Until now, NFT marketplaces have Trader A put their assets for sale at a specific price. When Trader B is willing to pay this price, the trade happens. The marketplace is more or less the middleman between Trader A and Trader B. Its job is to make the process seamless for them. It handles the payment, collects its fees and creator’s royalties (when applicable), and transfers the asset to the buyer’s account to match users’ buy and sell orders in record time.

This model is heavily dependent on a price agreement between both parties. If that does not happen, there is no trade. When an asset class doesn’t have many trades, we say that it has low liquidity. This is something that happens with the NFT market in general. However, Sudoswap is looking to change this by applying an AMM model to NFT Trading.

An Automated Market Maker (AMM) is the technology that powers a decentralized exchange (DEX). It enables assets to be traded by using crypto liquidity pools as counterparties. A liquidity pool is a smart contract where you usually have two assets on it: the trading pair. When interacting with a liquidity pool, a user can exchange (swap) one asset for another or be a liquidity provider (LP). To be an LP, the user must supply both assets of the trading pair. In the NFT context, an LP provides the NFTs and ETH, for example.

And why would somebody want to be an LP? The LP collects the trading fees of the liquidity pool where he deposited his assets. In NFT trading, this means that he would get a fee on this transaction and not the collection’s creator.

In this article, we will cover:

- What is Sudoswap

- Why is it different from OpenSea or X2Y2

- Metrics (Number of users, daily transactions)

What is Sudoswap

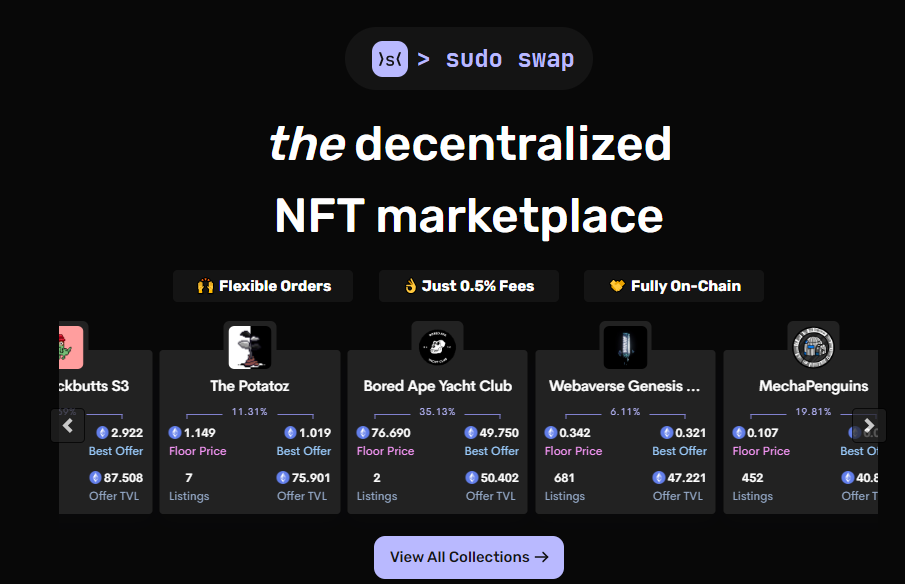

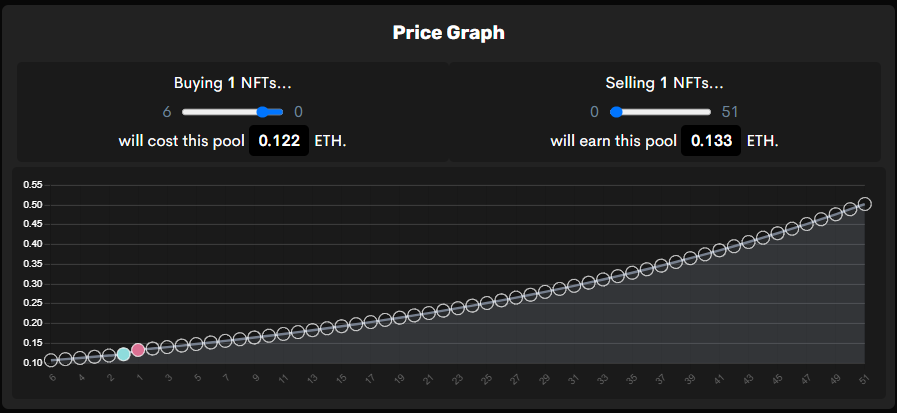

Sudoswap is a decentralized, on-chain NFT exchange that uses an AMM model. This brings to the NFT market the same trading conditions as DeFi, by improving the liquidity of the NFT collection traded there. But, for a user interacting with the protocol, it has the same functions as a regular NFT Marketplace. The user can select an NFT from a collection he likes and buy it. Another user can take his NFT and sell it for the price. These interactions are done on the page provided below.

Swap interface – Source: Sudoswap

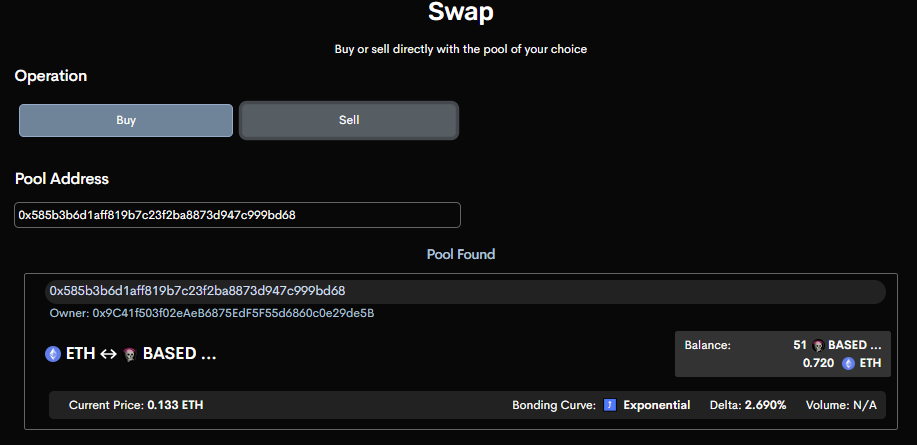

However, the main feature of Sudoswap is that it allows the NFT owner to become a liquidity provider, by creating a trading pool. It is useful for collectors or traders that own a lot of pieces of the same collection and want to set a floor price for it. The LP has control over the behaviour of the price changes inside his pool.

Pool Overview – Source: Sudoswap

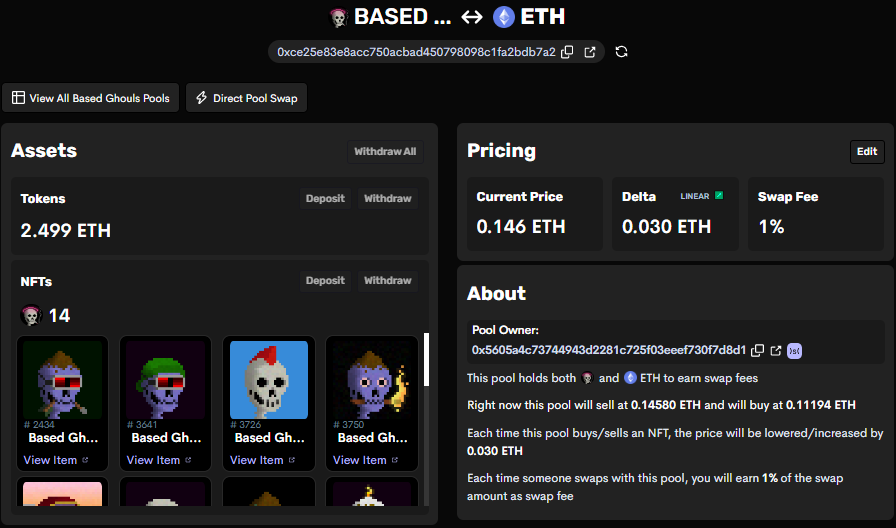

While being an LP, the user can set the price changes after a buy or a sell inside the pool (this is called the “bonding curve”). This configuration lets the LP know how many ETH we will have if all NFTs are sold, or how many NFTs he will have if all ETH inside the pool is used to buy NFTs.

Price action Graph – Source: Sudoswap

How is Sudoswap different from the other NFTs marketplaces?

While keeping the basic features of a regular NFT marketplace, Sudoswap’s approach to the NFT market is to give control to the NFT owners. They can set the trading conditions, prices, and earn fees on the trades happening on the pool where they are a liquidity provider.

Another difference is that Sudoswap does not pay royalties to the collection creators. This is a feature that the marketplaces have on their smart contracts. It is not on the smart contract used to mint the collection. Therefore, this is a decision that each Marketplace makes, as we saw in the X2Y2 decision to provide flexibility on it. For that reason, there is more incentive for the NFT owners to trade on Sudoswap.

The price action on Sudoswap is also different from a regular marketplace. Large pools have enough NFTs and ETH inside of them to make the price follow the bonding curve. This softens the price fluctuation.

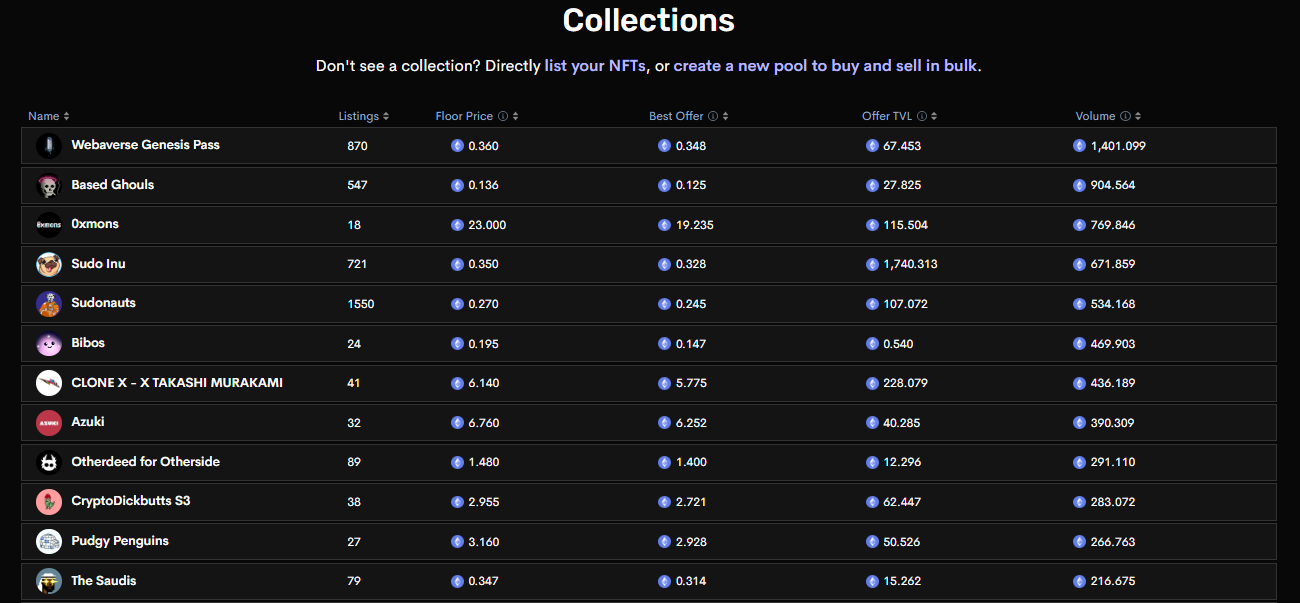

Collections Leaderboard – Source: Sudoswap

NFT owners of different collections are experimenting with this new concept, as we can see some well-known collections already available for trading there, such as Azuki, Otherdeed, and Pudgy Penguins.

NFT Projects can also benefit from this model, as they can create their “official pools” with items in their possession to bootstrap the trading activity. Examples of that on SudoSwap are “Based Ghouls” and “LobsterDAO.”

