In the goldrush atmosphere of crypto, it’s easy to forget about the losers, the ranks of which HECO looks like it will join. The decentralised chain of Huobi, the ecosystem has fallen far behind Binance Smart Chain, which it is highly similar to, in TVL and number of projects.

However, HECO isn’t going down without a fight and has recently launched its Master Builders program to attract talented developers.

While the outlook isn’t optimistic for HECO, could this chain—which does have several legitimate benefits—make a comeback?

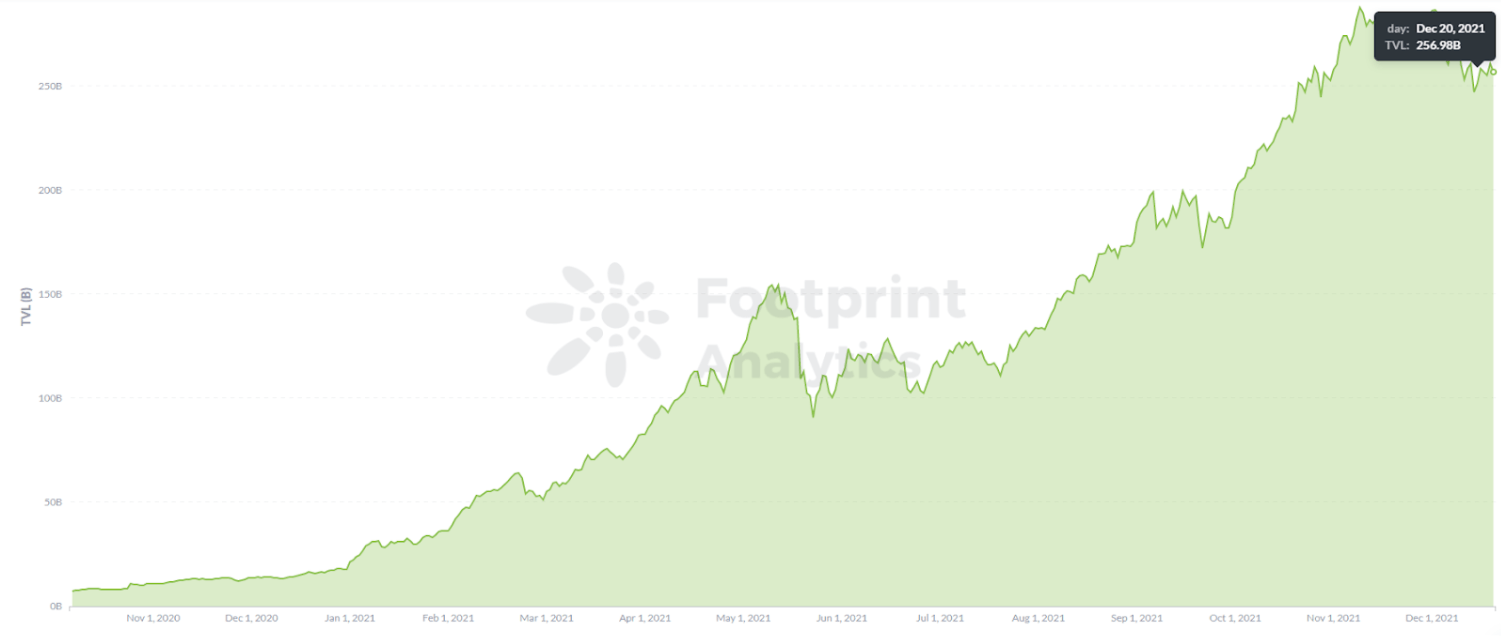

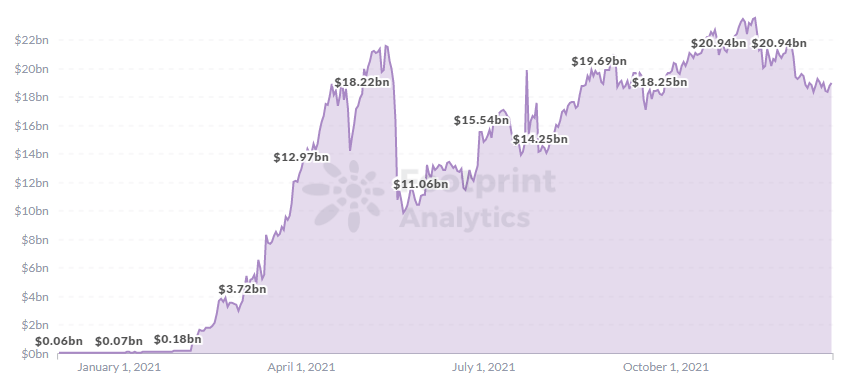

Footprint Analytics: DeFi TVL

What is HECO?

HECO, known as Huobi ECO Chain, went live on December 21, 2020. Its features are:

- EVM-compatibility, with lower migration costs for developers and a similar user experience.

- TPS up to 500, which means lower gas fees than Ethereum.

- HT tokens are used as native tokens to pay the gas fee.

- HECO uses the HPoS consensus mechanism where each verifier node needs to stake HT to get a reward, and since the node’s reward is also HT, this is a great way to increase the HT token price. The current number of nodes is 21.

HECO ecosystem status

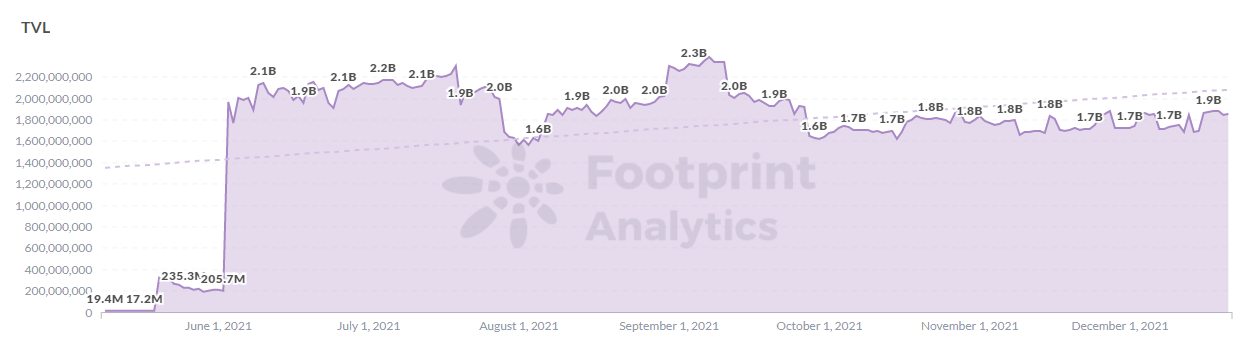

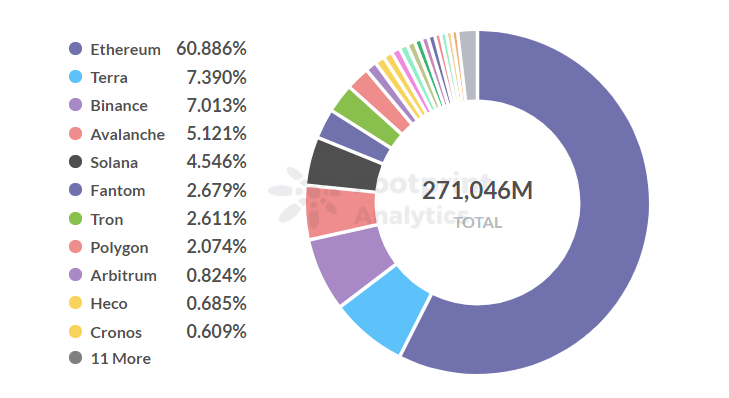

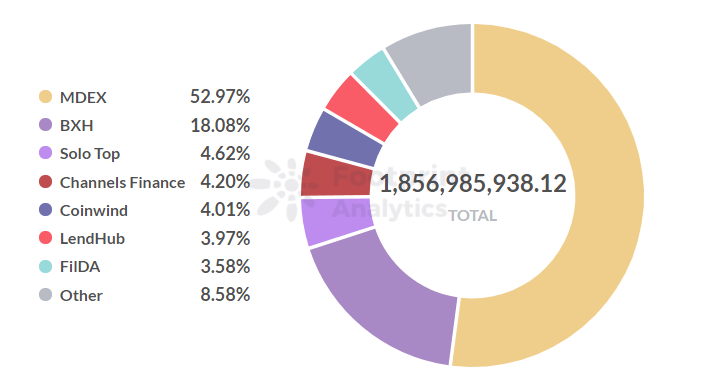

According to Footprint Analytics, as of December 23, HECO’s overall TVL was $1.86 billion, accounting for only 0.68% of all chains and ranking 14th.

Footprint Analytics: Heco TVL

Footprint Analytics: TVL Share by Chains

After the verifier node campaign, the HT price fell from a high of $35 to less than $10 after the 519 event and has been relatively quiet ever since.

Footprint Analytics: Price of HT

Lack of Diversity

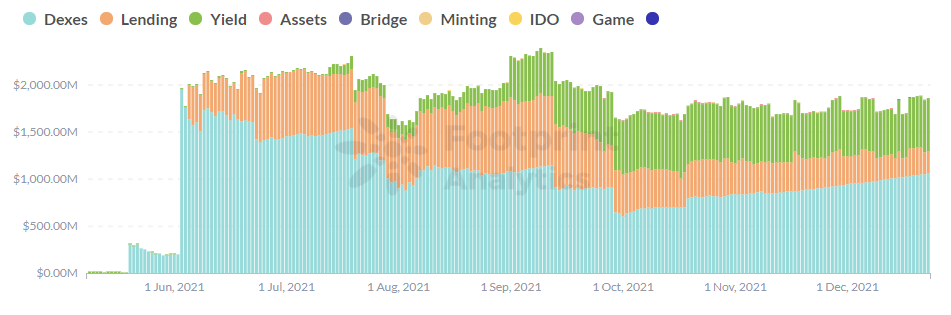

HECO mainly has DEX, lending and yield projects; from the composition of its TVL, we can see that DEX is 57%, yield is 30%, and lending is 13%.

Footprint Analytics: Heco TVL by Category

In terms of projects, the total number of DApps is 33. MDEX accounts for 53% of HECO’s TVL, which is $980 million; BXH, a yield aggregator project, has $330 million TVL, which accounts for 18%.

Footprint Analytics:Heco TVL by Project

BSC (Binance Smart Chain), which also relied on centralised exchanges and started almost the same time as HECO, has a TVL of $19 billion, a native token (BNB) with a coin price of $527 and 232 dApps.

Footprint Analytics: BSC TVL

Heco’s History

Developed by Huobi Exchange, HECO made a series of incentives and plans to promote ecosystem growth.

- On December 21, 2020, Huobi DeFi Labs announced a $200 million ecological fund that will focus on investing in high-quality projects in DEX, lending, oracle, cross-chain, stablecoin, and more.

- On December 25, 2020, HECO opened the registration channel of the “We Make Future” campaign for on-chain dApps, offering several benefits to dApps with good performance, including referral to the Huobi Global token listing audit team and HECO Eco Fund.

- On May 7, 2021, the Verifier Node campaign was launched to further increase decentralisation by the community governance rights.

- On August 18, 2021, HECO launched a $1 million developer incentive program to encourage developers to create and promote projects on its platform.

However, HECO has previously encountered some setbacks.

- Hash Bridge Oracle (HBO) errors

The Hash Bridge Oracle team incorrectly added HBO tokens to the HBO/USDT LP pool outside of a planned HBO/USDT mining pool contract. The mistake caused HBO to crash and substantial impermanent loss for LP investors. The price of HBO dropped directly from nearly $100 to $2 within a week.

- Book Finance (BOOK) surreptitiously increasing tokens

BOOK’s farming mechanism requires users to buy BOOK and other coins to provide liquidity, which effectively raises the price of BOOK and attracts users to deposit. The Book Finance team increased the number of BOOK surreptitiously and sold the tokens after mining. The price of BOOK fell from $30 to $0.1 within a week.

- Avatar (AVAT) scam

The Avatar team failed to launch its project and shifted the problem of code errors to the auditor. Community users found in the whitepaper that the avatar of its founder came from the internet and was the avatar of a real estate agent.

Why do projects on HECO go wrong so often?

As an early stage ecosystem, HECO sought rapid growth and failed to properly control and audit projects. At the same time, users got roped in by the promise of high interest yields.

Latest Ecosystem Incentive: HECO Master builders

In a December 2 press release, HECO announced it launched the first phase of the Master Builders campaign, selecting quality projects in terms of security audit, project innovation, product maturity, data growth, community and brand reputation, and offered generous rewards for the winning projects. The goal is to boost the growth of DeFi, GameFi and Metaverse projects.

Conclusion

The HECO chain creates more possibilities for its trading ecosystem, and it is highly similar to BSC in terms of technical architecture and ecological planning. However, the two chains are quite different in terms of TVL and ecosystem development. With the background of China’s strict crackdown on the crypto exchanges, the future of HECO, which mainly focuses on the Chinese market, is still not optimistic.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Youtube: https://www.youtube.com/channel/UCKwZbKyuhWveetGhZcNtSTg

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.