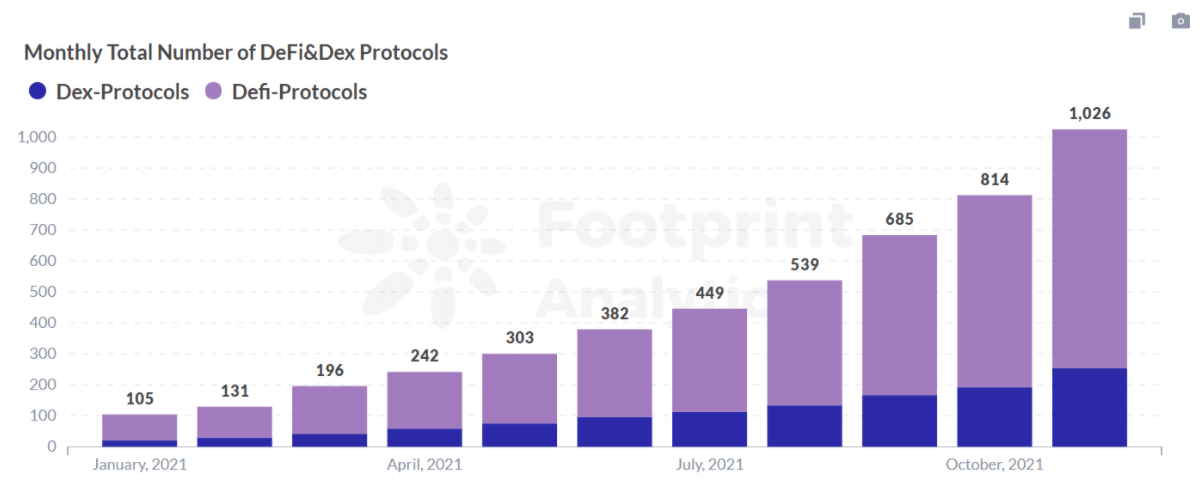

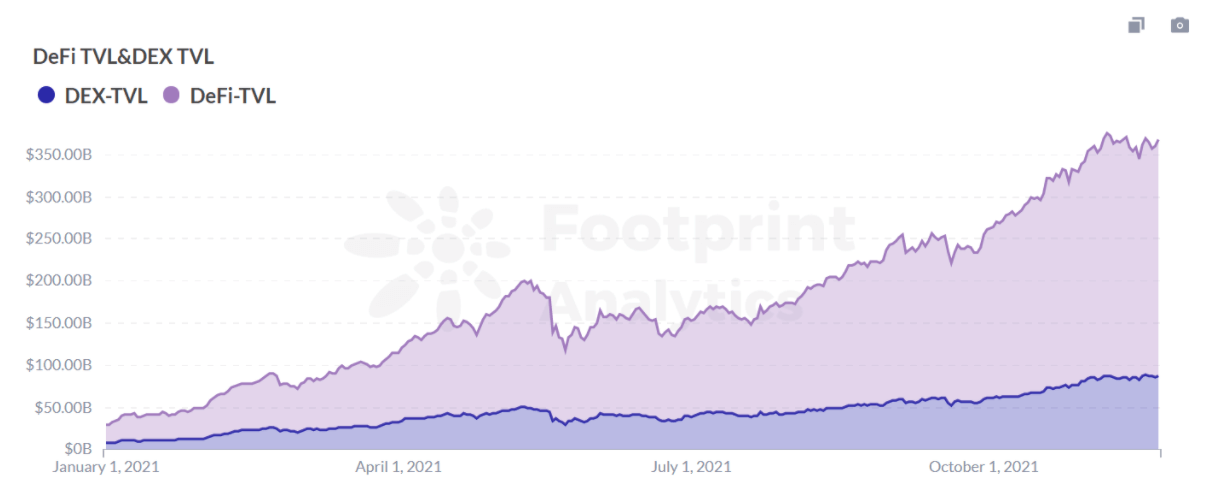

The DeFi world has witnessed a rapid growth from its number of protocols and amount of TVL. According to Footprint Analytics, 10x of new protocols in numbers have been deployed in DeFi this year, and so is the DEX sector, from 24 in January to 269 in November. In terms of TVL, DEXs have currently contributed 30% to the overall DeFi industry.

Footprint Analytics: Monthly Total Number of DeFi&Dex Protocols

Footprint Analytics: DeFi TVL& DEX TVL Trend

However, even though DEXs are one of the key components of DeFi, many people argue that DEX cryptocurrency trading will never replace CEXs because they:

- Lack efficient market maker mechanisms.

- Have high gas fees due to congestion on the Ethereum network

In this article, we will explain how DEXs are solving these two major problems.

How DEXs solve the market maker problem

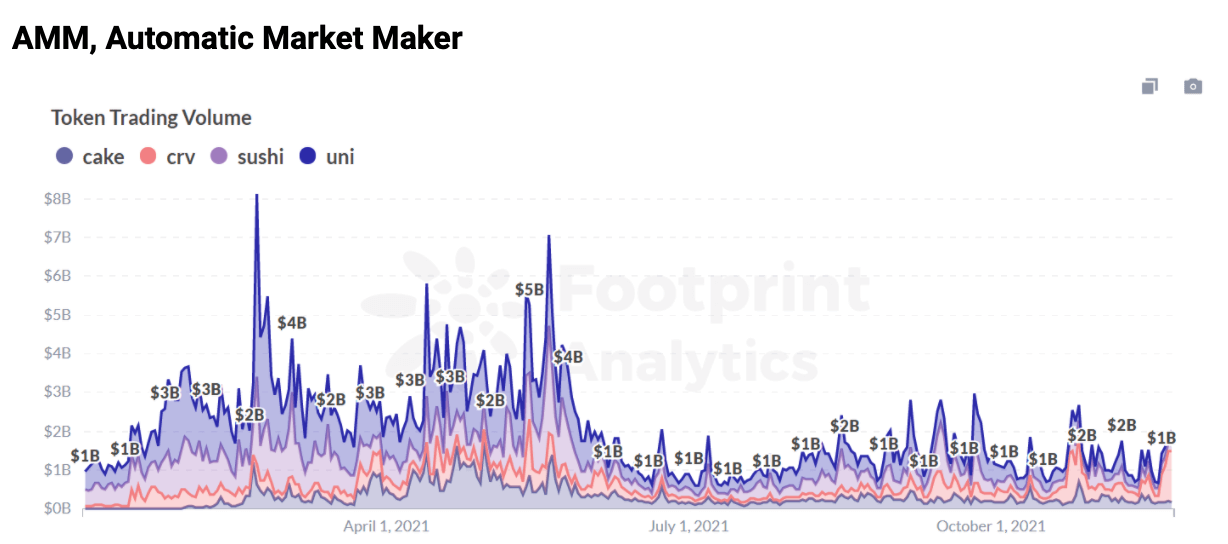

AMM, Automatic Market Maker

Footprint Analytics:Top Projects DEX Protocol Token Trading Volume

Currently, the top DEX projects in terms of trading volume are using the AMM trading model. These include Curve, Uniswap, Sushiswap and Balancer.

Uniswap, Sushiswap and Balancer, have reached over $1 billion in token trading volume.

The AMM model is not perfect and has run into several problems. For example:

- Functional layer limitations, where quotes and trades on an AMM DEX need to be completed based on the real-time status of the exchange pool.

- For on-chain transactions, the entire process from market making to trading needs to be done on-chain, congesting the network and creating high gas fees

- Slippage occurs when the size of a single trade is too large compared to the size of the exchange pool, causing a big impact on the expected price and the executed price.

For example, when a user purchases an ETH quoted at $1,000, while the market price of the ETH has dropped to $995 at the final settlement due to network congestion, but the user still has to pay $1,000 for an ETH, which means the user has paid extra $5 for the ETH, and this $5 is the positive slippage.

These shortcomings of the AMM model have been met by corresponding DEX platforms that have continued to refine the AMM mechanism.