Metrics

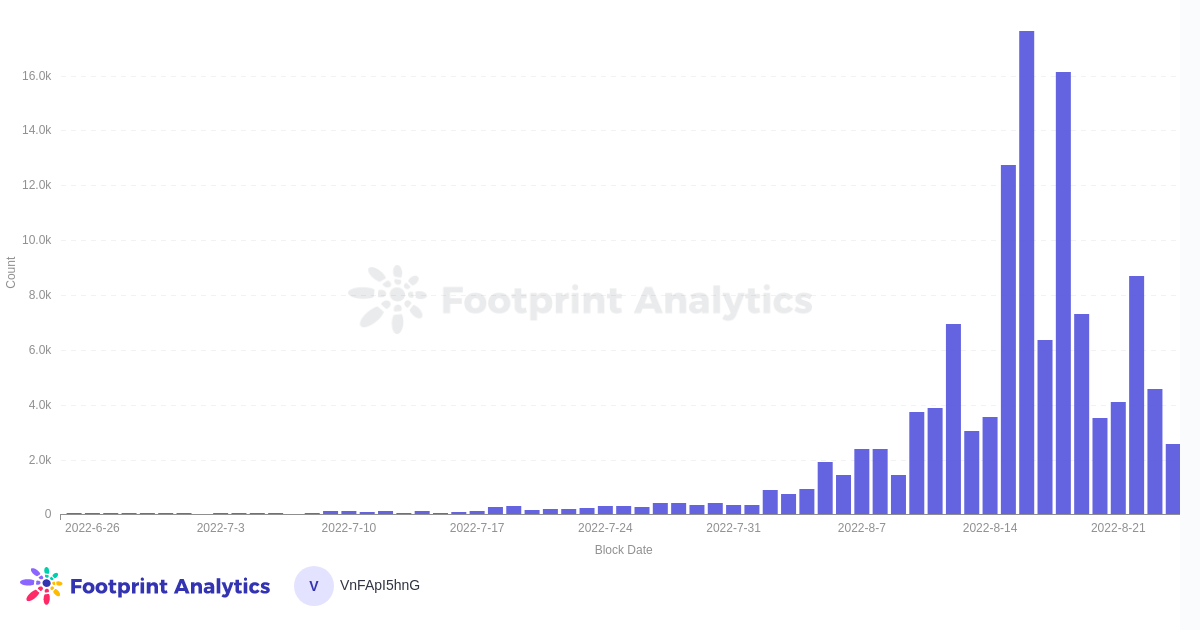

Sudoswap launched its AMM on July 7th. Since then, it already had over 100,000 NFTs transactions.

Daily Transactions – Source: Footprint Analytics

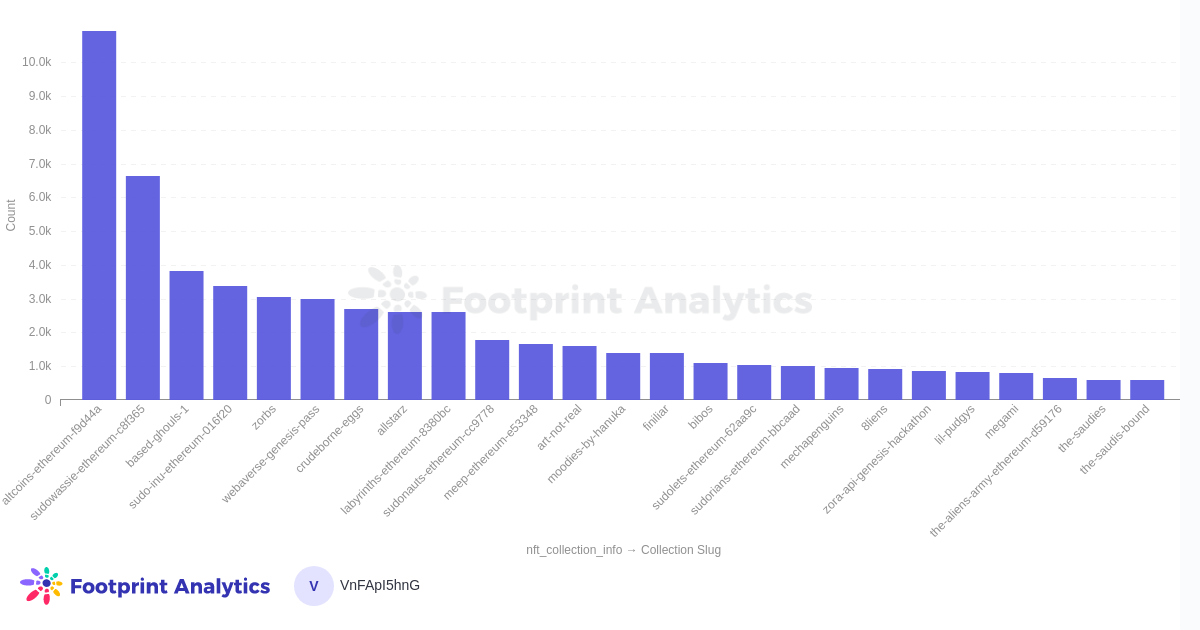

In the chart below, there are the Top25 NFT collections by the number of trades, cumulative. As the LP controls the trading fees on the trading pool, several collections have a trading fee lower than the standard 2.5% royalty fee applied on the regular marketplaces, making it more profitable to trade on Sudoswap.

NFT Transactions, by collection, last 30 days – Source: Footprint Analytics

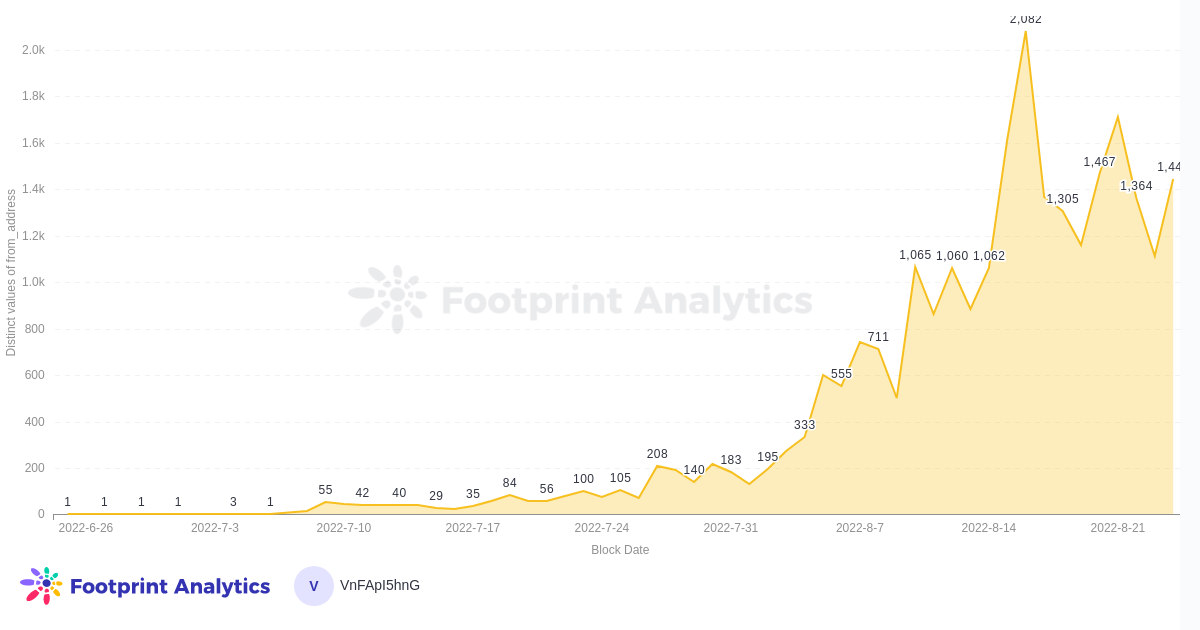

The number of daily users is growing as more people become aware of Sudoswap and its similarities with DeFi DEXs like Uniswap or Sushiswap (high liquidity and low fees).

Sudoswap daily users, last 60 days – Source: Footprint Analytics

Comparison with other Marketplaces

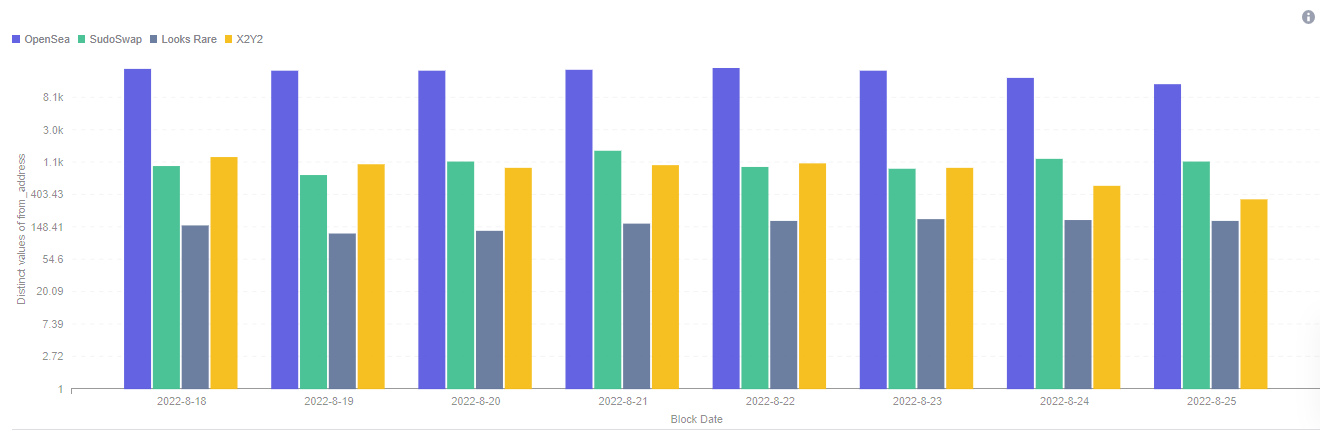

Daily users, comparison between Opensea, SudoSwap, Looks Rare, and X2Y2 – Source: Footprint Analytics

At the beginning of August, Sudoswap started to gain traction and, since mid-August, has almost the same number of daily users as X2Y2 (around 1,500 daily users).

Marketplaces Leaderboard – Source: NFTgo

Sudoswap shows 22M of total volume in the last 30 days, which computes in ~100k USD revenue, as the platform has a 0.5% platform fee. We are seeing all signs (increasing number of users, daily transactions) that the NFT community is willing to try this different trading model to better understand its benefits and shortfalls. While it is soon to say that the AMM approach will replace the traditional one, it has appealing features for NFT owners.

Sept. 2022, Thiago Freitas

Data Source: Sudoswap – A AMM Marketplace for NFTs

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.