The last time Bitcoin went parabolic, we saw moves of $3,000 a day as the price went on an exponential run from around $8,000 to its $20,0000 peak in December 2017.

We may now be in the early stages of another meteoric rise in value as the market looks to price ‘fair value’ back into the crypto economy. It’s not just the price that is going parabolic either, as volume is also ramping up to nearly $3 billion a day across major exchanges according to the ‘real 10’ data at On Chain FX.

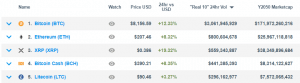

As the total market cap now approaches $170 billion, Bitcoin is still commanding the largest slice of the pie with a dominance of just under 60%. Other big movers over the last 24 hours have been XRP, which has risen 20% in value, along with close to double-digit gains for both Ethereum and Bitcoin Cash.

Shorts getting rekt

In the past couple of days, we have also seen the liquidation of large tranches of shorts on BitMEX (most likely traders playing around with high leverage). During the initial move up to $8,000, we saw around $79 million of short liquidations over a 6-hour period. The largest single liquidation in this stack was $28.6 million.

Very interesting.

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) May 13, 2019

This event mirrored a similar occurrence which took place yesterday where this time a similar amount of longs were forced into a period of liquidation. The single biggest position getting rekt on this occasion was $20 million as the market pushed off support from $7,700 to trade all the way up to new yearly highs of over $8,000.

reddit-embed-bq" style="height:500px" >$76 mill of FOMO longs got rekt

byu/coinsmash1 inCryptoCurrency

Scarcity

There will only ever be 21,000,000 Bitcoin, and with the block reward halvening coming in just over 12 months, it seems that scarcity is starting to be priced into the market.

Scarcity is a factor of both economics and social psychology. Dubbed the ‘scarcity principle’, it’s said that a limited supply of an asset, combined with high demand for it, results in an increase of the perceived worth of the asset (regardless of actual utility).

It still looks like a race back up to a symbolic five-figure valuation may be on the cards over the next couple of weeks. This is not the first time that Bitcoin has traded with such a pattern, and it most certainly won’t be the last given its intrinsically scarce characteristics.

For more news, technical analysis, and cryptocurrency guides, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.