DeversiFi – the leading layer-2 Ethereum exchange – has undertaken a 48.5% pump today following the entry of a major whale wallet into the space.

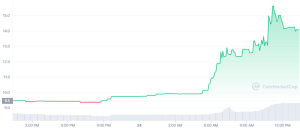

The price of the exchange native DVF token surged from a relatively stable price of $9.90 this morning, to a phenomenal $14 this afternoon in an unprecedented rally.

It appears the price action has been driven by the significant entrance of a major whale wallet, which swept into the market last night and placed a spot order worth just shy of $3.9m.

DeversiFi CMO explains whale’s decision

In exclusive comments to Coin Rivet, DeversiFi’s CMO Lexi Short, explained the position of the project and allure of the product.

“For the last few months Ethereum has been almost unusable due to high gas fees and although Layer 2 solutions, like DeversiFi, have been building to address this, they haven’t reached a point of mass adoption,” she explained.

“The recent growth in DVF holders, likely in response to our upcoming rewards programme and AMMs, is a great signal that this scale might be tipping.

“We’re really happy to welcome all the new holders and hope they enjoy the ride over the next few months. We’ll be continuing to build and bring the promise of Layer 2 to life.”

Indeed, the DVF token has been a major success for DeversiFi, especially following the launch of governance mechanism functionality for the token back in August which enabled users to stake DVF for xDFV in order to participate in network governance decisions.

And with the upcoming launch of a DVF rewards programme alongside AMMs many are excited about the unfurling roadmap.

Read more: DeversiFi launch Polygon (MATIC) bridge

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.