This column is a regular analysis of the EOS price (EOS to USD). We compare against the US dollar for ease of comparison (all our cryptocurrency analysis will put values in the US dollar equivalent). One of the aims of Coin Rivet is to promote understanding of cryptocurrencies and blockchain technology. Part of that understanding is looking at pricing trends for cryptocurrencies.

In discussing cryptocurrency prices, we are not recommending a coin neither are we recommending that you should invest in one. In fact, the more you learn and study the more you will realise that cryptocurrency prices fluctuate a lot and can be volatile. As we all know the value of investments can go up as well as down. In the case of cryptocurrencies that can be a lot – in both directions.

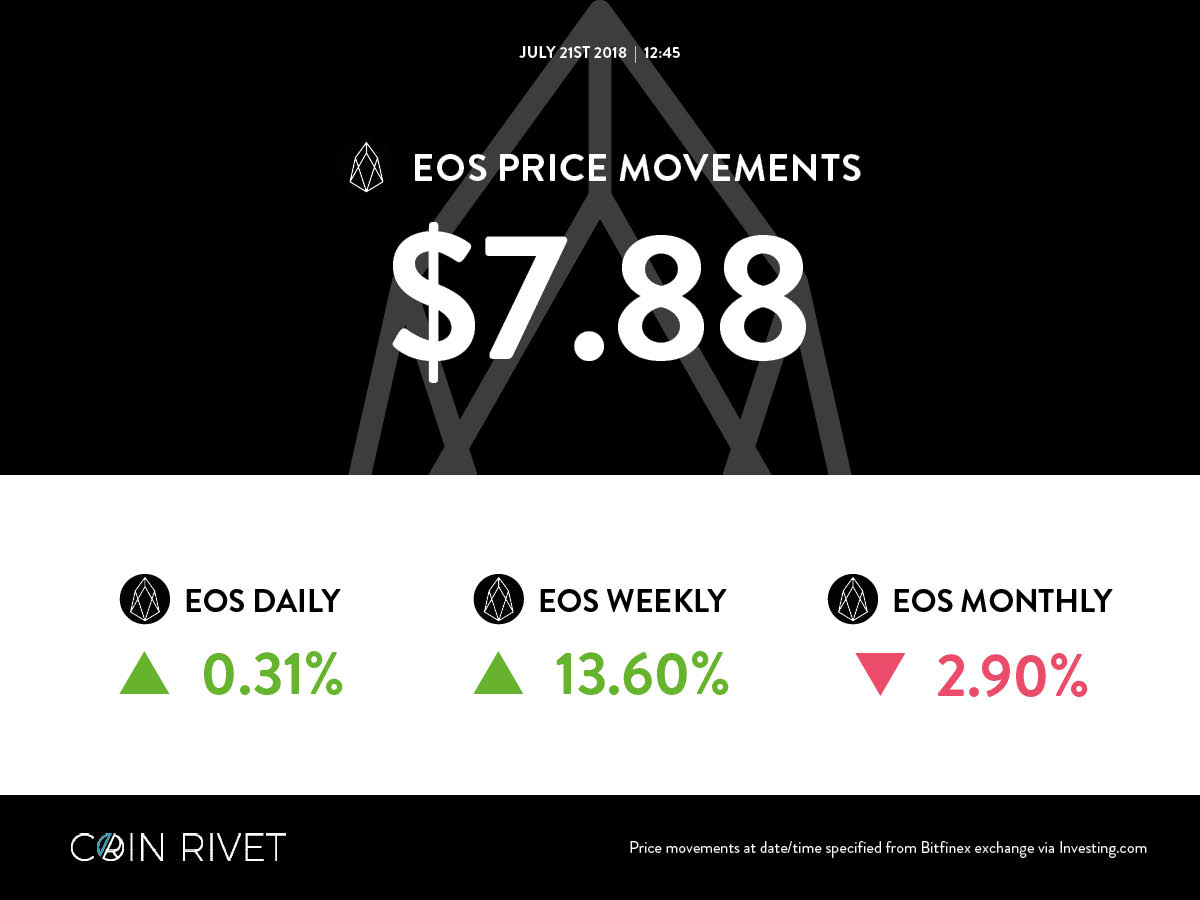

A good week for EOS but despite a big climb this week it couldn’t turn July green just yet.

Price: US$ 7.88

Daily: 0.31%

Weekly: 13.60%

Monthly: -2.90%

The EOSIO platform was developed by private company block.one and released as open source software on 2nd June 2018. One billion tokens are being distributed on the Ethereum blockchain by block.one. EOS is based on a white paper published in 2017 and the CEO of block.one (Brendan Blumer) announced it will be supported with over $1 billion.

Our monthy article lists The Top 10 Cryptocurrencies by market capitalisation.

If you would like to find out more about EOS and other cryptocurrencies, then some of the information and links to other articles, news stories and guides on our site will be useful. As a starter here is a selection of some of the EOS and cryptocurrency related material available on our site:

F2C exchanges allow you to exchange between fiat currencies (USD, GBP, EUR, JPY, etc.) to cryptocurrency (usually Bitcoin and Ethereum). On the other hand, a C2C exchange allows for conversion between different cryptocurrencies, and these options are usually represented by trading pairs with BTC, ETH, or another popular cryptocurrency.

This can be a little bit confusing, however, because an exchange can technically be both a F2C exchange and a C2C exchange. For example, Kraken offers an ETH/USD trading pair along with an EOS/ETH trading pair. This is just one example though, and it is becoming more common to see a combination of F2C and C2C offerings as cryptocurrency popularity increases.

You can read the full article on this link.

The world of cryptocurrencies and blockchain is full of new terms which can appear familiar but have been adapted to include a new meaning such as mining or token.

If you’re analysing an independent crypto that has multiple projects each with their native tokens built on its blockchain, you know it’s a reliable product trusted by many developers which increases your earning potential. The more applications are built on that blockchain, the better.

That doesn’t mean it’s the only thing you need to look out for but it’s usually a good predictor of the medium-term success of that crypto – other projects looked at the market and decided it was their best choice, so in a way, you can co-opt their option.

Conversely, if you’re assessing the potential value of a token-based project, it helps if it’s supported by a highly respected blockchain such as EOS or Ethereum.

You can read the full article on this link.

The US Patent and Trademark Office (USPTO) has granted Mastercard a patent that allows the firm to link fiat currency and cryptocurrency accounts.

According to the licence, users will be able to store in banks fiat currencies and cryptocurrencies under one profile, which inches crypto credit cards closer to being widely used for the purchase of goods. Mastercard says that customers are increasingly inclined to use cryptocurrencies over fiat money due to anonymity and in an effort to prevent fraud against them.

This could potentially pave the way for cryptocurrency credit cards to be widely accepted for purchases.

You can read the full article on this link.

IBM has partnered with FinTech venture Stronghold on a new cryptocurrency, called Stronghold USD, which is backed by Federal Deposit Insurance Corporation-insured US dollars.

“The process for seamlessly managing and trading assets of any form from digital to traditional currencies, needs to evolve as financial institutions are seeking ways to break into new asset classes like cryptocurrencies,” says Stronghold’s Co-founder and CTO, Sean Bennett. “Asset-backed tokens can provide seamless access to all currencies, improving the global movement of money. We’re honoured to work with IBM to explore new ways to use Stronghold USD within.”

You can read the full article on this link.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire