Despite the crash in token prices caused by macro conditions and the collapse of FTX, the NFT market continued to decline steadily rather than experience any significant jolt in November.

While overall activity and trading decreased, the number of investment rounds increased and blue chip collections saw increased trading.

Overall Market

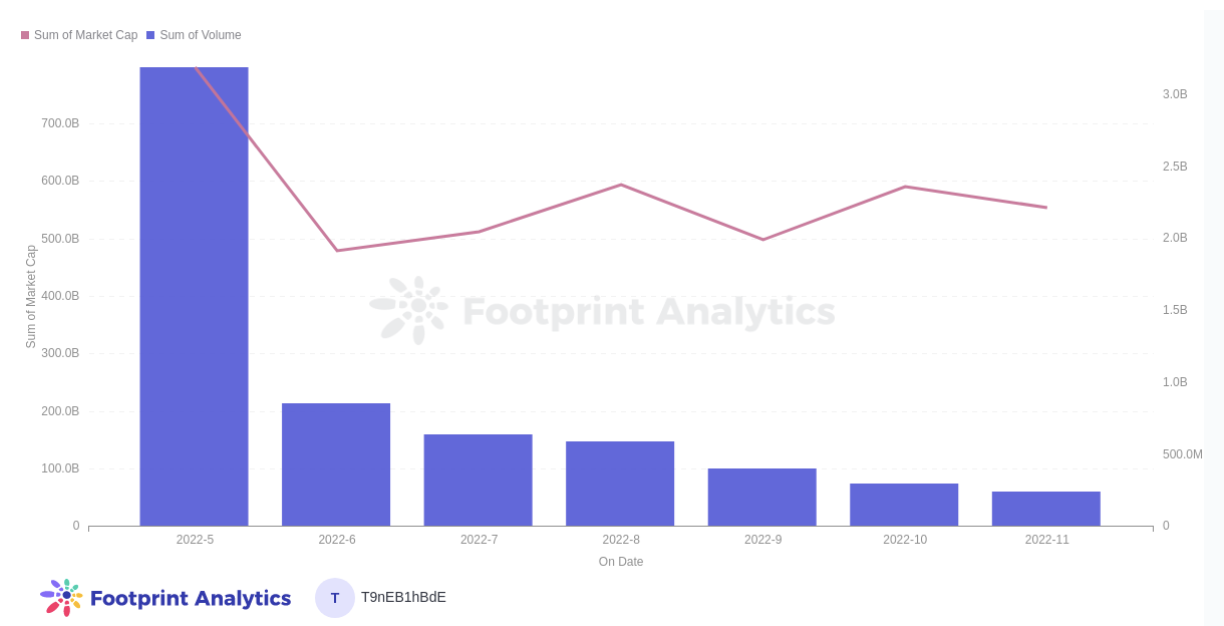

- The total market cap of the NFT sector decreased 6.3% from $590.9B to $553.1B.

- Across all measures, activity in the NFT industry has declined. The total volume of NFT transactions went from 297.5B to 242.4B.

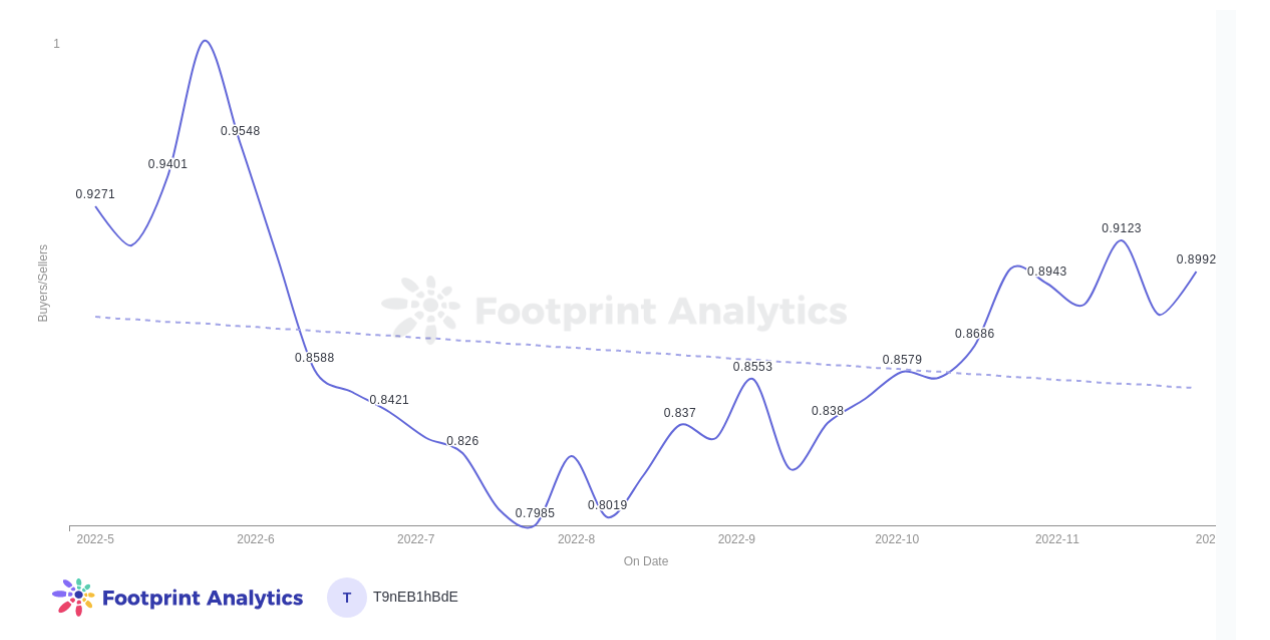

- While the number of NFT holders jumped from 16.7M at the end of October to 21.6M at the end of November, buyers and sellers remained steady.

- The buyer-to-seller ratio increased in November, reaching a high of 0.94 (91 buyers for every 100 sellers).

- The last time there were more buyers than sellers was in June, when there were 487,064 buyers and 485,095 sellers.

- Volume across NFT marketplaces declined by 26% MoM.

Financing & Investment

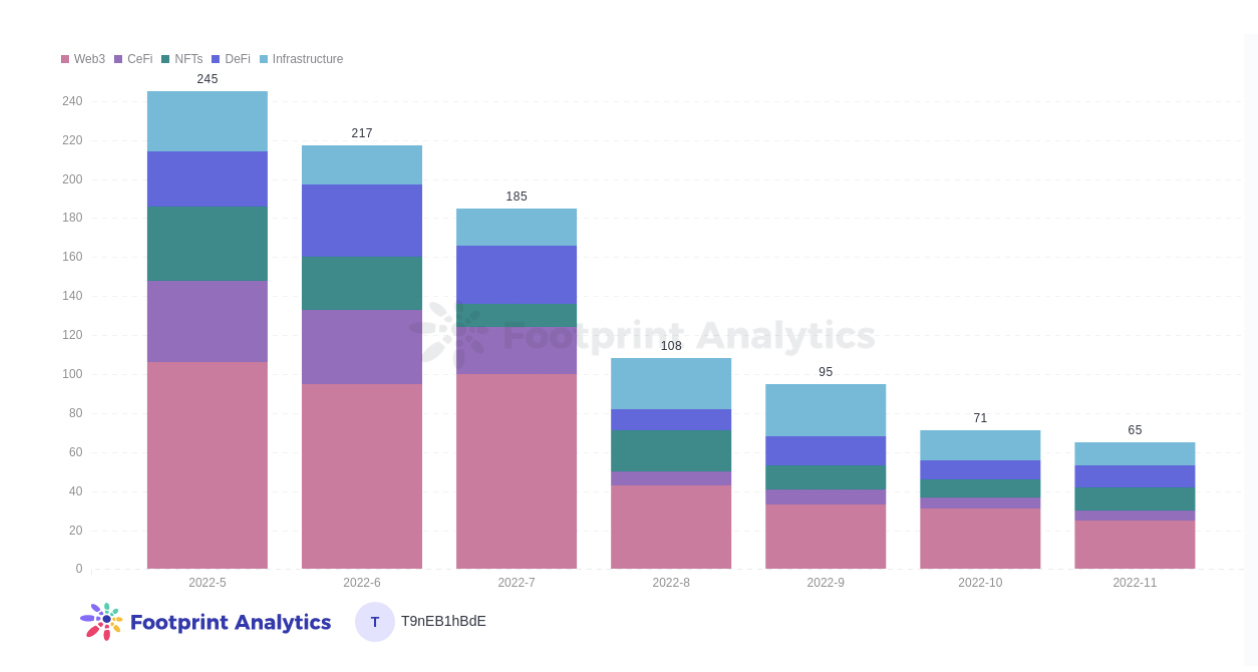

- The number of funding rounds in the NFT category increased from 9 to 11, whereas the number of rounds in the blockchain space overall declined by 8.4% MoM (from 71 to 65)

- Almost all rounds in November were relatively small seed rounds—all were under $10M

- Two of November’s largest rounds, including the largest, went to NFT marketplace projects. Joepegs an NFT marketplace on the Avalanche blockchain, raised $5M million led by FTX Ventures—money the project founders claim has been transferred out of FTX since the collapse—and the Avalanche Foundation. Courtyard closed the month’s largest round of $7M and hopes to let people monetize their real-life collectibles by turning them into digital assets.

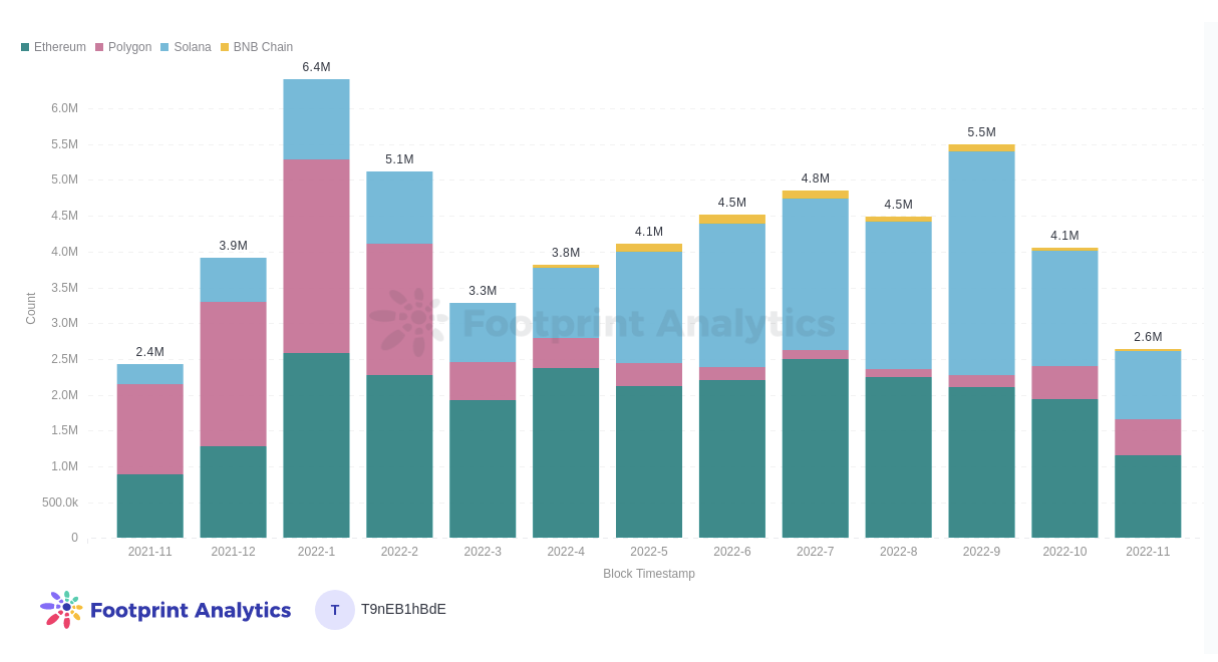

Marketplaces & Chains

- According to Footprint’s wash trading detection, wash trading plays a much smaller role in the NFT market than it used to, likely due to the decreased profitability of the overall NFT sector.

- In November, the filter found that only around 37% of the total volume on major marketplaces was wash traded.

- Ethereum still makes up most of NFT transactions, with Solana a close second and Polygon in third.

Collections Overview

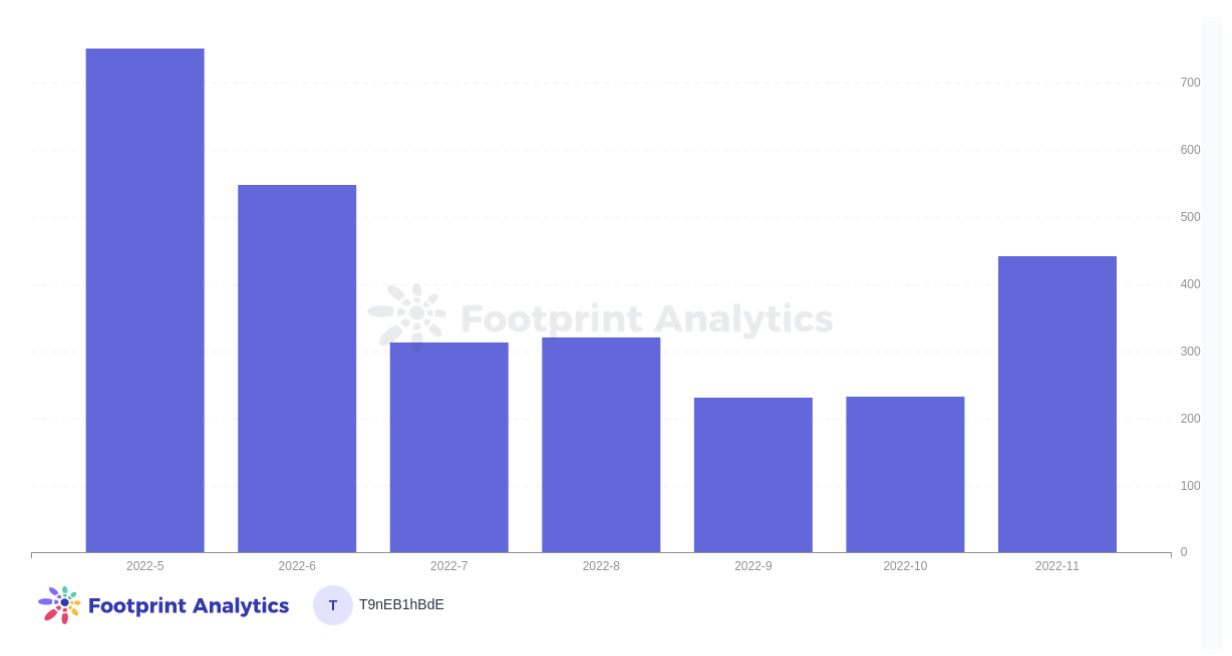

- Blue Chip NFT collections BAYC and CyptoPunks saw a sizeable increase in trading in November

- Transactions of BAYC NFTs nearly doubled MoM from 232 in October to 441 in November

- Transactions of CryptoPunks NFTs increased from 150 to 203

NFT Market Overview

In November, the amount of volume in the NFT sector decreased along with transactions and market cap. However, the data indicates that the market cap holds steadily between the $500B and $600B band despite the fluctuations.

NFT Market Cap & Volume (Nov. Report)

The ratio of buyers to sellers is used to gauge the supply and demand in the NFT market, which influences the price. In November, it has rebalanced to a steady level in the high 0.80s. In summer, the ratio severely favored buyers, driving down the prices of NFTs, but this began to re-balance in September and continued up in October.

Buyers/Sellers Ratio November Report

Investment & Fundraising

While the number of fundraising rounds in the blockchain industry decreased, the NFT sector had more in November than October, with 11 small (sub-$10M), mostly seed-stage rounds.

Investment by Category (Nov. NFT Report)

In light of the seemingly grim conditions, it’s useful to compare these figures to the broader market, where investment rounds also plunged YoY according to research from S&P Global, but to a lesser decree. The crypto market was clearly hit earlier and harder by macro conditions. While the above research might use different tools to track investment rounds than Footprint Analytics, it is also interesting to see that blockchain had roughly 5% of total global VC funding rounds (which the report put at 1,289) when we compare the data side-by-side.

Marketplaces & Chains

Wash trading is a form of fraudulent activity where trades are made in order to artificially inflate the amount of activity in a collection or marketplace, or for the trader to reapo the trading reward incentives in a market.

However, with decreased profitability in the whole crypto space, the prominence of wash trading in the NFT industry has decreased. In other words, tokens like $LOOKS simply don’t hold their value like they used to and there aren’t enough real buyers to justify the effort of wash trading. Although, wash trading might still occupy 30-40% of the total market volume.

The three top chains for NFT transactions are Ethereum, Solana and Polygon, in that order.

Collections

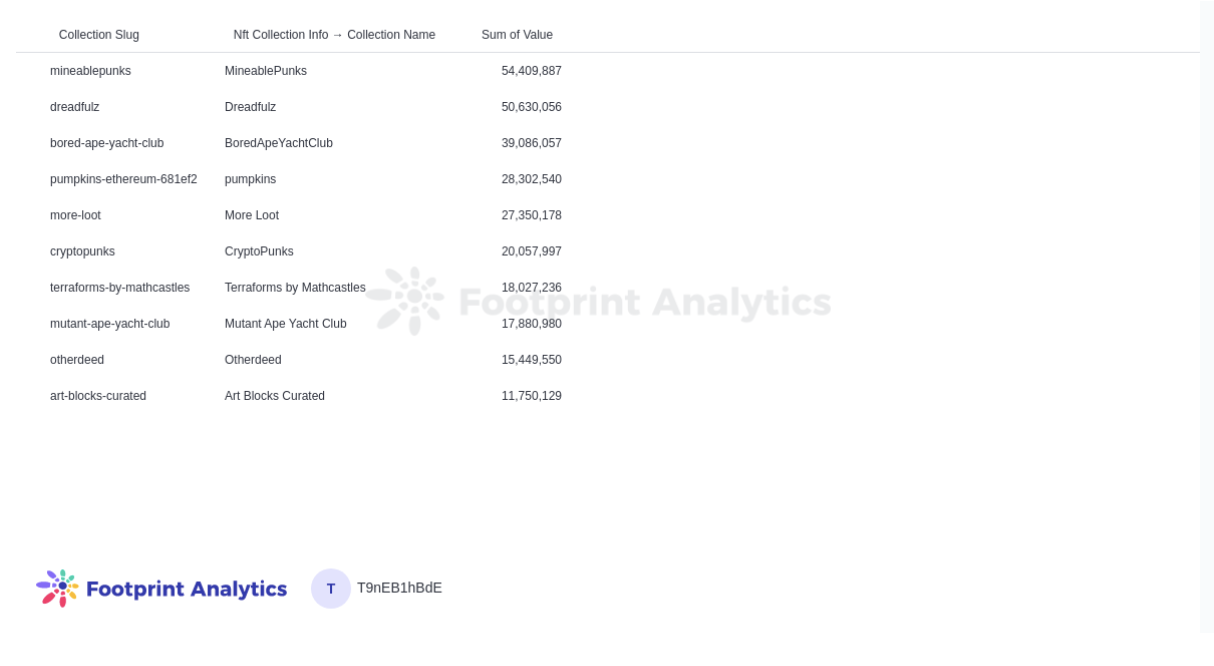

The top 3 collections by volume in November were MineablePunks, Dreadfulz, and Bored Ape Yacht Club. In the past, Dreadfulz has seen a lot of wash trading, while data is unclear about MineablePunks.

Top 10 Collections by Volume (November Report)

The activity of blue chip collections was a slight anomaly in November, jumping significantly. This was especially true of BAYC, trading of which almost doubled.

BAYC: NFT Transactions (Nov. Report)

Several publications have noticed, and AmberCrypto even published an article on Dec. 5 entitled, BAYC overcomes ‘dooms-month’ November but can APE decline to follow, which began:

“BAYC recorded a massive surge in its November performance, disregarding the crypto market crash.”

However, these kinds of articles disregard the fact that activity includes both buying and selling. A huge uptick in activity during turbulent times can indicate a selloff just as well as a surge in demand.

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Data Source: November 2022 NFT Report (ENG)

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.