Daily trading volume across all cryptocurrencies on CoinMarketCap.com has eclipsed the psychological $100 billion level over the last couple of days.

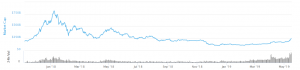

Going back to the last major cryptocurrency bull run in early 2018, daily trading volume was hovering around the $50-$60 billion range, while the total market capitalisation was over $800 billion for all crypto assets.

Today’s new trading volume high is based on a fraction of that total market cap however, as the market value currently stands at $243 billion. If you look at the market cap to volume ratio comparison between now and the last major bull run, the market looks to be in a much healthier place given that it takes approximately two-and-a-half days to turn over enough to cover the total market cap compared to nearly two weeks back in early 2018.

Last weekend, we also saw BitMEX announce that daily trading volume on its high leverage markets topped $10 billion a day for the first time in the firm’s existence.

Back at the start of the year, daily trading volumes were much lower. Since Bitcoin and other large-cap cryptocurrencies bottomed, we have seen both price and volume work their way back up and then explode during the recent April Fools’ Day and Mother’s Day rallies in the crypto markets.

With many traders now active again and making profits in the crypto markets, the volume ramp-up looks to be correlated with the renewed interest from both institutional and retail investors in 2019.

If open trading interest continues to stay this high and can carry on its trend for 2019, then it won’t be any surprise to see the total crypto market cap also break out above its current levels.

For more news, technical analysis, and cryptocurrency guides, click here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire