StarSharks fell from first to third place among games on the BNB Chain, with WAU falling off a cliff by 455%. Clearly, StarSharks, an up-and-comer on BSC, has failed to sustain its strong growth.

Despite a slew of updates, data from Footprint Analytics shows that, instead of going to the moon, the project now finds itself at a very dangerous juncture.

An update on the membership program was approved in a proposal vote completed on the last day of March. The team has provided more application scenarios for veSSS in order to reward SSS stakers and encourage external promotion.

The update narrows the scope of players who can create invite links to only eligible StarSharks Affiliates. This proposal specifies that only those with 10,000+ veSSS can create invite links.

On April 6, the output of SEA was reduced by canceling daily tasks and slot machines. In terms of consumption, by expanding the difference in output of shark levels and increasing the number of tokens needed to upgrade. Players are encouraged to consume more tokens while upgrading sharks.

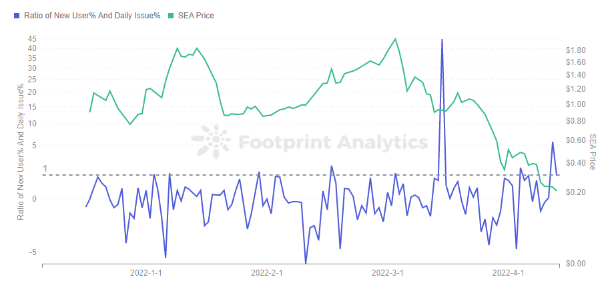

The Footprint Analytics data shows that the ratio of the growth rate of new users to the growth rate of token issuance is less than 1 most of the time, which means that the number of token issuances is completely outpacing the rate of new users coming in. This has led to an overwhelming number of SEAs, and the token price has been oscillating down.

Footprint Analytics – The Ratio of News Users Change and Daily Issue Change

The team also saw the inflation of SEA and started to control its output, but this led to less revenue for players and a drop in the number of daily active and new users.

Footprint Analytics – Daily Users

This update has had a noticeable effect on shark NFT issuance, which has turned to negative daily issuance, and total issuance has started to shrink. Controlling the NFT throwdown will maintain the price of sharks and allow players to synthesize more sharks to burn more SEA, so the price of SEA and NFT will need to be pulled up at the same time.

Footprint Analytics – Daily & Total NFT Supply -StarSharks

On April 7, adding the claim SEA condition restricts the circulation of SEA and slows down players’ mining and selling to empty out the token price. Added NFT escrow feature, users can let the platform escrow their NFT to earn SEA by holding veSSS, encouraging players to hold more NFT and SSS.

The revenue earned by players is locked, making token holders even less active. The fact that players can earn revenue through escrow without costing time, makes it seem less like a game and more like DeFi, which further reduces player activity.

Footprint Analytics – Token Holders Trend

On April 7, the StarSharks team burned all of the revenue reserved for 91.43 million SEAs, expecting to pull back the declining SEA prices caused by overproduction.

StarSharks Twitter

SEA’s total circulation dropped instantly from 127 million to 37 million after the burn, and it seems that the price of the token didn’t help, but kept falling.

Footprint Analytics – Daily Issue vs Token Price

The removal of the rental marketplace from StarSharks after April 8 caused a huge impact.

As shown by Footprint Analytics, StarSharks D1 retention was previously high, and the removal of the rental marketplace and daily tasks had a significant impact on retention and new users.

Footprint Analytics – Active Users vs D1 Retention

But for StarSharks, canceling the rental market was a necessity. Rental is a double-edged sword that can lower the barrier to attract more new players, just as StarSharks’ rapidly rising number of users did in the previous period. However, the rental model also has hidden dangers. There is no KYC on the blockchain, which is a problem unable to distinguish the player’s identity.

Gold farming is a term that refers to the act of playing games constantly to get tokens under the organization of a game guild. Unlike regular players or investors, they mint NFTs and play games with them to gain native tokens for profit. This in turn makes causes wild price fluctuations. This is enabled by rental markets lowering the threshold for users to enter the game. With rental markets, gold farmers can enter the game at low cost, which caused game tokens to be minted and sold to the market in large quantities, so that the token price accelerated the decline.

Data from Footprint Analytics shows that the SEA-BNB pairs on PancakeSwap were already trending towards selling SEA at the beginning of March. By the end of March the balance of the pool was broken and the pool was stockpiled with more and more sold SEAs. Such a large sell-off kept pushing the price of SEAs downwards.

Footprint Analytics – SEA-BNB Buy Sell Pressure

After the token price and new users continued to go down, the team updated the proposal for the special treasure box launch on April 18.

When the new treasure box (Box B) goes live, the old treasure box (Box A) will only mint 1-star sharks, and the daily sale quantity will be dynamically adjusted. Box B is priced at 1000 SEA and will have a chance to get 1 to 6-star sharks, fragments of 7 star sharks, honor points and other items.

The new shark burning mechanism will give players Box B and lucky points for burning the corresponding level and number of sharks, which will encourage players to buy boxes.

Box B was designed to curb SEA inflation in terms of the number of sharks, but it just went live and it looks like players aren’t paying for it, still not pulling SEA consumption in the first few days and the token price keeps falling.

Footprint Analytics – SEA Daily Mint & Burn

StarSharks cut off the two highlights that had allowed it to climb rapidly (the rental system and the invitation mechanism) after a series of adjustments, after which the project fell apart and the token price dropped.

After the update, SEA is still not burning enough, and has fallen to $0.1 SEA. New players can not see the hope of profit, leaving only old players struggling to support. The output of the new blind box is more suitable for big players to play PVP, and the survival space for newcomers and retail players becomes even narrower.

StarSharks’ cancellation of the rental marketplace was an attempt to stop gold farmers, but it looks like the team is not ready for a reshuffle of this magnitude. The project is still working hard to try to turn things around, and users can directly monitor whether StarSharks can accelerate the SEA burn in the coming days and get new users back or not.

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Data Source: Footprint Analytics StarSharks Dashboard

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire