Last week the G7 task force released a report stating Bitcoin had failed as a store-of-value (SoV), as well as stablecoins represented a threat to sovereign monetary and fiscal policies.

The working group comprised of the biggest world economies (except for China), alongside the Bank of International Settlements (BIS), stated that stablecoins have the potential to reach an international audience and have “significant adverse effects” on the current economic system.

To summarise their position on the general cryptocurrency panorama I underline the following statement:

“Bitcoin has suffered from highly volatile prices, limits to scalability, complicated user interfaces and issues in governance and regulation, among other challenges. Thus, cryptoassets have served more as a highly speculative asset class for certain investors and those engaged in illicit activities rather than as a means to make payments.”

In essence the report focuses on the small stuff that hardly matters, instead of looking at the bigger picture like how Bitcoin is a brilliant SoV in corrupt systems or where government-backed currencies (aka, fiat-currency) fails its citizens.

In addition, if the biggest cartel in the world, central banks and the general banking system, cannot properly stop illegal transactions was Bitcoin ever expected to?

G7 with a hard stance on stablecoins

Even though the G7 had an overall hard stance on stablecoins, throughout the report, and urged for stronger and swifter regulation on the cryptoassets, the working group also concluded stablecoins could be advantageous for users:

“These stablecoins might be more readily usable as a means of payment and store of value, and they could potentially foster the development of global payment arrangements that are faster, cheaper and more inclusive than present arrangements. Therefore, they may be able to address some of the shortcomings of existing payment systems and deliver greater benefits to users.”

To add to the debate, G7 argues that due to their potentially large size and reach, stablecoins could additionally pose challenges to fair competition, financial stability, monetary policy and – in the extreme – the international monetary system.

Also, these cryptoassets may impact the safety and efficiency of the overall payment system, the report shows. These challenges stem, in part, from the fact that stablecoins may transform from a cross-border payment solution to assets with money-like features.

Finally the working group believes that no global stablecoin project should begin operation until the legal, regulatory and oversight challenges and risks outlined in the report are adequately addressed, through appropriate designs and by adhering to regulation that is clear and proportional.

In essence G7 would like to continue having a say in who can produce a currency.

G7 argues Bitcoin has failed

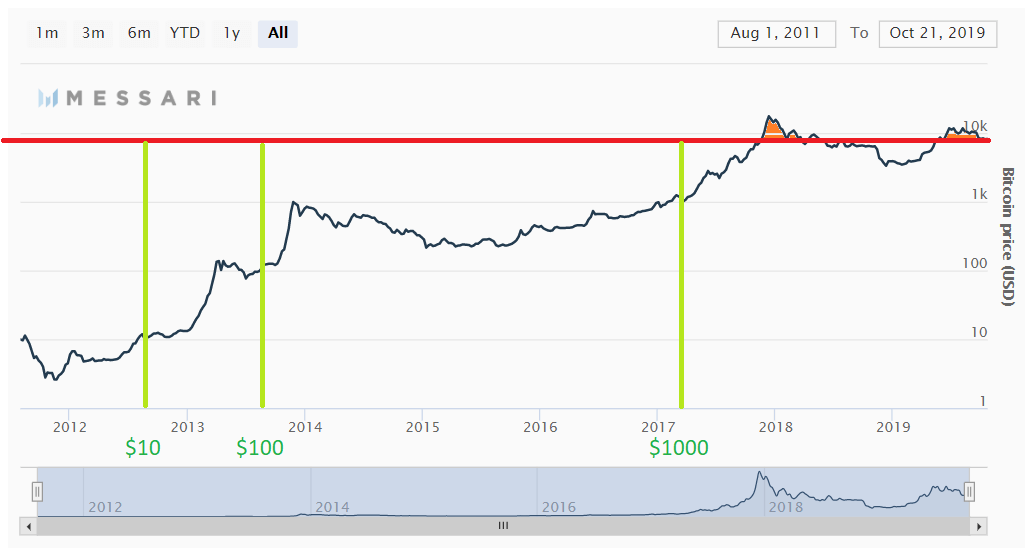

BTC/USD, thanks to Messari

I admit reading that Bitcoin has failed as a global SoV, on a report backed by a centralised system, cracked me up.

Above you can see Bitcoin’s logarithmic chart since late 2011. In red, at the top, I’ve highlighted the moments you should have not bought Bitcoin. All the area below the red line shows that if you’ve had bought Bitcoin during that period, you would be gaining.

In terms of percentage it means that:

- There’s a 95% chance you bought Bitcoin on the right days,

- There’s a 5% chance you bought Bitcoin during the wrong days.

Also, I’ve decided to mark the last time Bitcoin was trading at $10, $100 and $1000. You can easily see above Bitcoin hasn’t traded below $100 since before 2014.

In conclusion, what the data shows is that Bitcoin is an amazing SoV, and much better than any other asset in existence at the moment. This probably means that neither G7 nor the banking system puts your interests (or their clients), before theirs.

Otherwise, the working group would most likely conclude BTC is actually a safe-heaven due to its awesome properties like:

- Fixed 21 Million BTC supply

- PoW with terahashes of accumulated energy, making the network effectively super secure

- Permissionless and open network by design, without the possibility of blocking user-access

Safe trades!

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.