Inflation-ravaged South American countries such as Venezuela are seeing Bitcoin trading volumes surge as more and more people adopt cryptocurrency.

In Venezuela, a lot of the increased usage of cryptocurrencies can be credited to the financial crisis the country is currently battling through.

At the moment, Venezuela is experiencing the highest ever recorded level of hyperinflation. The country’s official currency (the Bolivar) is now almost worthless. This has led to the use of crypto as a substitute for many Venezuelans.

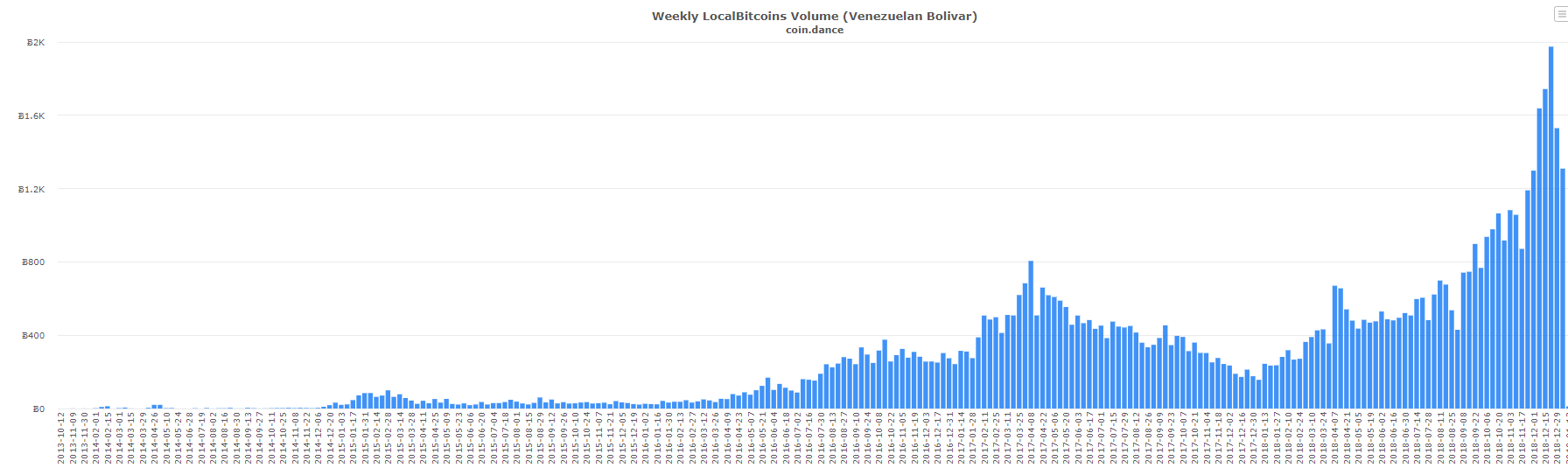

Currently, Venezuela has one of the highest trading volumes of Bitcoin of any country in the world. In the chart below, we can see a significant upturn in volumes for local Bitcoin usage from the South American nation.

According to the data from coin.dance, we can see that the local Bitcoin transaction volume in Venezuela peaked at close to 2,000 BTC in the week leading up the Christmas holidays.

We have also seen companies like Cryptobuyer announcing plans to install a Bitcoin ATM in Venezuela.

Jorge Farías, CEO of Cryptobuyer, says that the “team is ready to start the installation of the country’s first Bitcoin ATM.”

According to Farías, they are in the last phase of testing and are ready to start deploying the physical terminals and infrastructure.

“We are going to install the first cryptocurrency ATM in Venezuela in the course of the next two weeks (…), we already have the equipment physically installed in Venezuela, in Caracas. They are in their final tests, and we will be announcing them in social networks.”

From this recent Reddit post, we can also see that it’s not just Venezuela that is experiencing a surge in local Bitcoin volume. From a series of screenshots gathered from coin.dance, we can see that Argentina, Columbia, Chile, and also Peru have all seen an increased amount of trading activity in the past couple of weeks.

One Reddit user was not too impressed with the ramp-up in volume, saying: “The money in those countries is worse than toilet paper. People prefer to store whatever instead of pesos or bolivares or whatever other s****y fake money those failed governments are printing.”

Even if the perception of the Bolivar is closer to toilet paper (paper Bolivars may not even have the same utility), the ability for people to hedge their purchasing power to a non-state-backed and stable store of value will obviously always have a use case in hyperinflation-ravaged nations.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire