Mass cryptocurrency adoption can only take place if regular people feel it is safe, easy, and beneficial to join the space.

Without a shift in mentality, I doubt institutional investors alone will be able to drive worldwide adoption.

Much like what happened with computers or the internet, without people to create valuable network effects – like art, content, trading, advertising, and so on – there is little chance cryptocurrency prices will explode.

Therefore, we should praise countries leading the way in cryptocurrency adoption.

Over the course of 2019, South America has seen a huge boost in cryptocurrency adoption, with Brazil particularly seeing a substantial rise in crypto users.

Crypto adoption on the rise in South America

The rise of cryptocurrency adoption in South America can be seen quite clearly with the growing number of users on prominent P2P Bitcoin trading website LocalBitcoins.

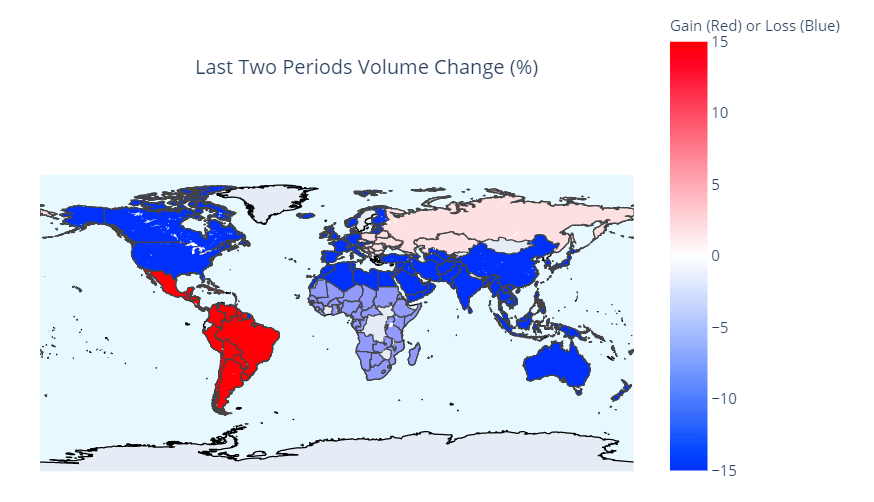

LocalBitcoins yearly volume by region, courtesy of UsefulTulips

Looking at the world chart above, we can easily see which region was most responsible for bringing positive volume to the cryptocurrency space over the past year.

South America is showing a 15% rise in volume traded on LocalBitcoins – much higher than anywhere else on the globe. This means unlike North America, Europe, Asia, or Oceania, South American populations in countries like Brazil, Argentina, and Venezuela have been pumping way more money in than out.

In fact, there’s plenty of additional evidence that South and Central America have been buying into Bitcoin much more than any other region.

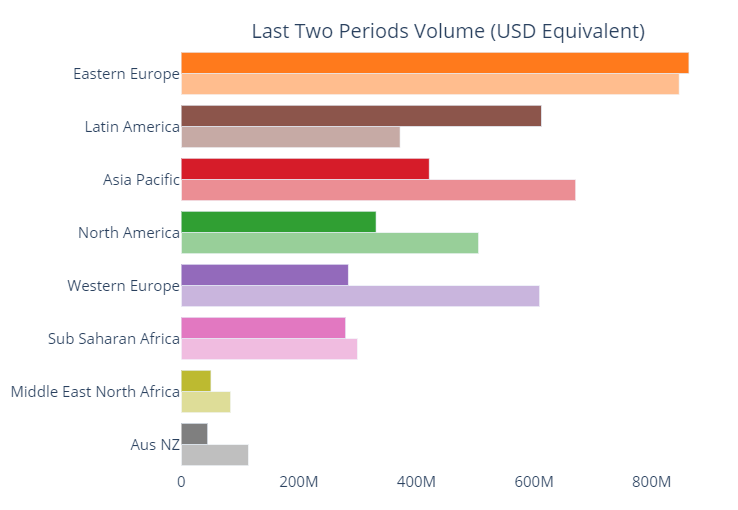

LocalBitcoins yearly volume by region, courtesy of UsefulTulips

Even though the graph above suggests Europe is the region where most people are acquiring Bitcoin, by comparing how much money went in to crypto vs how much came out, we clearly reach the conclusion that that’s not entirely true.

South America has a positive balance of over $200 million, while Europe remains flat. In addition, all other regions have shown negative trends over the past year, since more people are converting Bitcoin into USD than the other way around.

Will South America be the next crypto-hub?

Earlier this week, Coin Rivet reported on how Brazilian courts are chasing down alleged Bitcoin pyramid scams.

Coin Rivet has also recently reported on how the Brazilian central bank and regulators are keen on more people using crypto, simply because additional taxes can be collected.

Even though people may think corruption is a major hurdle and bottleneck for adoption, I argue crypto will help change this behaviour. For one, it requires people to have low time preferences. Secondly, after people learn “not your keys, not your Bitcoin”, they’ll transfer their Bitcoin into their own private wallets.

Bitcoin will empower people as it gives anyone a tool to independently be their own bank and settlement provider. As fiat currencies lose purchasing power against Bitcoin, more and more people will hodl as much as possible.

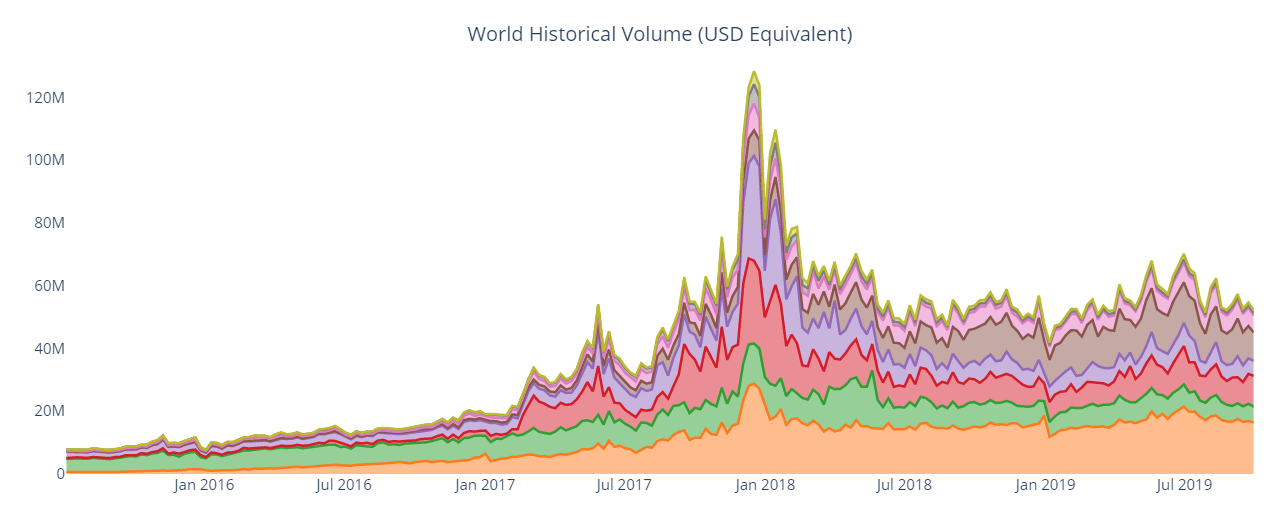

LocalBitcoins historical volume by region, courtesy of UsefulTulips

Looking at the chart above, it seems the path to adoption has been laid out. How will government-backed fiat currencies compete with Bitcoin?

I personally don’t think governments will try to compete with BTC in the long term.

As people’s preferred method of transferring value shifts towards hard-money and enhanced security technology, I argue governments will ride the trend by accepting Bitcoin, using it as a standard and even promoting the use of Bitcoin among populations.

Why would you try to compete with a digital asset that empowers your population with minimal effort?

Instead, we’ll see better policies around the use of cryptocurrency, much like Brazil has been pushing for recently.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.