The Canadian cryptocurrency trading platform Einstein Exchange has closed and $12 million is missing, receivers have confirmed.

Canadian regulators seized the exchange after customers complained they were unable to withdraw their funds.

Grant Thornton, a law firm that was appointed interim receiver for Einstein Exchange, does not believe Einstein has “any assets of substantial value”, and a legal document states there are crypto losses which could not be tracked.

Michael Gokturk, CEO of the now-defunct exchange, allegedly kept funds on other exchanges.

Einstein has said that it believes it owes $8-10 million to customers.

Earlier this month, the British Columbia Securities Commission (BCSC) announced in a press release that it was taking steps to “protect the customers” of Einstein Exchange by placing it in receivership.

Complaints from those inside Einstein Exchange, including shareholders, also allege that the exchange was potentially engaging in money laundering activities.

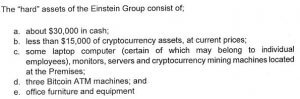

An excerpt from a legal document submitted by the court-appointed receivers

Proceedings against Einstein Exchange were confirmed by Sammy Wu, lead investigator for the BCSC, who issued an affidavit on November 1.

The affidavit states that BCSC staff believe that the exchange was facilitating the trading of securities – which requires official licencing from a regional Canadian Securities Administrator.

Einstein Exchange’s website is unavailable at the time of writing.

Earlier this year, the CEO of Canadian-based cryptocurrency exchange QuadrigaCX passed away, locking up $190 million worth of customer funds.

Gerald Cotten was reportedly the only person who had access to the private keys which could free the customer funds.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire