The illiquid cryptocurrency markets often have a tendency to make investors believe price is going one way, before viciously moving it in the other direction.

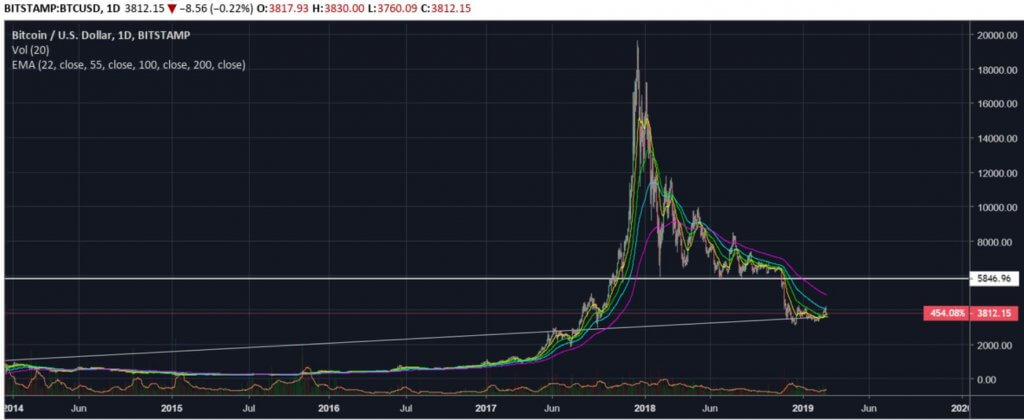

There was a clear example of this over the weekend, as Bitcoin broke above the $4,050 level of resistance before falling 12%, crushing levels of support on its way.

This sinister fake-out was a brutal demonstration of who is actually in control during a bear market: the bears.

Until Bitcoin breaks back above the $4,200, $5,000, and even $6,400 levels of resistance, the overall market trend is still extremely bearish, and rightly so.

The parabolic rise to $20,000 in 2017 was synonymous of a hype-driven bubble. Investors believed they could “get rich quick” without knowing exactly what they were investing in.

When price goes up so rapidly, the emotional tone of humans moves away from hope and optimism towards greed and selfishness. This type of behaviour will always have repercussions.

This doesn’t mean that the cryptocurrency bubble is popped for good. Take the dotcom bubble in the late 90s as an example. Many of the tech stocks withered away, but some – like Amazon, Google, and Apple – ultimately prevailed.

We have seen several altcoins fall more than 98% during the latest bear market, which considering many rose more than 1,500% in a couple of months, is completely justified.

Market cycles are dependent on human psychology and emotions. While it’s likely that a bull market will cycle back around, it won’t be until all hope and optimism has left the space.

Bitcoin is the undisputed champion of cryptocurrencies. It commands more than 50% of the entire market cap of the digital asset class and has the most public awareness.

For a bull market to cycle back around, Bitcoin will need to lead the way. A Bitcoin ETF, which is currently being discussed in the USA and South Korea, could act as a catalyst, but it’s unlikely to gather the same amount of hype as 2017’s ICO revolution.

In 2017, there was real, albeit contrived, hope that cryptocurrencies would disrupt mainstream industries. Bitcoin was a challenger to cross-border payment providers, while Ethereum was a platform for developers to hop on board the ‘blockchain’ buzzword.

But 18 months after the height of the ICO boom, there hasn’t been one cryptocurrency that has actually lived up to the hype.

For cryptocurrency to actually impact the FinTech and banking industries, the common person needs to be able to put more trust in cryptocurrencies than they do in their banks.

The 2008 financial crisis, which subsequently spawned Bitcoin, caused a fundamental change in the way in which consumers viewed their banks. Levels of trust were on the wane, so it was fairly logical that people wanted to take a new approach.

For Bitcoin to truly appeal to the mainstream, another financial crash or economic downturn may be needed, but judging by the stock market’s performance in the past month, this currently seems unlikely.

The S&P500 is currently teetering along a respected line of resistance. In January 2018, the S&P500 stopped at 280 before going on to reach a new all-time high of 286. Price then fell more than 11% in two weeks before bouncing off a powerful diagonal support trendline that has been respected since 2016.

The following 10 months saw the US stock market index continue to make a new all-time high after hitting 293 in October. Bulls eventually showed signs of exhaustion following a momentous rally, again falling more than 11% before finding support at 259.

The key to the reaction that followed was the failure to break back above 279, with price being rejected twice in one month.

The final rejection at the end of November was the most significant, as price fell more than 16%, with many predicting that a bear market was coming back to rear its ugly head.

Support at 259 broke with ease, as did the levels at 254 and 245, with the index eventually falling to its lowest point in nearly two years before a violent bounce off the 200 exponential moving average on the weekly chart and a well-respected diagonal support trendline tracing back to the start of the bull market in 2009.

The reaction was the largest points gain the S&P index had seen since the millennium, with a hellish 19% rally.

That leads us to the present day, where the index is once again testing the former support-turned-resistance level of 279.

If price gets rejected here for a third time, we could well witness a bearish reversal into a full blown bear market. However, if price breaks above this level, it would signify that the bull market is far from over, and that a new all-time high would be most definitely achievable in 2019.

For more news, guides, and cryptocurrency analysis, click here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire