At the time of writing, Brazil’s GDP (Gross Domestic Product) appears to be struggling.

While in 2011 the country’s total GDP was about R$2.8 trillion, today it’s almost 30% lower at just above R$2 trillion.

Can Brazil recover and avoid a potential economic meltdown?

If so, what role – if any – can Bitcoin and other cryptocurrencies play?

Even though Brazil’s GDP has actually increased over the past two years, the overall trend seems to be one of stagnation.

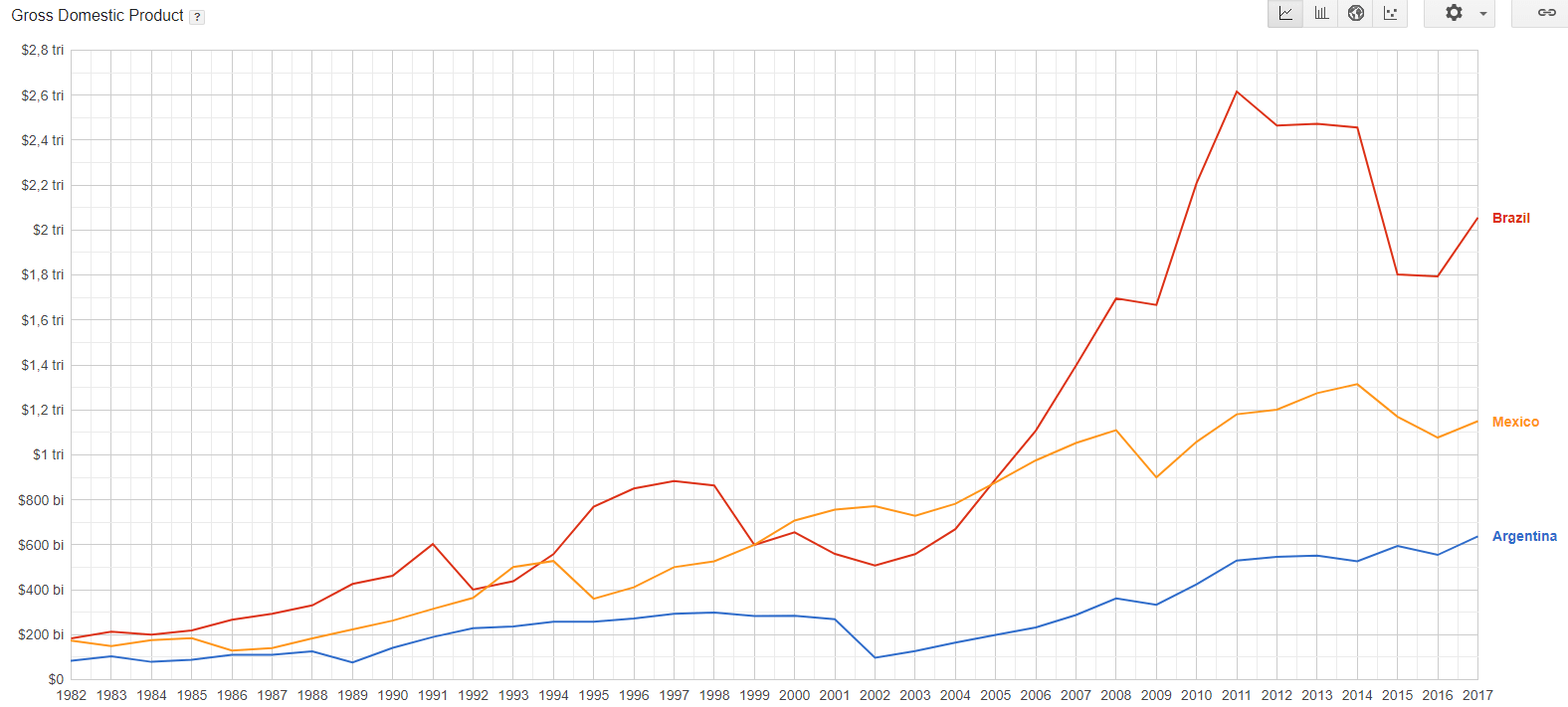

Looking at the chart above, we can clearly see the biggest jumps took place during the early 2000s, with the Brazilian market growing from about R$800 billion in 2002 to R$2.6 trillion in 2012 – just 10 years later.

Compared to other South American countries like the neighbouring Mexico and Argentina, Brazil has been the most important market in terms of value.

That’s largely due to the number of people living in Brazil, which clearly puts an enormous pressure on the market. With this large population, Brazil’s internal market can be sufficient to produce, consume, and sustain such high GDP levels.

To really understand the power of the internal market in Brazil, we should look into the percentage of GDP allocated to trade.

Looking at the chart above, we can clearly see the impact of trade on the Brazilian GDP is rather small.

For instance, when you compare the Brazilian market with the Argentinian market, there’s a similarity in terms of internal production being consumed by their citizens.

The problem is that Argentina is a considerably smaller country than Brazil. While in Argentina there are 44 million people, in Brazil we’re talking about four times that at around 209 million people.

As a comparison, Mexico has half of the Brazilian population at around 109 million people, but trades about 80% of what it produces. This means Mexico’s population is surely poorer than Brazil’s, simply because the internal spending power is less in Mexico than in Brazil.

What we can conclude from this is that although Brazil is the highest producer of goods in South America, it is also the biggest consumer, meaning its internal market is raging as people spend what they earn internally.

So how do you think Brazil would be affected by a trade war? Given the fact most of its production is consumed internally, I personally argue it won’t have a great impact.

The biggest issue facing Brazil is the lack of savings from its population.

Incredibly, if we compare the amount of money spent vs saved across the three countries mentioned in this section, we quickly reach the conclusion that even though Brazil is the highest producer, consumer, and earner, its people are not prepared for an economic slowdown as savings are incredibly low.

In my opinion, the graph above is quite scary.

It shows that Brazilians are the least worried about savings, literally spending everything they get.

This also shows that consumer prices are quite high – probably too high – given the fact people are unable to save.

For instance, in Mexico, even though GDP is smaller and trade is four times higher than in Brazil (imports and exports), we see Mexican citizens are able to save close to 25% of what they earn, while in Brazil it is only 15%.

Even though Mexicans and Argentinians have less money available, they are still able to save more than Brazilians.

Scary, right?

The last indicator I would like to highlight is arguably the most important one, and it’s the reason why I personally believe Brazil needs Bitcoin and cryptocurrency.

The chart below shows the Brazilian debt service and how dependent Brazil is on the outside world for funding its activities.

To put things into perspective, the debt to GDP ratio has increased in Brazil from about 50% in 2012 to over 80% in 2019.

Therefore, although Brazil is clearly growing, most of the growth is supported by debt. This means that if there is a worldwide debt crisis, Brazil will get hit hard.

Is there a way to avoid all this? How can Brazil use Bitcoin to its advantage?

Investors understand the idea that money can be worth more in the future instead of less. The deflationary aspect of Bitcoin makes people think twice about using their BTC to buy something as it might be worth more the next day.

By using Bitcoin and cryptocurrency, people become experts in the time value of money. Something can be worth less tomorrow just because the money they hold grows in value (as more people want it and the supply remains the same).

By using Bitcoin, Brazilians have a way to store value and to increase savings. That means if they buy Bitcoin today, in a couple of years, they may have turned a nice profit.

Imagine what cryptocurrency can do if there’s a national debt crisis? Or worse, a currency crisis?

The reason why cryptocurrency can help the Brazilian people is because it is detached from governments and banks.

Could cryptocurrency fuel economic growth in the country? I argue it can, as long as it’s the people who are buying in.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire