In this guide, we take a look at one of the best analysis tools to predict the long-term value of Bitcoin: the stock-to-flow model.

The stock-to-flow model was initially proposed by a Twitter user known as PlanB, even though similar tools have been used in the traditional investment field for decades.

This tool can be used and the process replicated among other Proof-of-Work cryptocurrencies as well, because they follow similar stock-to-flow models.

The only requirements for the stock-to-flow model (or ratio) to make sense are:

- A known (visible and accountable) supply

- A known maximum supply (preferable)

As long as an asset falls into the above categories – like gold, silver, or most precious metals – we can apply the stock-to-flow model in order to predict the future price.

It’s important to understand however that this model will eventually stop making sense when the number of Bitcoin reaches its maximum available supply.

Let’s check out how the model works and what it can tell us about the future price of Bitcoin.

Stock-to-flow ratio

#bitcoin stock-to-flow model & multiple .. 🚀 pic.twitter.com/O3QzkpuTPm

— PlanB (@100trillionUSD) July 16, 2019

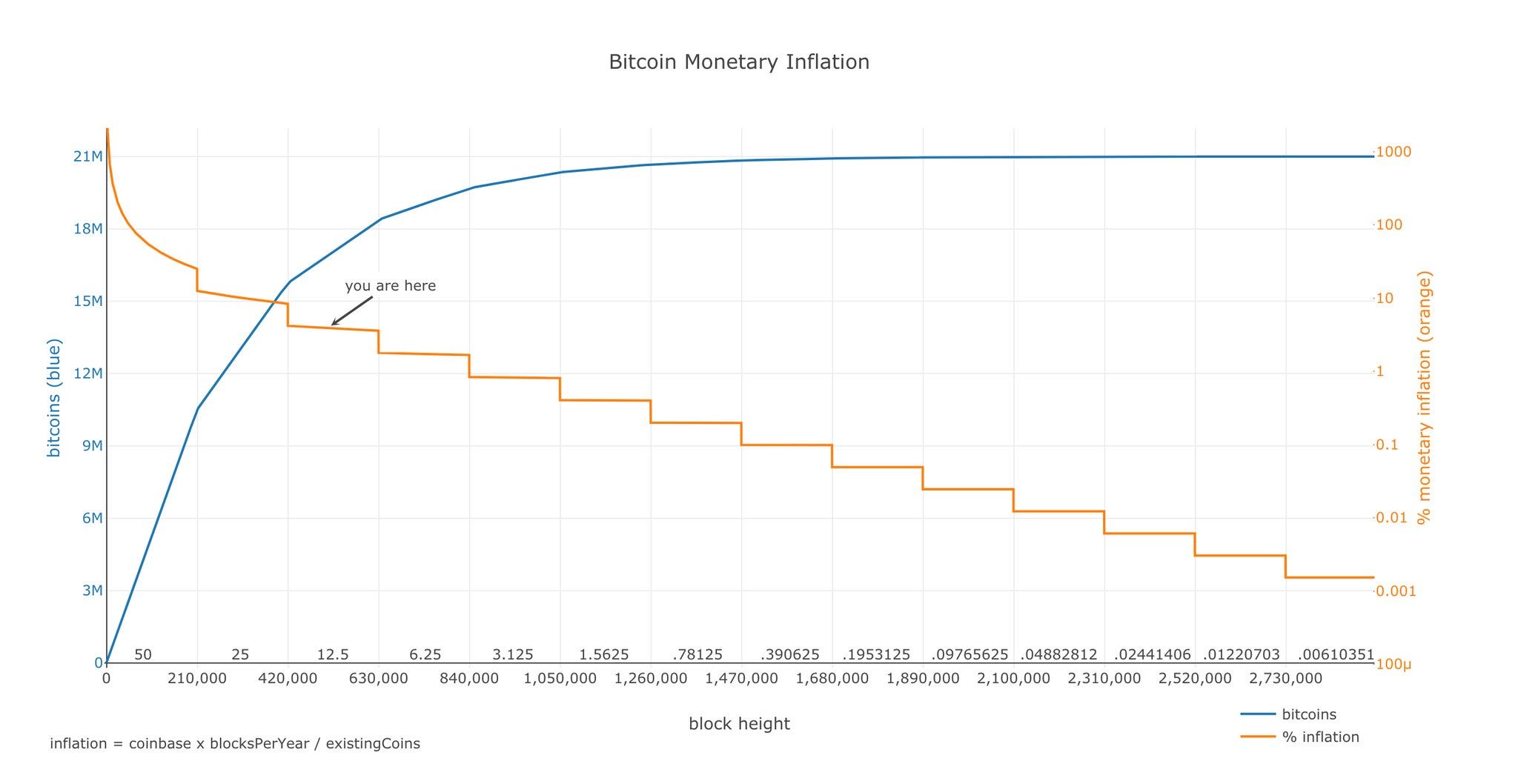

In essence, in the stock-to-flow model, the stock is the size of the existing stockpiles or reserves of an asset and the flow is the yearly production. Looking at Bitcoin, the stock is the number of circulating Bitcoins – at the time of writing, this is close to 18,000,000 – while the flow is the number of Bitcoins produced in a year, which currently amounts to an average of 657,000 BTC per year at the current block reward of 12.5 BTC.

Gold has the highest stock-to-flow ratio with 62, as it would take 62 years of production to reach the current level of gold stock. Silver has a ratio of 22, while Bitcoin is currently at 27. These high stock-to-flow ratios make them monetary goods.

As explained by PlanB:

“A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.”

In conclusion, the author underlined that:

- Gold and silver, which are totally different markets, are in line with the Bitcoin model values for stock-to-flow.

- There is an indication of a power law relationship.

- The model predicts a Bitcoin market value of $1 trillion after the next halving in May 2020, which translates to a Bitcoin price of $55,000.

Long-term Bitcoin value

According to the stock-to-flow model, we could see Bitcoin’s price mooning after the next halving event (or just prior, depending on how people react to the news).

For the last couple of years, the model has stood the test of time, and Bitcoin’s price is still showing strong correlation with the amount of coins in circulation versus the number of coins being minted and HODLed by crypto-enthusiasts.

If this model continues to satisfy its future predictions, this is what could happen to Bitcoin in the next couple of years:

- Bitcoin could reach $100,000 sometime in 2021

- Bitcoin could reach $1,000,000 sometime in 2025

- Bitcoin could reach $10,000,000 sometime in 2029

Of course, if such prices are ever reached, I seriously doubt people won’t already be using some form of Bitcoin standard, given it will be easier to measure prices in satoshis rather than BTC or USD.

Let’s see what the future brings. Will the stock-to-flow model continue to deliver, or will it completely break down?

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.