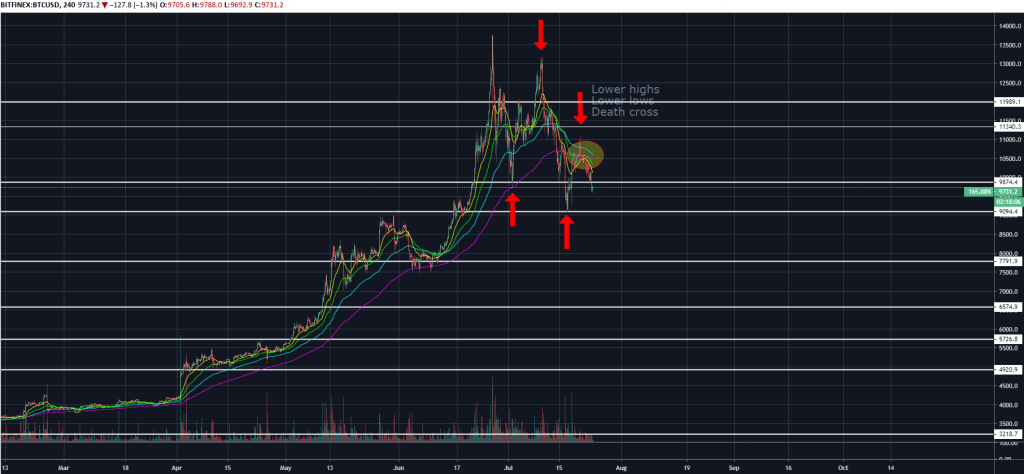

Bitcoin has experienced yet another negative slump in price, with more than $18 billion wiped off the asset’s market cap since the dreaded death cross on the four-hour chart.

On Monday, Coin Rivet reported that the death cross was beckoning as price hovered within the $10,200 and $10,650 range.

Just hours later, the death cross – where the 50 EMA crosses the 200 EMA to the downside – came to fruition. Price proceeded to fall to test the $10,000 level of support before breaking it to the downside.

Bitcoin has since managed a slight bounce from the $9,580 region, although short-term momentum has almost certainly shifted, indicating a further fall in price over the coming days.

The drop from $10,650 to $9,580 marks a 10.4% decline, with several analysts suggesting that this could be the start of a bearish phase in the market.

Coupled with the death cross, Bitcoin has put in three lower highs and three lower lows. This is typically indicative of a reversal similar to what was seen at the start of 2018.

Following the tremendous bull run that saw Bitcoin touch $20,000, it made lower highs of $17,300 and $11,800 while making lower lows of $10,760 and $9,220.

This time around, Bitcoin has failed to breach the yearly high of $14,000, falling to subsequent lower highs of $13,200 and $11,100.

The next notable level of support for Bitcoin would be $9,150. If that level breaks, then the $8,350 to $8,800 range seems to be the next logical stop.

The previous four-hour death cross on September 8 last year culminated in a 56% drawback for the price of Bitcoin. While a drop of that extent seems unlikely, that would put the world’s largest cryptocurrency back below the $5,000 level.

For more news, guides, and cryptocurrency analysis, click here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire