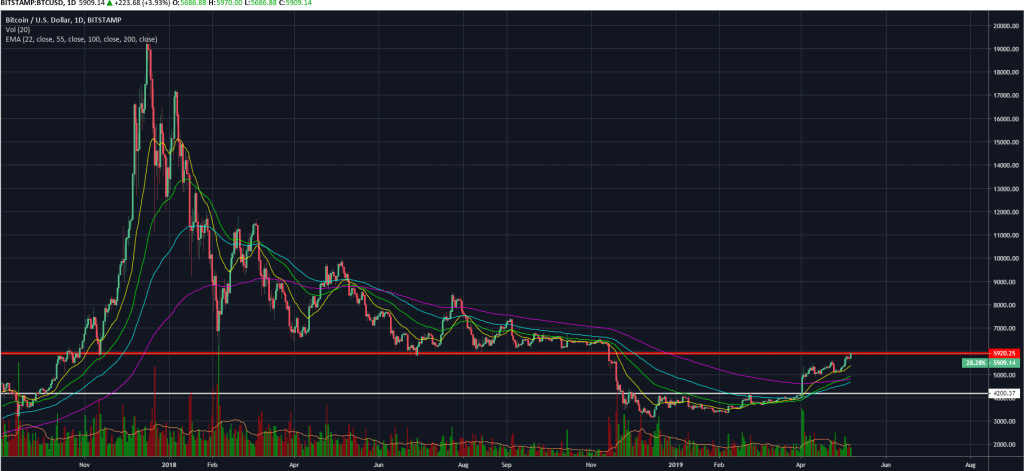

Bitcoin has been testing the crucial $5,900 level of resistance over the weekend. A break above this level would effectively signify the end of the bear market.

The cryptocurrency market has slumped during a gruelling downtrend over the past 16 months, with Bitcoin falling to as low as $3,150 after achieving an all-time high of $20,000 in December 2017.

However, a new-found sense of confidence and optimism has returned to the digital assets ecosystem, causing several coins to rally more than 100% since the turn of the year.

Ethereum has been one of the top performing cryptocurrencies, rising 113% from the $82 low on December 14 2018.

Why the $5,900 level is so pivotal

The $5,900 level has been key since the final phase of 2017’s bull run. In November 2017, Bitcoin fell 25% from $7,800 to $5,900 before bouncing violently. It then rallied to its $20,000 all-time high within a month.

The market topped out in December, resulting in the beginning of a downtrend in January and February. The February sell-off resulted in a 65% decline in one month, with a bounce finally coming at the $5,900 level again.

This was the second time this level was used as support in a matter of months, with the horizontal trendline continuing to offer support throughout 2018.

Bitcoin touched this trendline three more times in 2018 before eventually succumbing to downside pressure in November.

The resulting breakdown saw a 50% decline in Bitcoin, exemplifying the importance of the $5,900 level.

Levels of support often turn into resistance once they are broken. The recent stab at the $5,900 level is an example of this.

It’s rare, but not unheard of, for price to climb above resistance on the first or second attempt, but what’s more likely is three or four attempts before the level of resistance is truly broken.

However, the recent price action presents a notable short opportunity – as the saying goes: “Buy at support and sell at resistance.”

If price does in fact get rejected from this level, it could demonstrate that the market is simply too immature for another bull market and that we need to consolidate lower in order to establish strength from a fundamental standpoint.

Potential downside targets remain at $5,350, $4,800, $4,200, and $1,800.

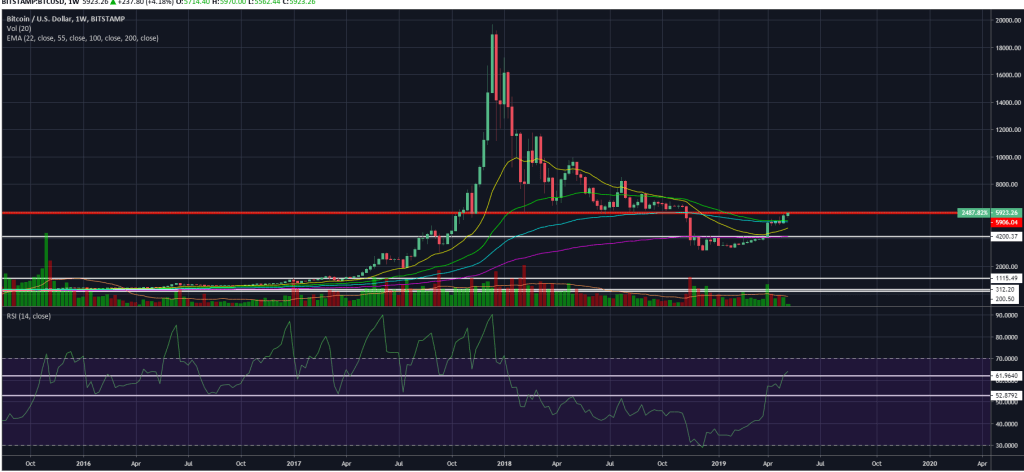

Don’t forget the golden cross in 2014

Alongside the recent price action to the upside, Bitcoin experienced a golden cross on the daily chart with the 55 exponential moving average (EMA) crossing above the 200 EMA. This usually suggests short-term momentum is on the rise, with continuation in price action expected.

However, Bitcoin has a history of ignoring the golden cross rule book. In July 2015, many believed the bear market had reached its conclusion, with Bitcoin rallying 16% after the shorter time-frame moving average crossed the 200 EMA to the upside.

Instead, Bitcoin was rejected from the $312 level before subsequently falling 37% to $200, with the moving averages crossing back to the downside.

A 37% decline from here would see Bitcoin fall back below $4,000, which could indicate a new phase of the ongoing bear market.

If an upcoming daily candle manages to close above $5,900, this theory would be invalidated.

Indicators suggest downside is coming

The daily stochastics indicator looks like it wants to cross to the downside as short-term momentum has shown signs of exhaustion.

The last time the daily stochastics crossed to the downside, Bitcoin’s price dropped 10%, although it soon recovered.

The weekly relative strength index (RSI) is at its highest point since January 2018 as it approaches the bullish control zone.

In 2017, the weekly RSI remained above 53 for the entire year. It also bounced off 62 on three separate occasions.

The RSI is currently residing at 63 on the Bitcoin weekly chart. It wouldn’t be a shock to see a slight consolidation from here, with it potentially falling to the mid 50’s before making another move.

Price has also touched the top of the weekly bollinger bands for the first time since January 1 2018, which suggests that a corrective move to the downside is on the cards.

Bitfinex resolution could act as a catalyst

A resolution to the ongoing Bitfinex and Tether scandal could act as a catalyst for price action. If the New York Attorney General Office’s claims are further substantiated, it could have a catastrophic effect on Bitfinex’s public image and user base moving forwards.

Tether's lawyers don't seem to understand what the point of "reserves" is. They complain that the injunction prevents Tether investing or otherwise using the reserves. Yes, that's the whole point. /1

— Frances 'Cassandra' Coppola (@Frances_Coppola) May 6, 2019

However, if Bitfinex can successfully reject the claims of allegedly being involved in money laundering and fraud, it could strengthen its position in the cryptocurrency space as well as legitimise itself among the mainstream.

A positive piece of news out of this week’s court proceedings could spring price above $5,900 and effectively end the bear market, but a negative outcome would almost certainly see price being rejected at this level, with downside targets of $5,350 and $4,900 looking likely.

For more news, technical analysis, and cryptocurrency guides, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.