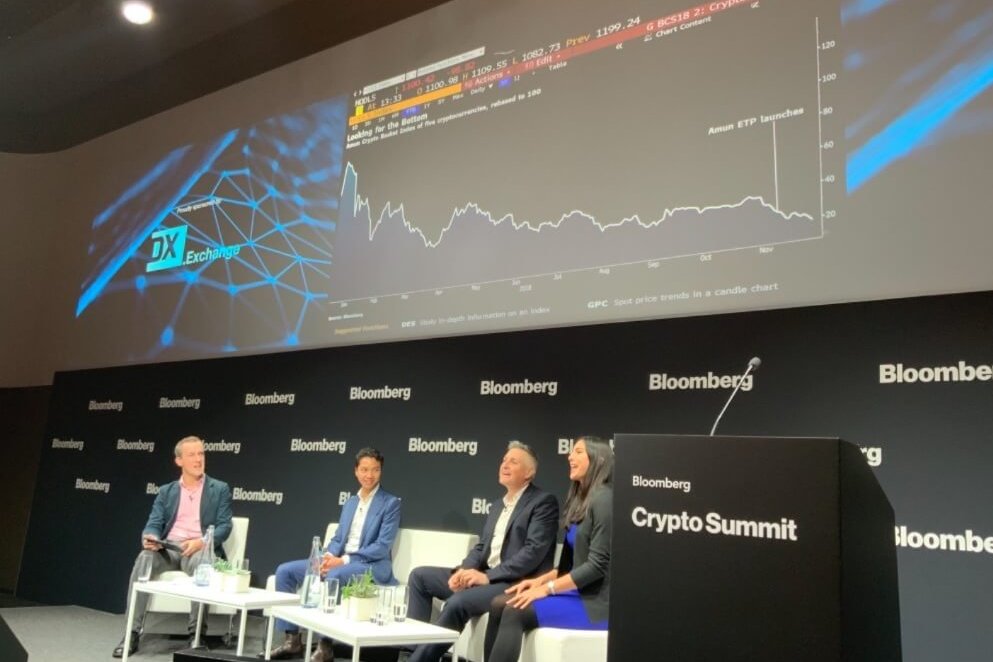

Estonia-based digital trading platform DX Exchange have announced that they will launch tokenised stock trading on the Ethereum blockchain next week.

DX Exchange are fully regulated within the EU and will use Nasdaq’s Financial Information Exchange (FIX) protocol to facilitate stock trading on their platform.

Users will be able to deposit cryptocurrency and purchase tokens that are backed by stocks in major traded companies.

“Digital stocks combine the best of both worlds: blockchain technology and traditional stock investments,” the company stated in a press release.

The press release continued: “Digital stocks are backed 1:1 to real-world stocks traded on conventional stock exchanges. You purchase tokens for leading assets that you choose to invest in, such as Google, Amazon, etc. Therefore, when you are a token holder, you own shares of the company.”

The platform, which was mapped out in May of last year, is reportedly the first exchange to be fully regulated within the EU.

As well as providing financial information to the exchange, Nasdaq are making further inroads into the cryptocurrency space in 2019, launching their Bitcoin futures product in the first quarter.

Their decision to list Bitcoin futures coincides with that of the Intercontinental Exchange (ICE), who are expected to launch their product, Bakkt, at the end of January.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire