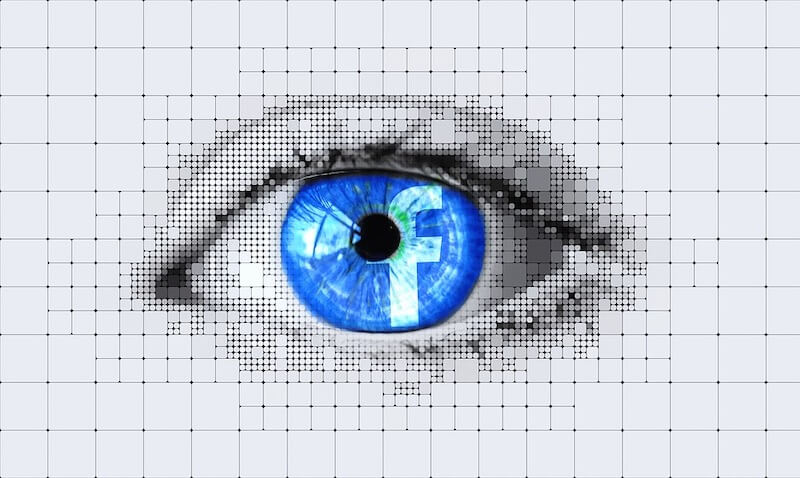

Ethereum co-founder Mihai Alisie fears that Facebook’s Libra project risks reversing gains in privacy and user sovereignty won by computer-networking pioneers.

In an interview with Bloomberg, he says: “This has implications on so many areas, from the economic to the political to the technological to surveillance and data privacy…Facebook is a very well-oiled machine of surveillance. It is actively manipulating the behaviour of people on a global scale.”

So far Facebook has partnered with such big hitters as Visa, Mastercard and PayPal. The risk Alisie sees here is that Libra users will anger one of these huge corporations and have their transactions reversed or blocked, something that’s impossible on the Bitcoin or Ethereum network. “Should they be in a position to control what you post from your device?” he comments.

As previously reported by Coin Rivet, another Ethereum co-founder, Joseph Lubin, recently labelled Libra “a centralised wolf in decentralised sheep’s clothing”.

In an article for Quartz, he stated that Facebook was painfully aware of the gulf of trust between itself and the public. And that’s likely why the social media giant itself is hardly mentioned anywhere in the Libra whitepaper or technical documentation.

“Trust is a slippery subject, especially when magnified to the scale of a global financial infrastructure. Ten years ago, the Bitcoin whitepaper proposed that instead of relying “exclusively on financial institutions serving as trusted third parties to process electronic payments,” we can instead rely on cryptoeconomic proof. With an internet connection, anyone can participate in the peer-to-peer network and inspect the ledger. Social consensus can protect against a cabal seeking to reverse or censor transactions,” Lubin wrote.

“Yet, with the Libra whitepaper, Facebook is not eliminating subjective trust, but imploring us to trust in Libra. You have to trust that one Libra coin will have “intrinsic value” by being backed by a basket of currencies and government bonds, rather than the capriciousness of daily cryptocurrency price swings. Facebook will seek trust from regulators that its Calibra wallet can comply with know-your-customer and anti-money laundering laws by requiring government-issued IDs to verify an account. It will need merchants to trust that their initial network will responsibly run nodes to validate transactions on the system.”

We are also all increasingly aware of how much money Facebook makes from our data, Lubin continued. What happens when you also wrap your personal finances up in this? That our digital identity will never merge with Libra’s financial data is a hard perception to shake. It is almost a given, even if they have the best of intentions—“accidents” and incursions happen when relying on centralised architectures.

Facebook’s arrival in the crypto space could have some positives, however. In a few years’ time, there may be as many as two billion new users onboarded to its Libra crypto wallet. In one fell swoop, talented UX designers could reduce the current friction of using cryptocurrency. Managing private keys, understanding gas payments and installing crypto browser plugins could be as simple as pressing “send” in WhatsApp, another Facebook-owned entity.

But the notion of trust won’t go away, Lubin insisted. “As of today, Libra has made a bold promise, and it’s one that Facebook needs to keep. Until then, Libra is like a centralised wolf in a decentralised sheep’s clothing,” he concluded.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire