Bitcoin is digital gold because it has a predetermined supply and cannot be censored.

Satoshi Nakamoto – Bitcoin’s creator – envisioned a worldwide digital currency backed by energy that could not be coerced by governments.

In order to achieve his goal, Satoshi had to solve two major problems with the current economy: censorship and inflation.

The most important key metric that really drives crypto adoption is price.

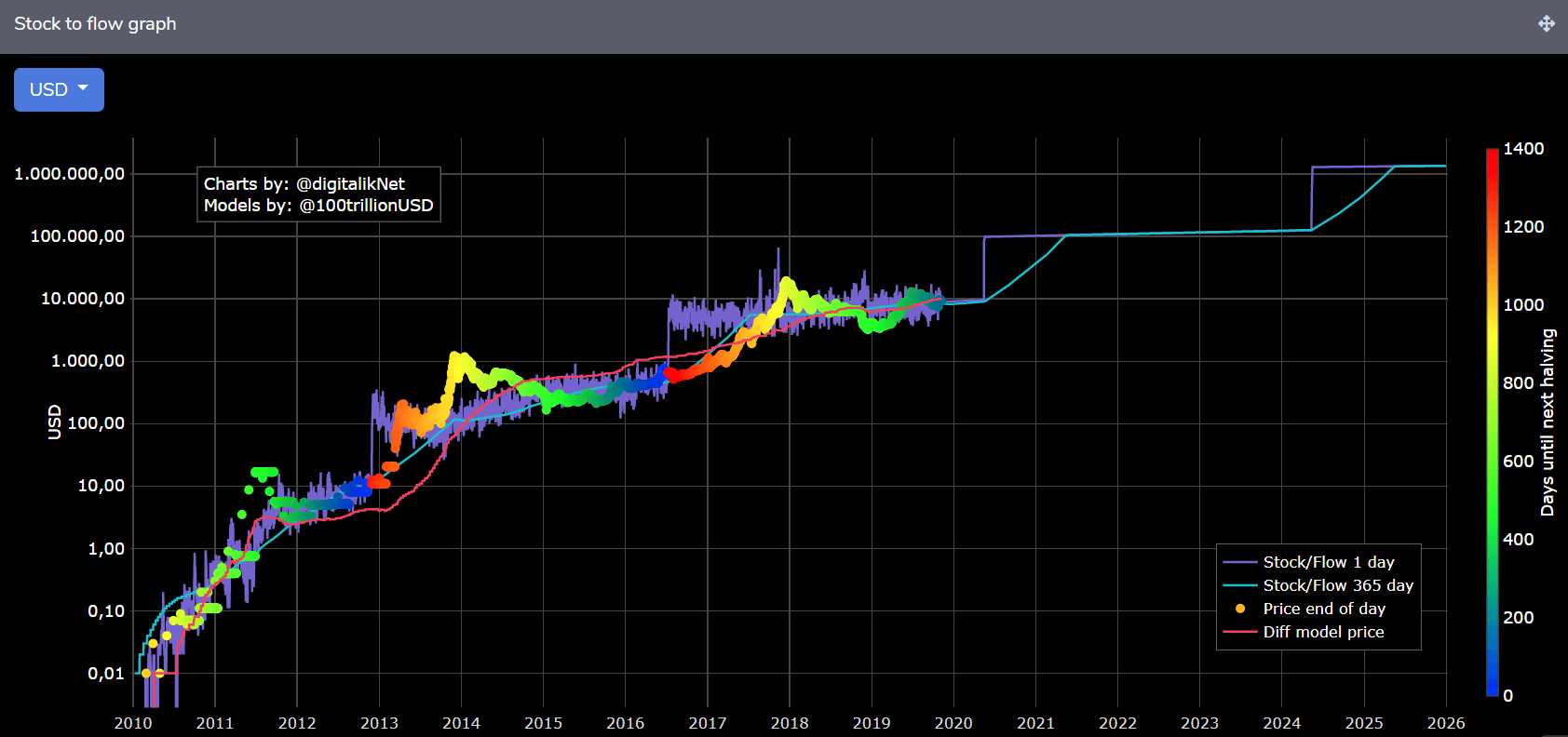

If you want to try and predict the future price action of Bitcoin, you should understand how price moves. The two main variables that affect BTC price action are:

When the late-2017 bull run took place, there were (literally) millions of people being onboarded every week and, sometimes, even on a daily basis.

Bitcoin’s price went through the roof because the number of Bitcoins available is limited and because the number of people looking to buy the asset exploded.

One of the most misunderstood problems by economists worldwide is the fact inflation is treated as simply an effect of money being produced.

We could look at inflation that way, like a natural cause that simply robs us of our wealth, but that is not how things work in the natural world.

As far as I’m concerned, most assets are limited, so money should be as well.

Since when new currency is minted it reaches the pockets of a select few first, these people can then buy stock or real estate. This causes the price of these assets to explode. Free/cheap money creates a bubble.

However, inflation is not the only problem Bitcoin fixes.

Now that cryptocurrencies are out of the box, my bet is that we’ll see government digital currencies being treated as cryptos – which brings us to the second issue.

Censorship resistance is the main goal of a blockchain. If your favourite blockchain project is fast but permissioned, you’re going to have a bad time.

Let me explain why openness is a key feature of Bitcoin in one line: if too few people control the network, they’ll censor your transactions.

Projects like EOS or NEO, which I support as interesting experiments, face this problem a lot (as we’ve seen in the recent past).

When too few people control the decision-making process, problems can occur. Out of nowhere, transactions can be censored by validators.

This is the really important feature when we look at Bitcoin vs “super-fast consensus” protocols. They trade decentralisation for scalability without telling you up front.

The real power of Bitcoin is its censorship resistance and hard-money properties.

Don’t forget, for money to be money, it needs to go through the three stages of acceptance:

If you do not agree with this logic, think long and hard about currencies that don’t serve the first purpose.

If you had to choose to spend either dollars or Bitcoin, what currency would you choose?

Easy. The one with the least perceived value. Therefore, the dollar is a great medium of exchange (however, it is a terrible store of value).

Bad money is always used first.

Safe trades!

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire