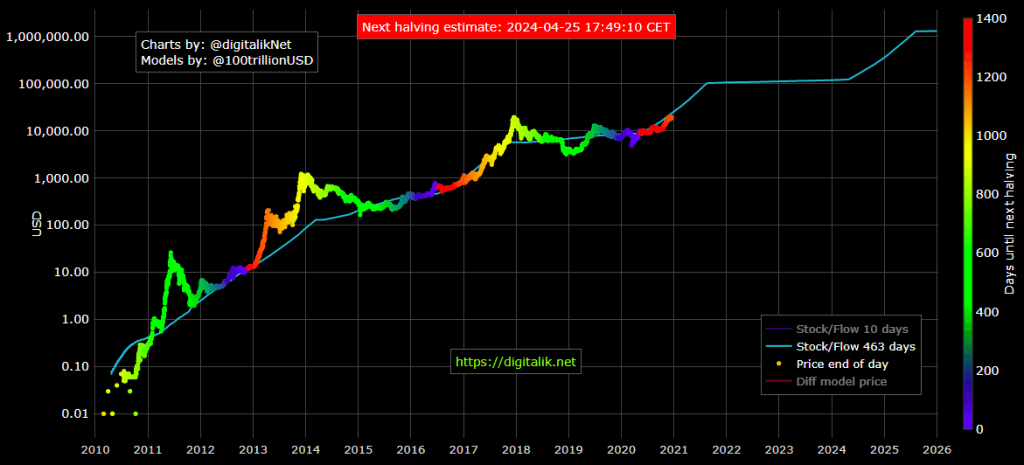

In March 2019, Twitter user “PlanB” (@100trillionUSD) published an article entitled ‘Modeling Bitcoin Value with Scarcity’. His ensuing stock-to-flow model uses Bitcoin’s known supply schedule, and historical price action to show there is a relationship between price and Bitcoin’s stock-to-flow over time.

A common criticism of his model is that it doesn’t include overall demand. But this isn’t really true – demand is simply encompassed within the model.

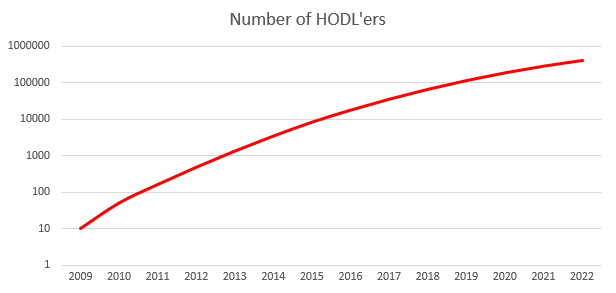

Understanding Bitcoin’s value proposition is hard. One must understand the history of money, the potential total addressable market, the underlying incentives, the trends in modern society and many other factors. It also takes time and a certain amount of critical thinking ability most do not possess. The barrier to entry of becoming a Bitcoin HODLer is larger than most realise.

Most people who own Bitcoin today are simply in it to make more of their local fiat currency. As soon as the price rises, they will sell. We define a HODLer to be somebody who believes that Bitcoin will become the dominant world currency over the coming decades and has no intention of selling.

Demand

At this stage, the number of people buying and holding Bitcoin for the long term is not changing based on the President’s tweets, the amount of QE announced by central banks, or whether an ETF is going to be approved. Whilst these cause short term trading movements, the long-term price is being driven by a continual increase in the amount of HODLers buying up an asset that has a fixed supply.

HODLers continue accumulating as much Bitcoin as they can, no matter what the price. They have no intention of ever trading their Bitcoin back to fiat currency. They are, on average, below the age of 40 and are willing to hold their Bitcoin for decades if necessary. Whilst they would like 1 Bitcoin to be worth a million dollars one day – they would be happy that their purchasing power has increased – at that stage, the last thing they would want would be a million dollars. A currency they have for years seen wildly depreciate against Bitcoin.

The number of people who “get it” over time is increasing, year to year. This is the real demand side of Bitcoin. Eventually the number of HODLers will plateau, but no more fresh demand will be needed, as the HODLers continuing to accumulate a diminishing supply will be all that is required to keep the Bitcoin price increasing in perpetuity.

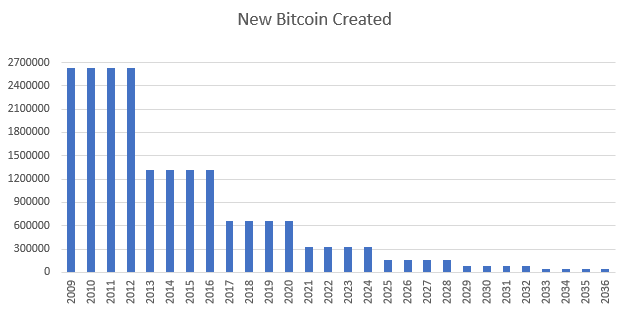

Supply

The Supply side is a constant emission of X BTC a day, for the HODLers to try to accumulate as fast as their budgets allows them. Mining is extremely competitive, so over any reasonable timeframe, most BTC must be sold by miners to meet electricity costs (and whatever percentage is HODLed is probably a similar rate over time, and therefore counts towards the HODLer demand side of the equation).

This is the supply side of Bitcoin.

Stock-to-flow

Because both supply and demand are so predictable, we can then graph this into the future. Whilst PlanB’s model specifically looks at price vs it’s stock-to-flow over time, it is essentially the above that is the intuitive driver of this relationship.

Ultimately, the only thing that will break the model will be Bitcoin failing for some technological reason and going to zero, or it breaking to the upside as most of the world’s capital allocators lose faith in fiat currency. Both of which are highly unlikely to happen in the next 5-6 years. Plan B’s model will likely hold for a while longer yet and beyond the next halving. Making Bitcoin the only asset in the history of the world where we can accurately predict the future price ahead of time.

Whilst most think of ‘hyperbitcoinisation’ as a future event, we are actually living it now. It’s just that nobody has realised.

For more news, guides and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.