As DeFi rose in popularity and NFT and GameFi exploded, gas fees on Ethereum increased, and other public blockchains rushed to launch in response.

While Ethereum’s market share has fallen below 60%, it remains the first choice for many projects choosing a chain to launch on, making the gas price relevant for every user.

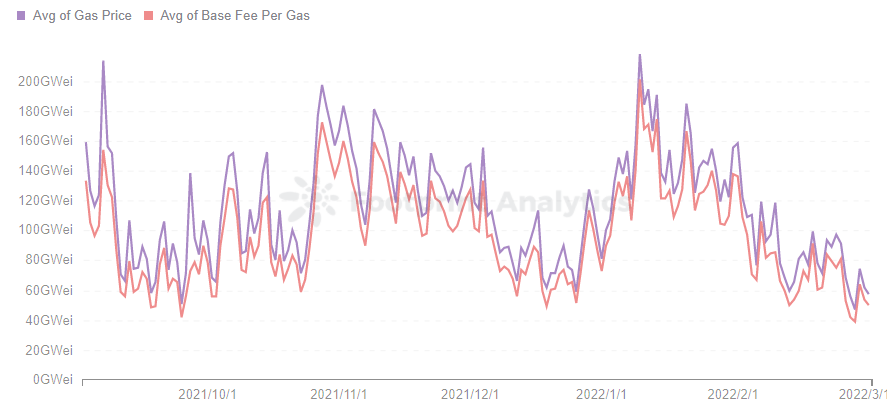

The London upgrade in August changed the structure of gas fees and has caused much discussion. Here is a look at how gas fees have performed in the last six months since the upgrade, according to Footprint Analytics.

The London upgrade was not designed to solve scalability, so there has been no significant trend change in the last 6 months in terms of average gas prices and base fee prices.

The upgrade changed the fee structure by splitting the fee into a base fee and a priority fee. Gas prices will increase or decrease based on the utilization of the last block, making user expenses more predictable and thus reducing the waste caused by overpaying for gas.

Footprint Analytics – Avg Gas Price vs Avg Base Fee per Gas

It can be seen that the fees after the launch are still dominated by the base fee, and the priority fee paid to miners only accounts for about 15%. The priority fee is more than 50% in some cases, but the overall payment of the priority fee is relatively stable.

Footprint Analytics – Gas Fee VS Priority Fee

There is no significant reduction in the general trend, but a slight difference can be seen in the median gas price. The median gas price for the last 30 days was 71.8 Gwei, compared to 79 Gwei in September.

Footprint Analytics – Txn Gas Price Distribution (Latest 30D vs Sep. 2021)

Looking at the distribution of gas price bins, the last 30 days of data shows a slight move to the left compared to September. The percentage of users that spent below 60 Gwei has increased by 9% to 50% of users, while about 90% of transactions are below 140 Gwei. Although the move is not significant, it does lower the price of gas for some users.

Footprint Analytics – Txn Gas Price Distribution (Latest 30D vs Sep. 2021)

The shift to the left cannot be ignored without the impact of the London upgrade, with more users choosing the EIP-1559 transaction type. According to Footprint Analytics, the percentage of users choosing EIP-1559 as their transaction style has risen from less than 50% to nearly 80% in the last six months.

Footprint Analytics – Txn Type(Share)

Looking at the breakdown of gas prices in the last 30 days, there is a significant difference between the median gas price of 67 Gwei for choosing the EIP-1559 transaction style and 83 Gwei for choosing the legacy type.

In terms of the distribution of gas prices, the overall price trend is smoother for the EIP-1559 option due to the more predictability. Gas prices for the legacy transactions are more volatile, with significant sudden increases between 120 and 125 Gwei.

Footprint Analytics – Txn Gas Price Distribution (EIP-1559 vs Legacy)

The price for choosing EIP-1559 is also significantly more shifted to the left than the legacy transaction type, and a greater percentage are in the lower price range. 51% of users who chose EIP-1559 spent less than 70 Gwei, compared to 35% for the legacy. This means that EIP-1559 is generally helping more users save in gas fees.

Footprint Analytics – Txn Gas Price Distribution (EIP-1559 vs Legacy)

Gas fees are ultimately a reflection of supply and demand. With the blockchain developing at a rapid pace, it’s hard to see a breakthrough price reduction. The data from Footprint Analytics shows that gas prices can be tracked at different times of the day, and users can save money by avoiding peak transactions.

Looking at the different hours of the day, gas prices are lower between 4:00 and 13:00 UTC for the last 3 months, averaging under 100 Gwei, and rising at other times. The lowest price is about 76 Gwei at 11 o’clock and the highest price is about 150 Gwei at 17 o’clock. Choosing the right time to trade can save almost half the cost.

Again the variance is greater after 14:00, meaning that prices are more volatile during these hours and that those who want smoother prices may consider trading at times with less variance.

Footprint Analytics – Gas Prices By Hour of the Day (UTC)

The lowest prices by week seem to be on Sundays, followed by Saturdays, with the highest prices occurring on Thursdays. People still choose to trade more on weekdays.

The date with the highest variance is Saturday, so Sunday is a good choice for those who want a smooth and low price. Choosing a non-working day and a reasonable time of day can be a great way to save gas.

Footprint Analytics – Gas Prices By Week Day (UTC)

Ethereum is moving forward with Layer 2 expansion and Ethereum 2.0 along with the London upgrade. Ethereum 2.0 will turn PoW to PoS mechanism, and will move from single chain to multi-chain fragmentation.

Many people are counting on Ethereum 2.0 to reduce their gas fees. The upgrade will increase network throughput and reduce network congestion, but there is a long wait for fragmentation to complete.

With the current trend of crypto world development, the demand for people to trade is increasing hugely. With such rapid growth, the relationship of demand outweighing supply will drive up the gas price.

Don’t forget about the price of ETH as well. The London upgrade has also turned on the burn mechanism, which is expected to burn up 1.8 million ETH per year at the latest burn rate. The amount of ETH issued will drop significantly when the switch to PoW is made, which may send ETH into deflation. If the price of ETH rises, the value of gas paid in ETH will also increase passively.

Gas fees as “gas” are essential for users to drive freely in the crypto world. Although it is not possible to determine the gas price, smart users can choose the best trading type and time period by analyzing the data.

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire