When Bitcoin briefly crossed the $9,000 threshold, for those who didn’t blink and miss it, there was fleeting cause for celebration. Analysts far and wide were confirming the return of the bull market and debating how high the digital asset could go this time.

But as BTC struggles to hit the $8,000 mark once again, plenty of “experts” in the space are scratching their heads. How the cryptocurrency market will move, it seems, is anybody’s guess.

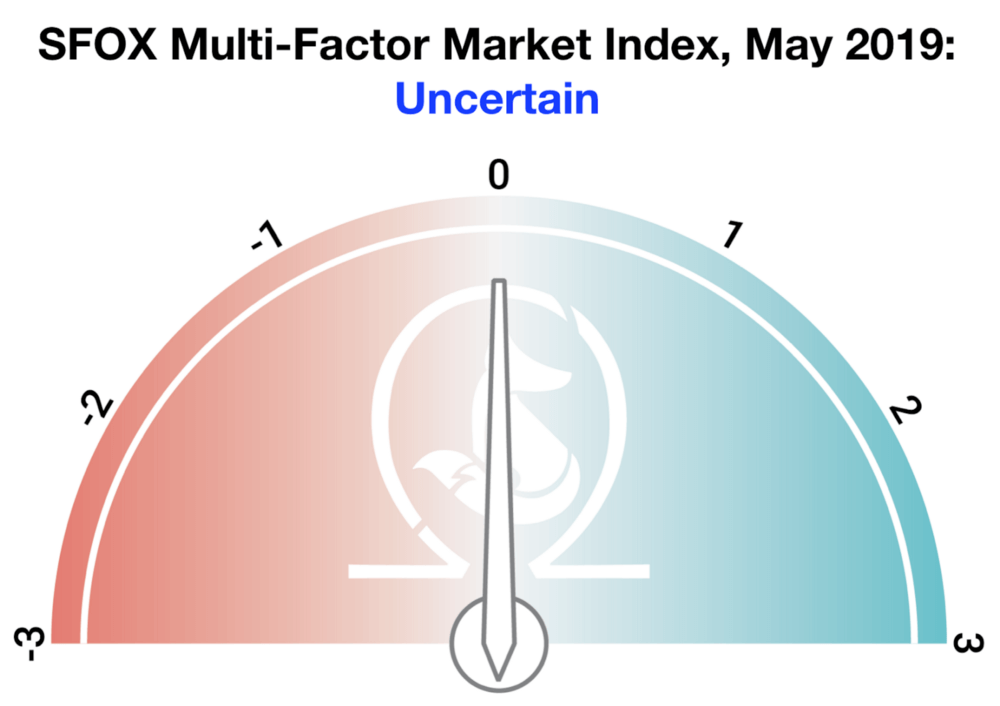

Every month, SFOX – a crypto-assets dealer for institutional traders and investors – compiles a volatility report for the previous month and sets the mood for the coming month. For most of 2019, that needle has been nudging toward mildly bullish. You can guess where it was throughout most of 2018.

This month, even SFOX seems to have given up making predictions, setting the multi-factor market index at “uncertain”.

Major analysts and influencers in the space, from Morgan Creek Digital co-founder Anthony Pompliano to Tommy Lee, have been bubbling with enthusiasm about the bull market and making their predictions.

Then you have well-known Bitcoin traders like Tone Vays calling for a pullback. His knowingly cautious (or bearish) stance on Bitcoin could be taken in several ways. Is it conservatism on his part or a bid to safeguard his reputation? Or perhaps it’s just common sense.

So far, it seems that no one has any real idea of how Bitcoin and the cryptocurrency market will move. And that probably makes sense given its infancy and lack of historical data to make an accurate assessment.

The cryptocurrency market is also notoriously sensitive to external pressures such as regulation, decisions from the SEC, large conferences and events, and institutional announcements. Yet despite plenty of bullish signs last month, retail Bitcoin FOMO has yet to set in.

The debate still rages over whether Bitcoin has any correlation with the stock market. Until recently, most experts, including Pompliano, would have agreed that there was no correlation with the stock market.

After all, when the stock market goes haywire, most investors flock to safe-haven assets like gold. However, with gold price declining by almost 25% over the years, it’s starting to look as if Bitcoin is becoming the new digital gold even for conservative investors.

The SFOX report, compiled using data from eight major exchanges in May, states that for the first time there was a “near perfect negative correlation” between BTC and the S&P 500 upon the news that China would be raising tariffs on US goods. This suggests that Chinese investors are using Bitcoin as a hedge against spiralling global markets.

This also means that further bad news for the markets such as Trump’s new Mexico tariffs could also impact the cryptocurrency market.

While announcements from Microsoft, Whole Foods, and Facebook were all bullish for the market in May, the SEC dropped a few bombs. Firstly it took up a decidedly threatening posture on ICOs and looks set to come down hard on them. And secondly, it kicked two more Bitcoin ETF decisions down the road until the end of summer.

However, as the SFOX report notes, the market didn’t seem to react this time around to the delayed Bitcoin ETF. Investors appear to be much more concerned with the state of the stock market and using Bitcoin as a hedge against it.

While it honestly feels rather more like speculation, hearsay, and hot air, SFOX proposes some key factors that could influence volatility in the cryptocurrency market in June. One of these continues to be trade relations and the shape of traditional markets.

If the theory that Chinese investors are using BTC as a hedge is true, more bad news for stocks could be good for crypto.

Then there’s the Bitcoin 2019 conference in San Francisco toward the end of the month. This is the sort of Consensus of the West Coast that attracts many Silicon Valley types to the market that have the potential to move it.

Finally, the CME BTC futures last-trade date and BitMEX XBTM19 expiration date are coming up on June 28. CME BTC futures typically spike crypto volatility around their expiration time and, with CBOE out of the race for now, BitMEX and CME expirations may cause more volatility than usual – or not, of course.

With massive spikes and sudden unexplainable drops, traders making bad call after bad call, and analysts undecided, it could just be anybody’s guess how the cryptocurrency market will move.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire