In the goldrush atmosphere of crypto, it’s easy to forget about the losers, the ranks of which HECO looks like it will join. The decentralised chain of Huobi, the ecosystem has fallen far behind Binance Smart Chain, which it is highly similar to, in TVL and number of projects.

However, HECO isn’t going down without a fight and has recently launched its Master Builders program to attract talented developers.

While the outlook isn’t optimistic for HECO, could this chain—which does have several legitimate benefits—make a comeback?

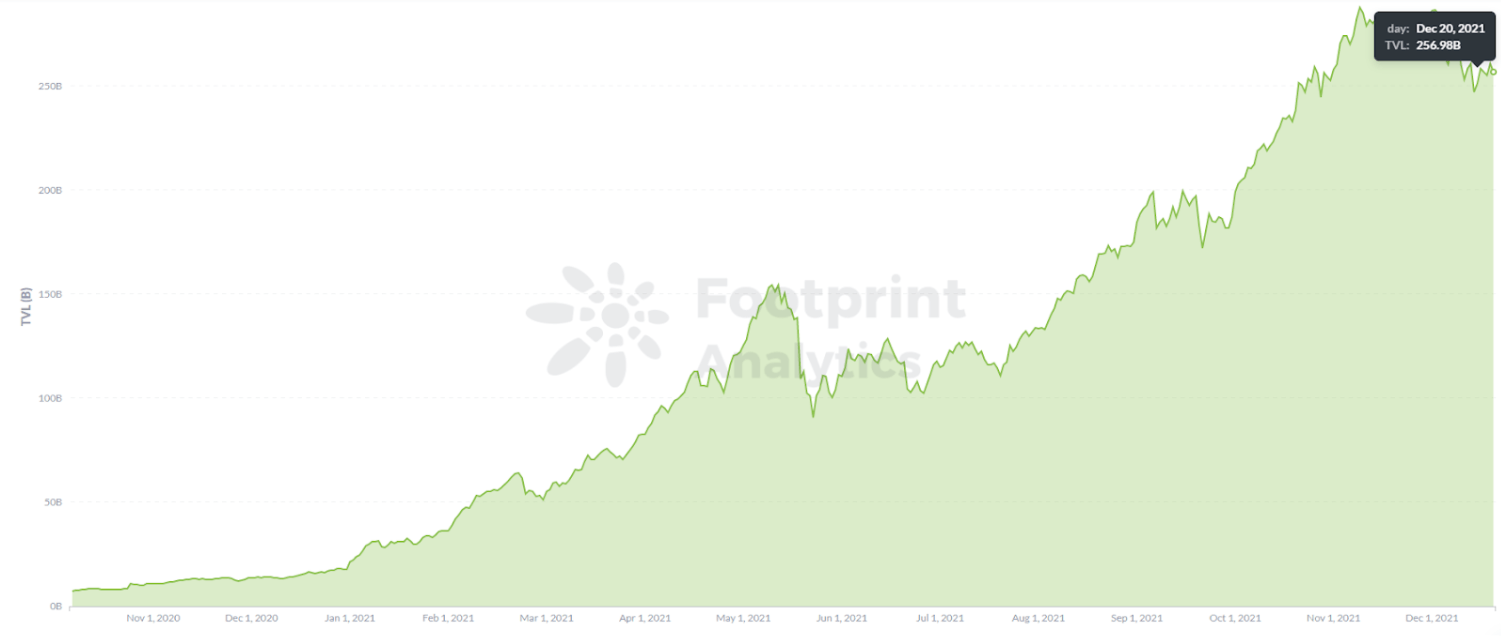

Footprint Analytics: DeFi TVL

HECO, known as Huobi ECO Chain, went live on December 21, 2020. Its features are:

According to Footprint Analytics, as of December 23, HECO’s overall TVL was $1.86 billion, accounting for only 0.68% of all chains and ranking 14th.

Footprint Analytics: Heco TVL

Footprint Analytics: TVL Share by Chains

After the verifier node campaign, the HT price fell from a high of $35 to less than $10 after the 519 event and has been relatively quiet ever since.

Footprint Analytics: Price of HT

HECO mainly has DEX, lending and yield projects; from the composition of its TVL, we can see that DEX is 57%, yield is 30%, and lending is 13%.

Footprint Analytics: Heco TVL by Category

In terms of projects, the total number of DApps is 33. MDEX accounts for 53% of HECO’s TVL, which is $980 million; BXH, a yield aggregator project, has $330 million TVL, which accounts for 18%.

Footprint Analytics:Heco TVL by Project

BSC (Binance Smart Chain), which also relied on centralised exchanges and started almost the same time as HECO, has a TVL of $19 billion, a native token (BNB) with a coin price of $527 and 232 dApps.

Footprint Analytics: BSC TVL

Heco’s History

Developed by Huobi Exchange, HECO made a series of incentives and plans to promote ecosystem growth.

However, HECO has previously encountered some setbacks.

The Hash Bridge Oracle team incorrectly added HBO tokens to the HBO/USDT LP pool outside of a planned HBO/USDT mining pool contract. The mistake caused HBO to crash and substantial impermanent loss for LP investors. The price of HBO dropped directly from nearly $100 to $2 within a week.

BOOK’s farming mechanism requires users to buy BOOK and other coins to provide liquidity, which effectively raises the price of BOOK and attracts users to deposit. The Book Finance team increased the number of BOOK surreptitiously and sold the tokens after mining. The price of BOOK fell from $30 to $0.1 within a week.

The Avatar team failed to launch its project and shifted the problem of code errors to the auditor. Community users found in the whitepaper that the avatar of its founder came from the internet and was the avatar of a real estate agent.

As an early stage ecosystem, HECO sought rapid growth and failed to properly control and audit projects. At the same time, users got roped in by the promise of high interest yields.

In a December 2 press release, HECO announced it launched the first phase of the Master Builders campaign, selecting quality projects in terms of security audit, project innovation, product maturity, data growth, community and brand reputation, and offered generous rewards for the winning projects. The goal is to boost the growth of DeFi, GameFi and Metaverse projects.

The HECO chain creates more possibilities for its trading ecosystem, and it is highly similar to BSC in terms of technical architecture and ecological planning. However, the two chains are quite different in terms of TVL and ecosystem development. With the background of China’s strict crackdown on the crypto exchanges, the future of HECO, which mainly focuses on the Chinese market, is still not optimistic.

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Youtube: https://www.youtube.com/channel/UCKwZbKyuhWveetGhZcNtSTg

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire