One reliable indicator of a market’s state of development and potential is institutional capital flowing in, with highly connected and deep-pocketed backers giving whole categories of the crypto space impetus and license to grow.

Until recently, institutional investors like banks, funds and VCs have played a relatively small role in the crypto market.

However, 2021 saw an influx of major investment organisations entering the crypto world. In this article, we take a look at investment funding rounds from VCs to see what type of projects are generating interest and where the industry is heading.

The conclusion: While CeFi is (unsurprisingly) the most mature category for crypto projects, DeFi and NFTs have caught the attention of some very smart people.

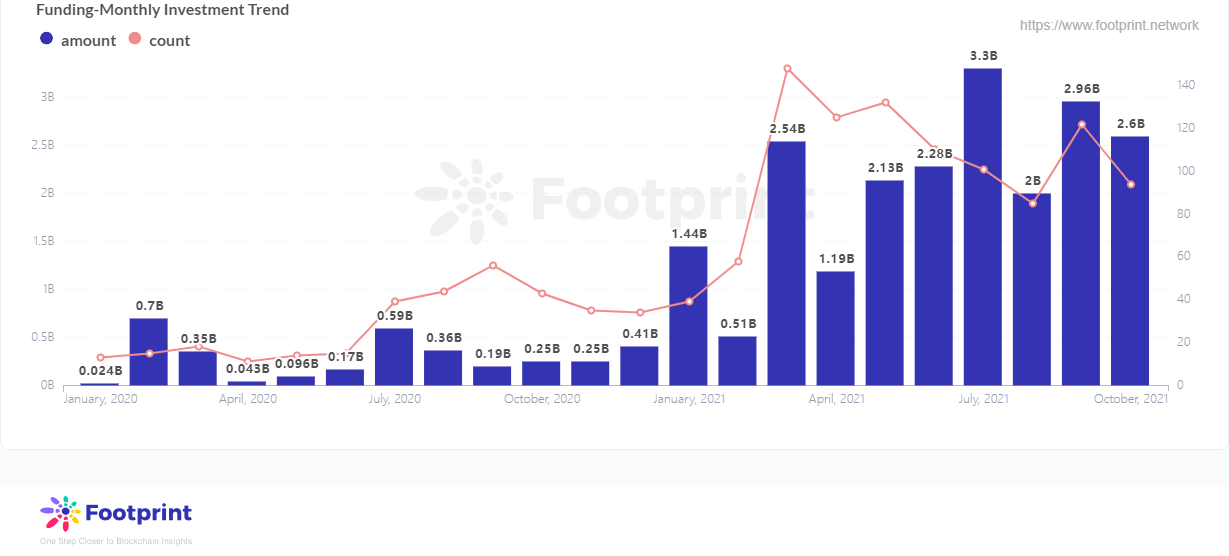

Compared with 2020, the amount and number of funding rounds in 2021 has increased significantly.

Taking data about funding rounds from Footprint Analytics, it’s found that the average amount per investment since May exceeds $20 million, and the average is increasing. June saw an all-time-high $3.3 billion in funding.

Monthly Investment Trend(Since Jan,2021)

Data source:Footprint Analytics

Interestingly, even when token prices fell in May, financing remained strong at $2.1 billion and has continued through as the entire crypto market remains hot.

Many countries have introduced policies that regulate crypto to varying degrees, which – rather than stymying investment – seems to have calmed some worries about DeFi from established investors.

Looking at the number of investments that banks and VCs made in 2021, DeFi projects received more funding rounds than any other business category at 229, followed by infrastructure. It is worth noting that the NFT category, which was not popular in 2020, overtook CeFi in third place, reaping 136 investments.

The rapid increase of NFT projects lifted gaming as well, with the subcategory rising from the bottom of the rankings in 2020 to the top in 2021, accounting for 12% of all rounds.

Number of Investment by Category(2020)

Data source:Footprint Analytics

Number of Investment by Category(2021)

Data source:Footprint Analytics

CeFi projects, while ranking fourth in terms of number of investments, ranked first in terms of amount invested by an overwhelming margin, accounting for approximately 48% of all funds in 2021. CeFi also far outpaces other areas in terms of average investment amount, followed by NFT and infrastructure projects.

Monthly Avg Investment Amount(Since Jan,2021)

Data source:Footprint Analytics

Seed rounds and strategic investment still dominate DeFi financing, with the latter making up 57% of all rounds and the former about 18%. Series A took 17% while Series B and above less than 10%. This reflects the fact that crypto is still in its early investment stages, and continues to sprout all kinds of new projects.

Fundraising Rounds(2021)

Data source:Footprint Analytics

Out of all funding rounds in 2021, investment app Robinhood reached the highest level at Series H. The highest funding process was carried out to Series H, only one is Robinhood, it is a stock brokerage that allows customers to buy and sell stocks, options, ETFs, and cryptocurrencies with zero commission. Robinhood, of the category CeFi, was created with the aim of providing many younger, less capitalized users with the ability to participate in the stock market and not have to worry about stock gains being gobbled up by most brokerages. Robinhood’s With commission-free cryptocurrency trading for BTC and Ethereum introduced in February, the platform is counted by Dovermetrics under the CeFi category.

This year, all but one of the three companies that received Series E financing were CeFi. As one of the only infrastructure projects, Chainanalysis is a data platform that powers investigation, compliance and risk management tools.

Fundraising Rounds by Category(2021)

Data source:Footprint Analytics

Although more rounds were obtained for CeFi projects, the incubation market for new projects is still more optimistic about DeFi and NFT, with these two categories occupying more than 60% of the investment in seed rounds this year.

NFT got the most Series e-rounds, including Dapper Labs—the firm behind CryptoKitties, a game which got so popular that at one point is paralysed the entire Ethereum network with congestion.

Blockchain-specialised investment firm AU21 backed more projects than any other VC with 115 investment rounds, while Coinbase Ventures followed with over 100 investments.

The recently active investor A16z (Andreessen Horowitz) has invested in 47 projects, more than 70% of which were invested in this year, with an average of 3 projects per month. A16z mainly focuses on three sectors – infrastructure, DeFi and NFT, each accounting for about 25%.

Number of Projects by Investor & Category(Oct,,2021)

Data source:Footprint Analytics

Polychain Capital invested in most of the top 20 TVL protocols with financing for MakerDAO, Compound, Liquity, Orca, Dydx and BadgerDAO. Tied for second place are Coinbase Ventures and Three Arrows Capital, both investing in five of the top 20 TVL protocols respectively.

Investor Ranking in Top 20 Protocols(Oct,,2021)

Data source:Footprint Analytics

The TVL of the MakerDAO recently overtook Curve in first place, rising 42% in one month. A16z is also one of the major investors. A16z completed a $15 million investment in MakerDAO back in September 2018, and MakerDAO has become the leading DeFi protocol, verifying the accuracy of A16z’s early judgment on crypto projects (the full table can be viewed here.)

2021 was a breakthrough year for crypto venture capital financing. Depending on how you see it, either CeFi or DeFi was the biggest beneficiary of this wave of institutional enthusiasm. NFTs have also finally received backing from institutional investors, a signal that they are rapidly going mainstream. However, it is also clear from the data that the market is still in its infancy, with almost all projects still in early stages of financing.

The above content represents the personal views and opinions of the author and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website:https://www.footprint.network/

Discord:https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire