If you are familiar with the Solana blockchain, which has garnered more attention from investors in recent times, then you probably have come across the answer to “what is Serum?”

In case you are just hearing the word for the first time, sit back, and relax as we will work you through everything you need to know about the decentralised exchange (DEX). But first, let’s get into the discussion with a brief history of Serum.

A brief history of Serum

The journey to the launch of Serum started with Sam Bankman-Fried, who has a degree in physics from MIT. He joined Jane Street Capital as an ETF trader sometime in 2014 and spent a couple of years until he left in 2017 to found Alameda Research, a cryptocurrency trading firm.

Subsequently, Sam founded FTX, a derivatives exchange in 2019, and has since become an active member of the Defi community, with some people regarding him as a “de facto community leader of the infamous food-themed Sushiswap DEX”.

Having some time, Sam and other members of FTX cryptocurrency brainstormed on how to developing a Defi protocol, and apparently, Serum was the proceeding outcome of that meeting.

Then, part of their initial resolution was admitting that they were not going to build on the Etherum blockchain which is overwhelmingly saturated, and more so, giving the intensive feature they intend to host on their DEX platform.

They were also particular about standing out from the mother brand, FTX exchange as well as the trending food-themed Defi protocols like Uniswap, Pancakeswap, e.t.c most of which employs automated market maker (AMM) instead.

Following a holistic comparison of available blockchains, they eventually settled for Solana for specific reasons that will be discussed after now. So, to the main discussion, what is Serum?

What is Serum?

Serum, as previously stated, is a type of decentralised exchange (DEX) based on the Solana blockchain that allows traders to buy, sell and exchange cryptocurrencies. However, unlike the bulk of its competitors, Serum places great value on speed, minimal transaction costs, and a satisfying user experience.

The DEX platform’s great speed comes as a benefit for being hosted on the Solana blockchain which, on the other hand, edges out its competitors by increasing user scalability through faster transaction settlement.

Specifically, Serum can handle between 50K to 65K TPS (Transaction Per Second) which is also the default transaction speed rate on the Solana blockchain.

Talking about user experience, if you’re familiar with Coinbase, which is a centralised exchange in its own right, you’ll see a number of similarities between the two.

Also, being one of the first major DEX projects on its host blockchain, Serum is building a futureproof Defi ecosystem with the help of its DEX platform doubling as the fundamental pillar, it is fully interoperable for Ethereum-based cryptocurrencies.

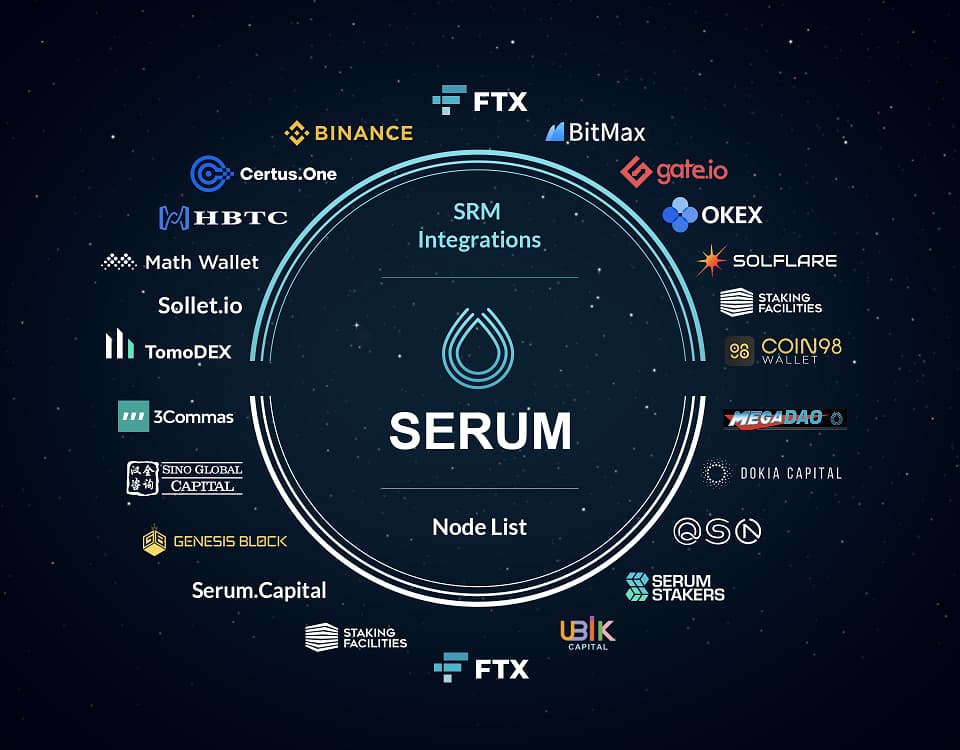

Source | SRM integration node list

Currently, the Serum DEX platform features more than 40 different cryptocurrency markets, most of which are traded against USDT and USDC. The best part of this is that creators can develop their own sub-DEX on the platform which also offers additional trading pairs.

How does Serum works?

Serum, unlike most DEX’s that built using the AMM trading model, uses what is known as an “order book” which is commonly associated with centralised exchanges. However, in this case, Serum employs a decentralised order book model that is run by smart contracts.

In comparison, AMM DEX’s allows traders to trade against a pool of liquidity that has already been staked by some token holders. On the other hand, the decentralised order book trading model allows traders to choose from a list of prices offered by other traders based on how high they are willing to sell or buy.

As a result, participants on the Serum DEX have access to a list of buy (bid) and sell (offer) orders which are organised by price and order sizes, including the number of shares to be bought or sold. This also implies that participants have full control over their trading activities which is void of third-party interference.

Also, similar to other exchanges, traders on the Serum DEX are required to pay a specific amount of SRM, the platform’s native token, as a trading fee.

While Serum applies the ‘buy and burn model’ for all transaction fees remitted on the platform, it removes all tokens used during the process from circulation.

Furthermore, Serum offers cross-chain support which implies that traders can trade other cryptocurrencies outside of the host blockchain, for instance, crypto-assets based on Ethereum, BSC, or even Polkadot can be traded on the platform.

In the same light, existing Defi protocols, regardless of their host blockchains, can as well access some features present on the Serum DEX.

Serum’s utility token – SRM

Just like most DEX’s, Serum also makes use of a utility token which is also used for DAO purposes. By holding SRM, traders can receive up to a 50% discount on their trading fees on the exchange. holder

Similarly, SRM token holders can participate in the network’s governance protocol, where participants can vote for or against modifications that will be made to the platform.

Ultimately, Serum is out to rival other DEX’s, especially those that are built using the AMM trading model. More so, giving that it is a frontrunner on the Solana blockchain, Serum wants to create a new experience for DEX trading.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.