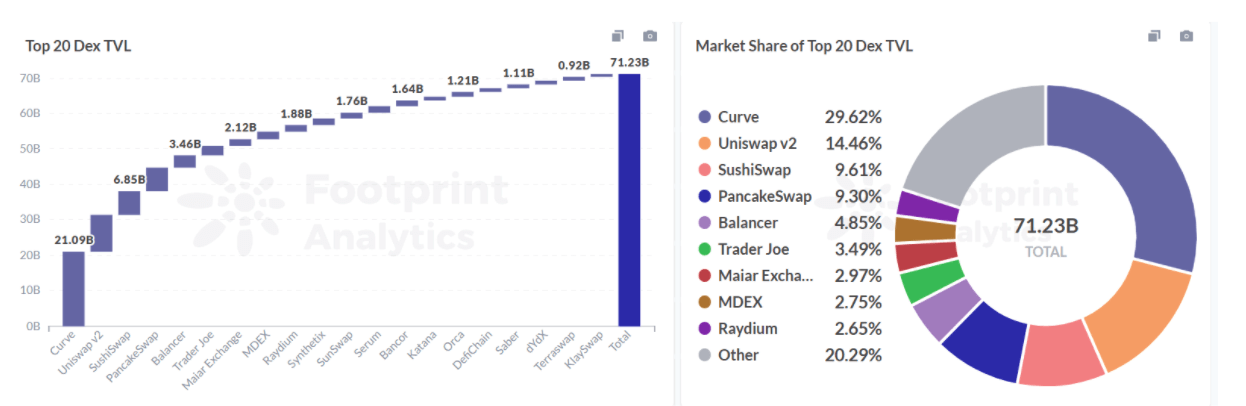

Footprint Analytics: Top 20 DEX protocols TVL’s market share

The biggest reason why Curve, which occupies the leading position among DeFi projects, is that it has been positioned as a decentralized exchange specifically designed for stablecoins since its inception, and has also made breakthroughs in solving the problems of high slippage and high gas costs of the AMM model. So are the updates of Bancor from v1 to v2, allowing users to pledge unilateral assets and earn gains protected from slippage.

Uniswap continues its iterations from V1, V2 to V3. The upgrade of Uniswap V2 is to expand trading pairs to support any ERC-20 token, enabling LP Token to be automatically compounded. Regarding Uniswap V3, it provides more options to liquidity providers (LP) such as the price range to improve their capital utilisation and the fee ratios (0.05%, 0.30%, 1.00%) selection.

PMM, Proactive Market Maker

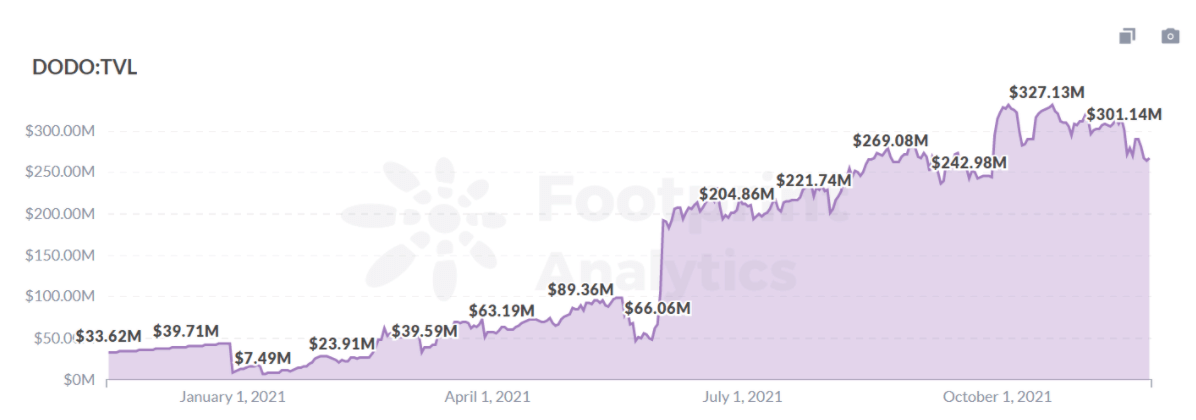

Footprint Analytics:DODO TVL Trend

According to Footprint Analytics, in early June, the DEX project DODO’s TVL broke through from $49 million to over $200 million in a matter of days, an increase of more than 340%, by using its own original PMM algorithm, which gives users lower slippage than the AMM protocol and lower impermanent losses on individual asset exposures. PMM means Proactive Market Maker and is the main difference between DODO and other DEXs.

The core of PMM is to guide prices by introducing price parameters from oracle to obtain the current market price of a particular token. This allows a large amount of market making capital to be gathered around the mid-market price, allowing for a relatively flat price curve and providing more liquidity.

This also means that PMM has a higher capital utilisation and lower slippage, offering better prices.

DMM, Dynamic Market Maker

Kyber’s DMMs reduce impermanent losses and increase the profitability of liquidity providers through dynamic fees by monitoring the volume of on-chain transactions.

- DMM will operate like any other AMM when the market is at its normal state.

- The DMM will raise the fee when the volume of transactions is higher than usual.

- When trading volumes are lower than usual, the DMM reduces its fees.

This is similar to the revenue maximisation strategy of professional market makers, which dynamically adjusts the market maker.

How DEXs are reducing gas fees

DEX Aggregators

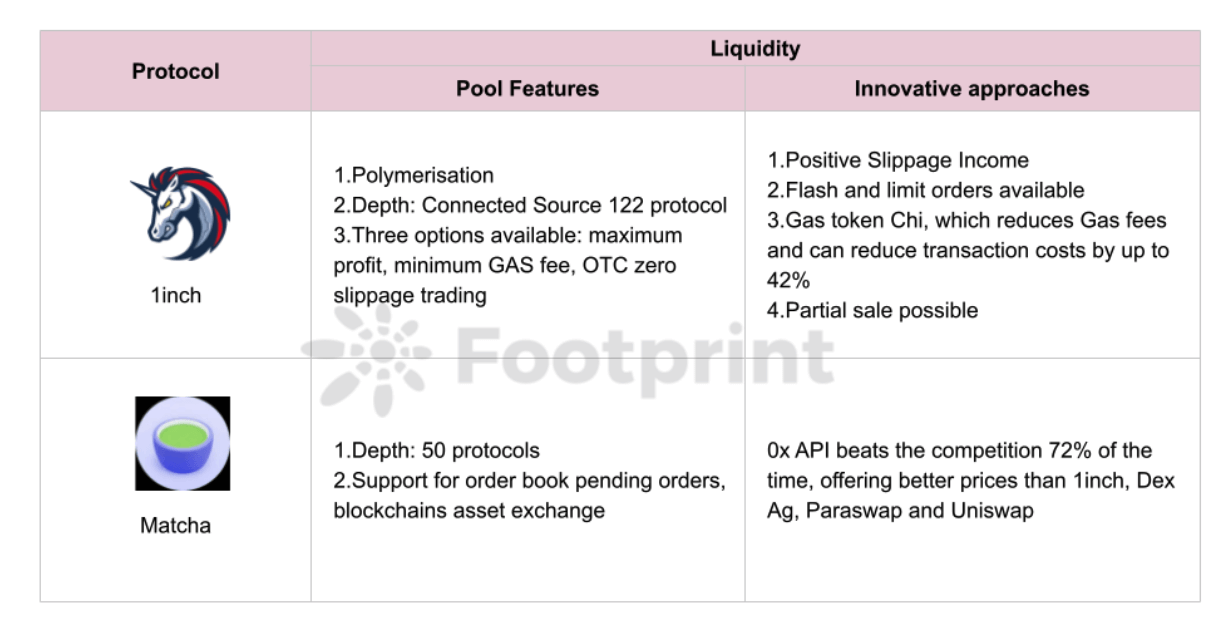

A DEX aggregator consolidates liquidity and intelligently delivers orders to enable users to optimally execute trades, reducing transaction costs, number of trades and gas fees.

There are a number of representative DEX aggregator projects emerging, including 1inch, Matcha and Paraswap, with a focus on the 1inch aggregator project.

1inch supports passing orders through multiple liquidity agreements

1inch is a DEX aggregator that automatically matches users with the optimal transaction path and executes redemptions with one click.

The DEX aggregator uses advanced algorithms to discover the most efficient exchange path by searching through over multiple liquidity protocols so that traders can get the most efficient price for their trades.

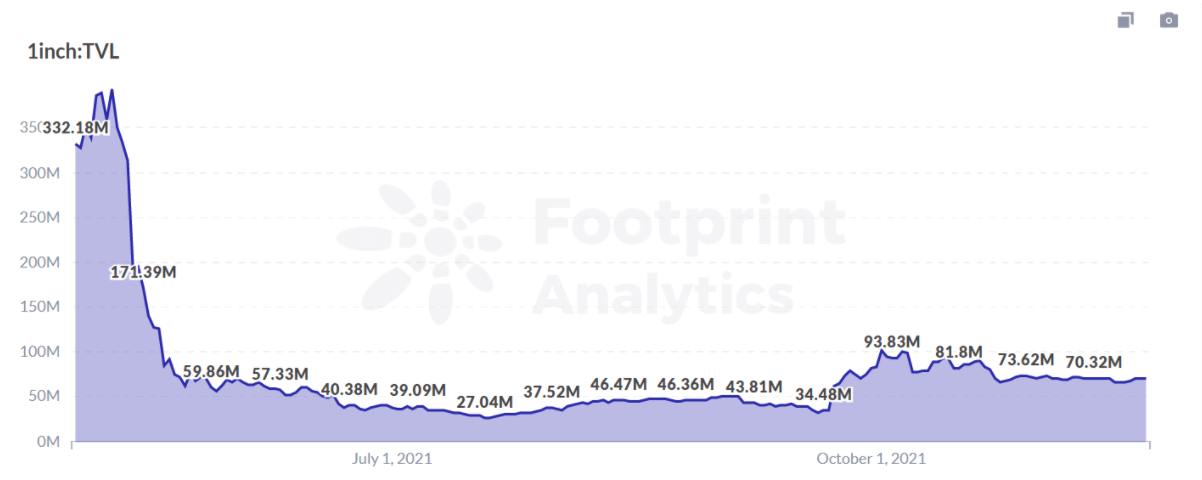

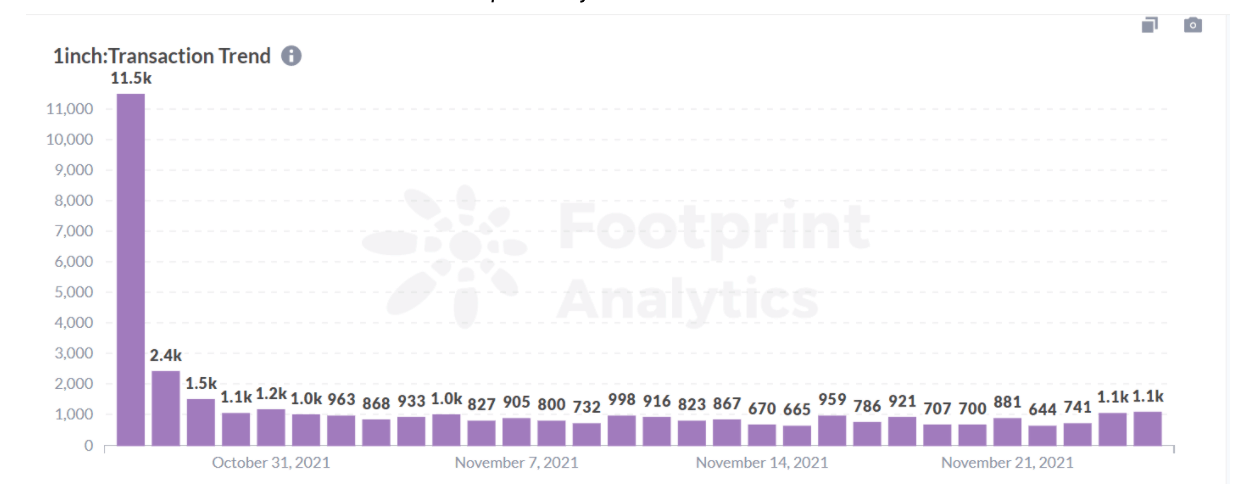

According to Footprint Analytics, 1inch’s TVL and trade volume trends are relatively flat, with 1inch v2 trading at number nine in the head DEX protocol trade rankings, indicating that the aggregator is also constantly updating its version to offer better deals to users.

Footprint Analytics:1inch TVL Trend

Footprint Analytics:1inch Transaction Trend

As mentioned above there are problems such as inefficiency and difficulty in finding the best exchange rate for the transaction path. Aggregators can find the best token exchange rate for users in the shortest possible time, and through various strategies, such as connecting protocols, maximising profit, and minimising gas fee, users can receive the exact quoted amount, allowing them to complete the best transaction at the best price and avoid losses and risks caused by price fluctuations.

Conclusion

At the beginning, DEXs replicated the orderbook model of CEX as the market-making mechanism. However, gas fees and slippage have made them a second choice to trade crypto and earn interest on stablecoins compared to their centralised competitors.

However, the blockchain ecosystem is constantly being updated and iterated, and various projects are also breaking through and innovating. DEXs are now solving problems such as network congestion, high gas fees, and low capital utilization. These improvements are providing better experiences and more premiums to projects and users, greeting a lot of potential for the future of DEXs.

For more data developments and content from the DeFi ecosystem, click on the Footprint link for more project dashboards and analysis.

The above content is only a personal view, for reference and information only, and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

What is Footprint?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website:https://www.footprint.network/

Discord:https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.