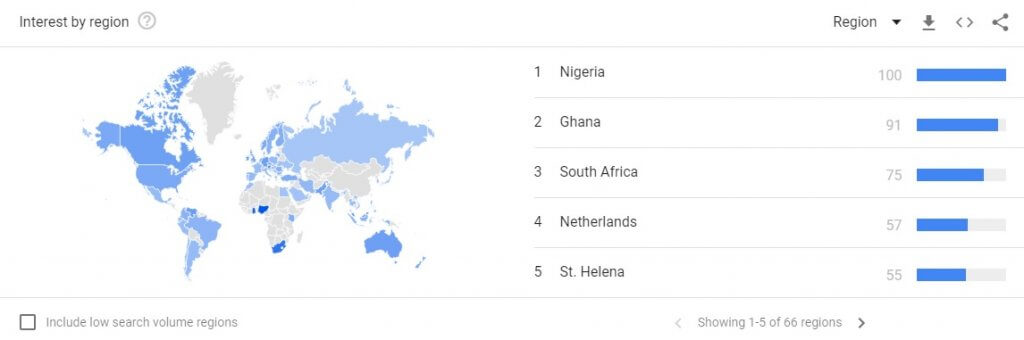

Over the past 30 days there has an influx in search terms coming from Nigeria, South Africa and Ghana, with St Helena and Netherlands also high up on the list.

The change in behaviour could indicate that people are anticipating a bottoming in Bitcoin, with the $3,000 and $1,800 price-points being cited as potential re-entries after this year’s slump from $20,000 to under $4,000.

Google search trends have typically been in correlation with the price of Bitcoin over the past five years. However, the last month has been one of the only times search times have been on the up in conjunction with the falling price of the cryptocurrency.

The increase is potentially a bullish sign; it means that if Bitcoin is to rally and break out of the current level, the heightened interest could trigger feelings of fear-of-missing-out (FOMO) among the masses, which could in turn be a catalyst for an extended rally.

For Coin Rivet’s exclusive guides on cryptocurrency, exchanges, blockchain technology and more, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.