The U.S. Department of Justice has launched a criminal investigation into alleged manipulation of the price of Bitcoin (BTC) and other cryptocurrencies by traders, reported Bloomberg on Friday.

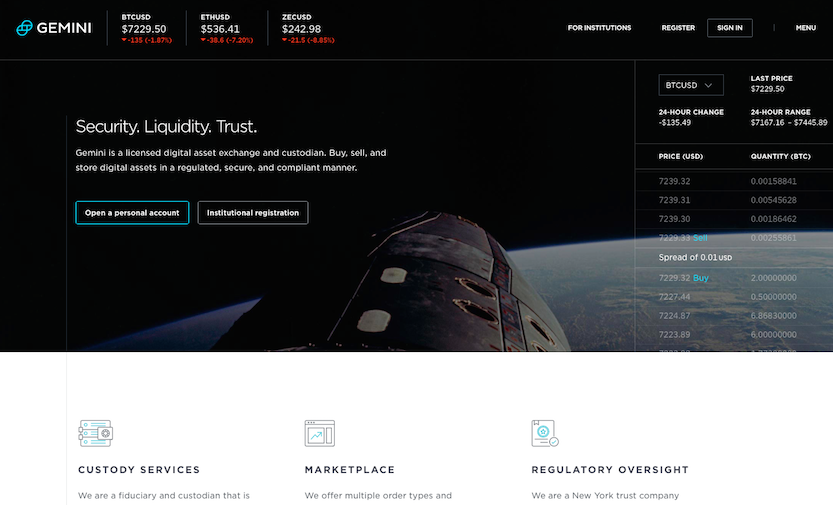

Anonymous sources told the media outlet that the DOJ in coordination with the Commodity Futures Trading Commission (CFTC) are specifically investigating wash trading and order spoofing.

The sources underscored the lack of regulatory clarity in the cryptocurrency sector has created the conditions that have made widespread manipulation ubiquitous.

Apparently, the Justice Department is especially looking at traders manipulating the price of BTC through sophisticated trading tactics.

The director of cryptocurrency Relex (RLX), Peter Lee, welcomed the probe saying his company refuses to get involved in price manipulation.

“We will not only cooperate, but give full support to the U.S. Government in their investigation of cryptocurrency-related price manipulation practices, effective immediately.”

In 2017, Coinbase CEO Brian Armstrong declared his company would investigate allegations that some traders at his firm may have been involved in insider trading, which in itself is not wash trading or order spoofing although it is a fraudulent practice that may be covered by the DOJ’s probe.

Various experts pondered what legal measures the DOJ could take if any criminal activity is uncovered, while others questioned whether prosecutors would also look into increasing pump and dump schemes.

The limited regulatory measures of cryptocurrency trading makes it an easy target for spoofers, according to University of Texas Finance Professor John Griffin, who has analysed manipulation in Altcoin markets.

“Some market participants have alleged that crypto manipulation is rampant. Last year, a blogger flagged the actions of ‘Spoofy,’ a nickname for a trader or group of traders that have allegedly placed $1 million (£750,000) orders without executing them,” concluded Bloomberg.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire