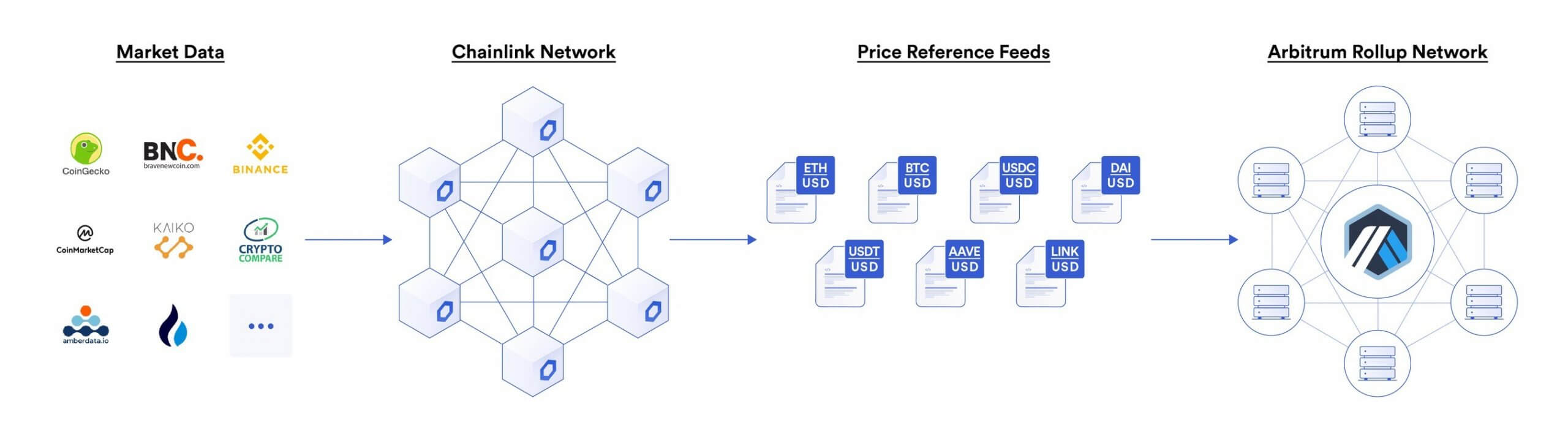

The much-anticipated layer-2 Ethereum scaling solution Arbitrum One has integrated Chainlink Oracles to its mainnet network.

The integration includes support for various USD-denominated Chainlink Price Feeds on Arbitrum, with plans to rapidly scale support for new price pairs and other types of data feeds coming soon.

Chainlink is now live on @Arbitrum One, providing hundreds of smart contract applications direct access to #Chainlink's decentralized services, starting with high speed, low-cost Price Feeds and expanding to more off-chain computations.

— Chainlink (@chainlink) August 12, 2021

The Chainlink price feeds will supply dApps (decentralised applications) built on Arbitrum with access to decentralised, low-cost, and high-frequency off-chain price data in order to accurately value assets on-chain, in real-time. The Arbitrum team noted that the integration was heavily requested by smart contract developers on their network and was needed due to the ecosystem’s “growing demand for DeFi “.

The Arbitrum network is a Layer-2 rollup solution, which handles transactions “off” chain on an external Layer-2 network – in this case Arbitrum- and then posts the transaction data on a Layer-1 network like the Ethereum mainnet. Often referred to as optimistic rollups, layer-2 solutions like Arbitrum work under the assumption that transactions are “honest” and do not require further input to prove their validity.

This in turn allows Arbitrum to be highly scalable, greatly reducing fees for users while providing faster transaction completion.

The importance of Chainlink to the Arbitrum network is further highlighted by the need for accuracy and trust in the data provided. Arbitrum noted that their solution was “infeasible due to the limitations of baselayer blockchains” and that Chainlink provides them with the price data needed to maintain and operate a Layer-2 rollup solution.

“Providing smart contract developers on Arbitrum One with native access to Chainlink’s oracle networks was crucial to ensure all of the smart contract use cases that exist on the Ethereum blockchain can be seamlessly ported over to Arbitrum with next to zero changes to their Solidity code,” said Ed Felten, Co-founder of Offchain Labs.

“Integrating Chainlink into the Arbitrum One mainnet for secure oracles was an obvious choice given its proven track record and flexible architecture that can support access to any external resource and off-chain computation.”

Arbitrum has been in testing in a “sandbox” environment for the past four months, allowing various developers to test the network and used selected Chainlink Oracles to assess the viability of the price feeds. Now, both new and existing protocols on Arbitrum will have native access to the highly reliable price data provided by Chainlink Oracles on their mainnet network, which is set to launch later this month.

According to the announcement, development teams that require Oracles on Arbitrum can use Chainlink and receive the same data quality and reliability that is already provided on the Ethereum base layer, but with higher update frequencies and lower costs.

Alongside Price Feeds, Arbitrum One intends to use other Chainlink services in the future, including Chainlink Verifiable Random Function (VRF) to provide on-chain gaming dApps and NFTs provably fair random numbers, Chainlink Proof of Reserve (PoR) to audit the collateralisation of tokenised assets, and the ability to call any web API, enabling any premium off-chain data source to be used on-chain.

Many leading DeFi applications operating on the Ethereum Mainnet plan to use Chainlink Price Feeds within its Arbitrum deployment, including Aave, the largest DeFi protocol by Total Value Locked (TVL), Bancor, MCDEX and Tracer DAO. UniSwap, the leading Ethereum-based DEX platform, has committed to using Arbitrum as a layer-2 solution following a community vote. Arbitrum was also selected by Reddit to oversee its community points system.

Chainlink currently has more than 700 integrations and remains arguably the most essential piece of the DeFi puzzle behind smart contracts themselves. Their most recent integrations include partnerships with Swisscom and Accuweather, both of which mark the gradual expansion of the Chainlink ecosystem. They recently announced a partnership with Google Cloud to provide weather datasets on Google’s BigQuery and an integration with the growing blockchain provider, Avalanche.

The introduction of Chainlink Keepers also marks a pivotal development in the solidification of Chainlinks imperative role in the DeFi ecosystem. With Keepers, development teams can automate key smart contract functions and event-driven tasks in a highly reliable, decentralised, and cost-efficient manner. Upon its launch, leading DeFi platforms such as Aave, Synthetix and Bancor will use Keepers, with many more integrations expected in the future.

Chainlink Keepers is live on #Ethereum mainnet! Development teams can now use #Chainlink Keepers as a decentralized off-chain computation service to reliably automate smart contract functions based on defined conditions, providing advanced utility to dApps.https://t.co/c5qlZgIj9o

— Chainlink (@chainlink) August 5, 2021

Chainlink recently hosted SmartCon, a three-day event that saw 200+ industry-leading founders, researchers, and developers discuss important innovations and collaborations across the blockchain ecosystem.

The event saw a spate of insights and discussions into the future of the industry alongside the reveal of Chainlinks open-source, cross-chain interoperability solution dubbed Cross-Chain Interoperability Protocol (CCIP).

The protocol was designed for developers to easily build secure cross-chain services and applications on a universal messaging interface. On CCIP, smart contracts will be able to communicate across multiple blockchain networks, send messages, transfer tokens, and initiate actions automatically across multiple networks.

The advent of CCIP further enforces the importance of Chainlink to the rapidly growing DeFi space and marks the next step in Chainlinks rumoured bid to become the much-needed, and somewhat necessary “god protocol” of the crypto industry.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.