Mining refers to the process of creating and injecting new crypto assets into circulation. Mining also refers to the process of executing a crypto transaction on a block, as well as the creation of new blocks that can contain newer transactions.

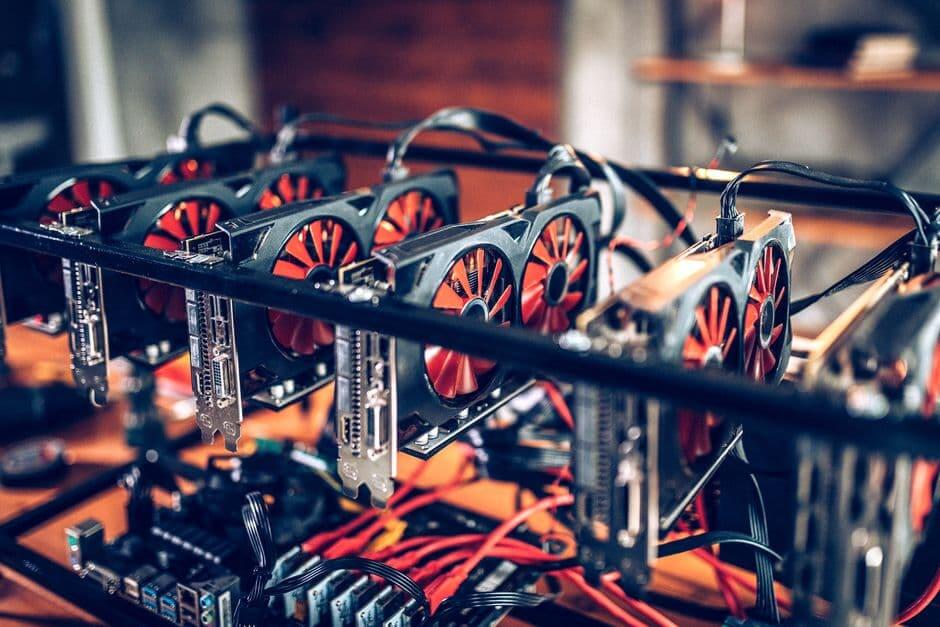

While this may sound interesting, a lot of manpower (miners) is required to successfully complete a mining procedure. In the same vein, this further implies that several computational facilities will be required.

With miners operating heavy duty computational devices in order to facilitate a mining process, the resultant effect is very high consumption of energy, most of which are powered by non-renewable energy. As a result, mining has been frowned upon by several nations, and in some cases are considered an illegal activity to involve in.

The legality of cryptocurrency, and crypto mining varies from one continent to another, and even among the countries within a region. While the reason for this can be attributed to various concerns such as an unregulated economy, the majority of the nations are more concerned about the environmental impact.

In Europe for instance, cryptocurrency, and cryptocurrency mining are largely considered legal. Notably, there is no specific legislation or legal framework that officially kicks against crypto mining or general utilization. More so, the same is applicable to most countries across Central, Eastern, Northern, Southern, and Western Europe.

Although cryptocurrency is largely unregulated in Europe, the governments of many nations including the United Kingdom (UK) have notified their citizens that digital assets will be treated as foreign currency for most purposes. On the other hand, not every European country seems comfortable with energy-intensive crypto mining.

Recently, the Swedish government called upon the European Union to ban any form of crypto mining activity within the region. The reason for Sweden’s standpoint was blamed on the rising energy usage which is threatening the country’s ability to meet its obligation under the Paris Climate Agreement.

For context, Erik Thedéen, director of the Swedish Financial Supervisory Authority, and Björn Risinger, director of the Swedish Environmental Protection Agency, noted that the energy consumption in the Nordic country rose by “several hundred percent” between April and August 2021.

More specifically, Thedéen and Risinger said Bitcoin mining alone has consumed the equivalent amount of electricity of 200,000 households. The governing authority of Sweden further blamed the excessive energy usage on the proof of work (PoW) consensus mechanism found amongst the most prominent crypto assets.

According to Swedish authorities, Proof of Work – unlike Proof of Stake – requires validators to spend more time solving mathematical puzzles in order to validate transactions within a given block.

Likewise, the process is designed to become even more complicated as the number of blocks for validated transactions in the chain increases, suggesting an even more intensive energy usage.

Technically, miners would strive to become the first to validate a new block – something that is only possible to achieve based on how powerful the computational device/hardware is, thereby causing more harm to the environment.

This is still very much an ongoing conversation and, as such, no real action has been taken against crypto mining in any nation under the European Union.

It is also worthy of note that in some other European countries like Germany, crypto is treated as private money for tax purposes. This implies that the mining of crypto by individuals is taxed as ‘other income’ (under Section 23 of the country’s Income Tax Act).

While the above is also applicable for a couple of other European countries, the majority choose to ignore concerns over environmental issues, at least for the time being.

In 2018, Mariya Gabriel – the current European Commissioner for Digital Economy – backed crypto mining, saying it was subject to standard electricity rules.

She said: “If the energy consumed for this activity is produced according to law, then there is no basis to forbid or even limit it.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire