In order to make any profit from cryptocurrencies, traders need to know how to get the best price when selling their holdings.

If you’ve ever found yourself asking “How much should I sell?” or “When should I sell?”, this article will hopefully help you find some answers.

You’ll learn how to control your emotions, set price levels to sell your Bitcoin and altcoins, and what percentage of your portfolio you should sell at what prices.

My aim in this article is to show you how to create a long-term trading strategy that will maximise your ROI while maintaining over 20% of your total cryptocurrency holdings.

As always, the views in this article should not be considered financial advisement. The volatility of the crypto markets means money can easily be lost. Never invest more than you can afford to lose and always do your own due diligence.

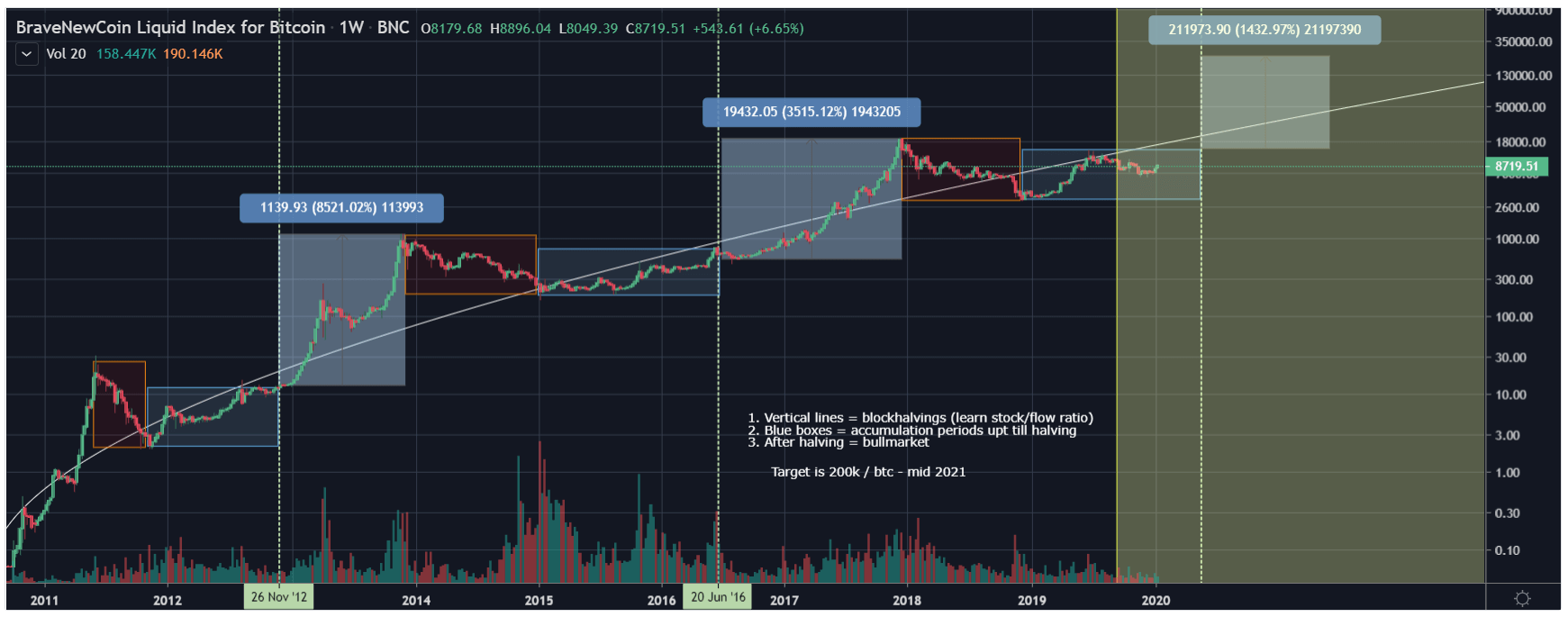

Above we can see the BraveNewCoin Liquid Index future price chart for Bitcoin, courtesy of user daanafgaan on TradingView.

The chart shows the different trend phases in Bitcoin’s price history and uses these trends to calculate when we’re likely to hit another bull market.

While nobody can accurately predict what Bitcoin will do in the future thanks to the volatility of the market and potential unforeseen black-swan events, looking at historical data can at least provide some insight into potential movements and therefore when might be a good time to sell.

According to the chart, there’s usually an initial bull run followed by a price top that ends with a +50% drop. Afterwards, there’s a long accumulation period followed by a new bull run.

Each bull run coincides with the Bitcoin supply halving. If you’re wondering whether halvings are priced in, this chart clearly shows they’re not.

Otherwise, why would BTC always find a new top a few months after the halving event? Historically, massive profits can only be achieved after each halving, not before.

The chart predicts that the next BTC peak will be over $200,000 sometime in 2021, indicating the best time to sell would be after a potential post-halving bull run.

The sooner you start selling, the faster you realise some ROI. However, remember that the later you start selling, the more profit you’ll earn per transaction.

It’s important to play around with these two concepts when setting your selling price levels.

If we’re to assume the price of Bitcoin will hit $200,000, some potential sell targets would be between $100,000 to $200,000.

If you want to be a bit more cautious, you could follow the example below and start selling sooner, for example around $50,000.

To maximise your profits, you should know what percentage of your portfolio to sell and what percentage to keep.

After all, nobody can time the markets perfectly.

To understand how much you should sell, you should ask yourself, “How much Bitcoin am I ready to part with?”

If you’re in it for the money, perhaps you want to sell close to 100% of your cryptocurrency stack.

If you’re a hardcore believer in the future of cryptocurrency, you may want to keep at least 50% of your portfolio in BTC and other altcoins. Perhaps more.

My personal aim is to follow a doubling logic. Let me explain with a straightforward example.

Let’s say you bought 1 BTC in the past few years at about $10,000. In addition, you’re looking to sell between $50,000 and $200,000. What would your profits and ROI be?

| Percentage sold | Bitcoin price | Bitcoin sold | Revenue per transaction | Cumulative BTC sold | Cumulative revenue |

| 1.00% | USD 50,000.00 | 0.01 | USD 500.00 | 0.01 | USD 500.00 |

| 2.00% | USD 60,000.00 | 0.02 | USD 1,200.00 | 0.03 | USD 1,700.00 |

| 3.00% | USD 70,000.00 | 0.03 | USD 2,100.00 | 0.06 | USD 3,800.00 |

| 4.00% | USD 80,000.00 | 0.04 | USD 3,200.00 | 0.10 | USD 7,000.00 |

| 5.00% | USD 90,000.00 | 0.05 | USD 4,500.00 | 0.15 | USD 11,500.00 |

| 6.00% | USD 120,000.00 | 0.06 | USD 7,200.00 | 0.21 | USD 18,700.00 |

| 7.00% | USD 140,000.00 | 0.07 | USD 9,800.00 | 0.28 | USD 28,500.00 |

| 8.00% | USD 160,000.00 | 0.08 | USD 12,800.00 | 0.36 | USD 41,300.00 |

| 9.00% | USD 180,000.00 | 0.09 | USD 16,200.00 | 0.45 | USD 57,500.00 |

| 10.00% | USD 200,000.00 | 0.10 | USD 20,000.00 | 0.55 | USD 77,500.00 |

| 11.00% | USD 220,000.00 | 0.11 | USD 24,200.00 | 0.66 | USD 101,700.00 |

| 12.00% | USD 240,000.00 | 0.12 | USD 28,800.00 | 0.78 | USD 130,500.00 |

The table above is a personalised selling matrix based on the parameters described in the previous sections.

The results show you could end up with a cumulative profit of over $130,000 by selling 0.78 BTC. Percentage-wise, that would represent a 1,300% ROI on your initial $10,000 investment.

Moreover, you would still own 0.22 BTC, or 22% of your initial portfolio. This means you can either keep the cryptocurrency or adopt the same strategy for your remaining stack.

As mentioned earlier, this scenario is purely hypothetical, but I hope this article has helped you in your cryptocurrency selling endeavours. Never forget, maximising your profits means not putting all your eggs in one basket.

Safe trades!

Disclaimer: The views expressed in this article are the author’s only. This article isn’t financial advice or promotional material; it represents my personal opinion and should not be attributed to Coin Rivet.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire