One of the most debated topics in the cryptocurrency sphere is whether Bitcoin’s Proof of Work (PoW) consensus is wasteful, and if so, why doesn’t the community simply change to a more environmentally friendly PoW consensus?

Usually, when the topic is debated, there are two major positions:

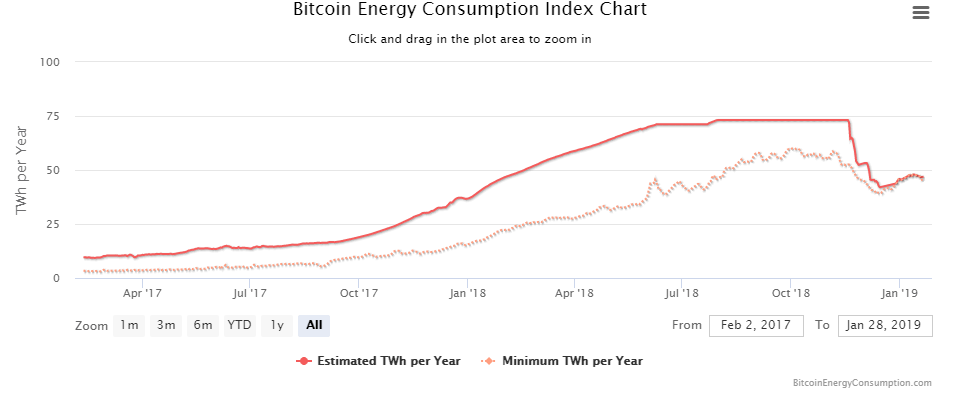

https://digiconomist.net/bitcoin-energy-consumption

Both arguments do have a point. However, it seems the key reason why Bitcoin needs so much energy going into its hash rate is somehow forgotten.

What keeps Bitcoin’s blockchain secure is the total amount of hash rate.

Even when miners do not earn a block reward, they’re still keeping the network secure as they’re contributing to increasing Bitcoin’s hash rate.

As you can imagine, this is the first reason favoring the argument that Bitcoin does need incredible amounts of energy going into its hash rate, as that is the process that secures the network against unwanted players.

In order to perform a 51% attack on Bitcoin, a miner would need to control more than half of the total Bitcoin hash rate, which in essence is almost impossible.

We could potentially see a state-wide attempt to control Bitcoin, but to organise this without any miner/Bitcoin enthusiast/developer noticing would be highly unlikely.

Moreover, there are easier and better ways to perform a considerable and more devastating network attack.

For example, if you have alternative consensus mechanics that aren’t energy dependent, like Proof of Stake (PoS), it’s highly likely your network will end up being controlled by a small group of people at some point in time. This is due to the fact there is no energy requirement, and so whoever controls the money supply, controls the network.

The key reason why Bitcoin is safer to use as a store of value and medium of exchange when compared to any other cryptocurrency is its decentralised governance, both at a technical level and at a social level.

For any cryptocurrency to be properly decentralised, it should have at least one of the following properties, as highlighted by one of the most prominent Bitcoin developers and educators, Jimmy Song:

I would argue the core idea of Jimmy’s argument is that there should not be any entity with enough power to impose network changes on their own, be it through hash rate control, GitHub repository control, supply control, or any other control mechanism.

To properly achieve decentralisation, PoW is by far the safest and most effective consensus mechanism. Whether or not you think Bitcoin promotes a wasteful mechanism, one cannot deny that spending energy securing Bitcoin’s global network of money does not seem like a waste at all.

In the end, I believe we should focus on decentralising what needs to be decentralised, such as base-layer protocols like Bitcoin and Ethereum. It’s OK to expect some level of centralisation at the dApps level, especially considering so many will have to obey local regulations in order to exist.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire