Major cryptocurrency exchange Bitfinex made the bold decision suspend fiat deposits on Wednesday evening, potentially acting as a catalyst for Bitcoin’s major sell-off.

According to reports, Bitfinex ‘expects the situation to normalise within a week’. However, the exchange’s decision to halt deposits has reignited concerns surrounding insolvency and financial instability.

Bitfinex were reported to be banking with HSBC through a private account of Global Trading Solutions. It has since transpired that the private account is no longer functional.

The exchange hit out at the rumours of insolvency, writing the following in a blog post: “Bitfinex introduced fiat operations in 2015 to act as a global point-of-access to traders wishing to enter the digital asset space. There have been ups and downs along the way, with complications scrutinised by watchful ‘investigators’ eagerly anticipating and predicting the industry’s collapse. These parties are quick to scream insolvency, seemingly with little understanding of what this concept means and what they are generally talking about.”

They continued: “Bitfinex is not insolvent, and a constant stream of Medium articles claiming otherwise is not going to change this. As one of only a very few exchanges operating since 2013, with a small team and low operating costs, we do not entirely understand the arguments that purport to show us to be insolvent without providing any explanation about why. The wallets below represent a small fraction of Bitfinex cryptocurrency holdings and do not take into account fiat holdings of any kind.“

The Bitcoin price fell significantly yesterday evening, breaking the support level at $6,500 before falling to around $6,100, with many citing Bitfinex’s decision to halt deposits as a key driver in the 4.50% decline.

Whether or not Bitfinex have insolvency issues remains to be seen, but it’s important to remember that Bitfinex have been operating for five years, bouncing back from two malicious hacks and volatile market swings.

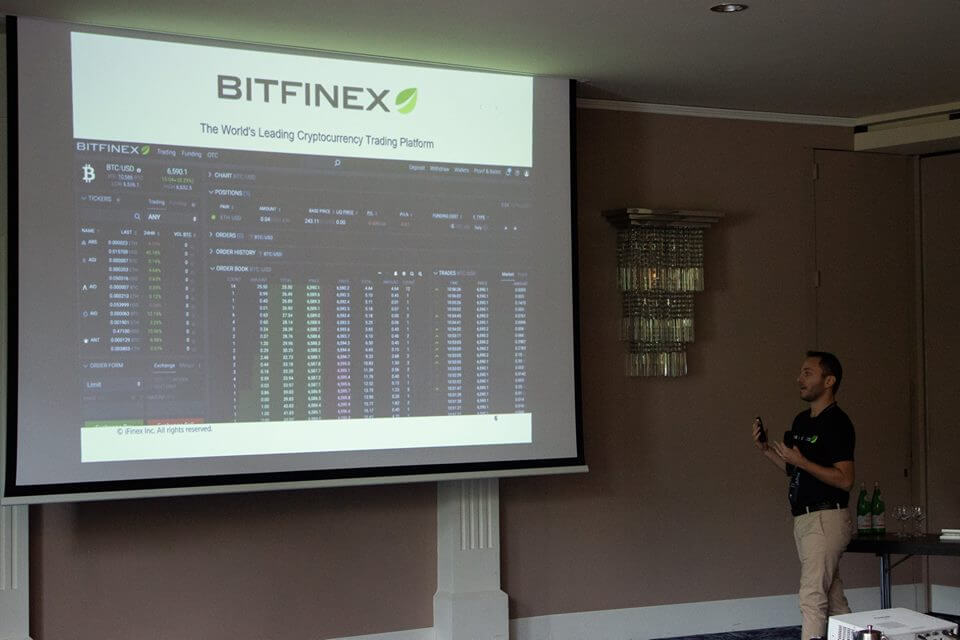

Click here for a comprehensive guide to Bitfinex, covering their history and trading tools.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire