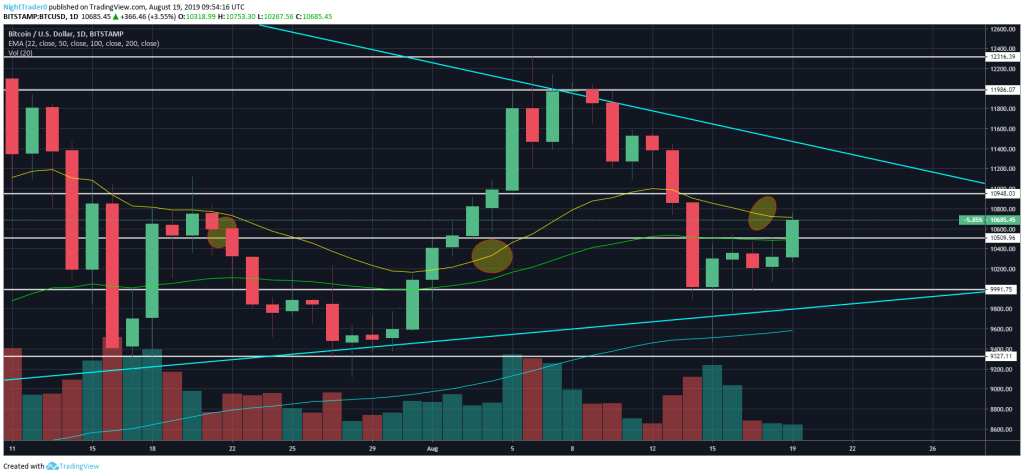

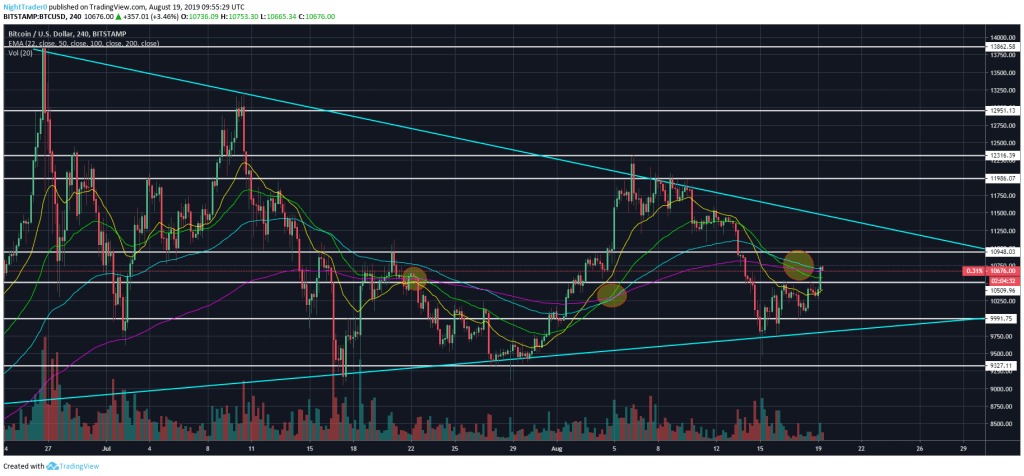

Bitcoin experienced a 6% rally to the upside over the weekend, testing the 22 exponential moving average (EMA) on the daily chart at around $10,700.

For now, the lower side of the symmetrical triangle seems to be holding, with it being used as a level of support three times dating back to July 17.

The latest bounce coincided with the 100 EMA on the daily chart, with price rapidly bouncing from its confluence at $9,480 to above $10,000 in a matter of hours.

It’s worth noting that every time a level of support is used, it becomes weaker. This suggests that if price falls back below $10,000, it may signal a bearish break that could see price plummet to the lower $9,000 region.

The 22 EMA was also used as a bitter level of resistance on July 21, prompting price to fall by 15% over the following seven-day period.

$GOLD is now down almost 2% since Friday after being rejected from the 1527 level of resistance.

As tensions between the US and China continue to ease, the 1450 level seems to look likely

This doesn't bold necessarily well for $BTCUSD, which has correlated with Gold recently. pic.twitter.com/k69C6GVi2z

— Oliver Knight (@OKnightCrypto) August 19, 2019

One similarity with today’s formation compared with July 21 is that the four-hour death cross has just come into play, with the 50 EMA crossing the 200 EMA to the downside.

This has historically resulted in momentum to the downside, but if Bitcoin breaks above the 22 EMA at $10,750 and takes a stab above $11,000, this theory would be invalidated.

The upper band of the symmetrical triangle is currently sloping down to around $11,350. If Bitcoin can break out of this level with conviction, it would be feasible to see price rise back to the $13,000 level.

However, the key indicator for the next bullish phase in the market would be avoiding a fourth lower high, with previous highs coming in at $14,000, $13,200, and $12,300.

Interestingly, the price of gold – which has seemingly correlated with Bitcoin recently – has also suffered a minor blip in light of its recent rally, falling back below $1,500/oz as trade tensions between the US and China begin to dwindle.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.